If you have problems with installation, let me know. I am searching collaborators for this project. If you have experience and want to collaborate We are currently developing privately, if you want to join the team please contact us. https://www.linkedin.com/in/luislcastillo/

SEE ALSO Machine Learning Strategy

Things this project offers that I did not find in other free projects, are:

- Testing with 36 models. Multiple combinations features and multiple selections of models, easily expandable (TensorFlow , XGBoost, Sklearn, LSTM, GRU, dense, LINEAR etc )

- Threshold and quality models evaluation

- Use 637 technical stocks indicators

- Independent neural network selection of the best technical patterns for each stock

- Response categorical target (do buy, do sell and do nothing) simple and dynamic, instead of poor and confused, continuous target variable ("the stock will be worth 32.4 in 2 days")

- Powerful open-market-real-time evaluation system

- Versatile integration with: Twitter, Telegram and Mail

- Train Machine Learning model with Fresh today stock data

The project is long and dense, trying to install it without understanding is a mistake, the first thing to do is to run and understand the TUTORIAL,

To manage collaborations we have a Telegram GROUP: https://t.me/+3oG6U_hp93I2M2Ix (Once executed and understood the tutorial) (recommended to review the point: https://github.com/Leci37/stocks-prediction-Machine-learning-RealTime-telegram/edit/master/README.md#possible-improvements).

Strategy models with Randon Forest, simpler Randon Forest

- TUTORIAL - IMPORTANT: Once executed and understood, join the community to avoid repeating work or try out useless developments already done.

- Detailed start-up

- Possible improvements: - Combine the power of the 17 models - Better use tuners - Real-time alert with .png financial data - Improvements in predictive models using multi-dimensional - Review the way ground true is obtained - For unbalanced classes, you should look at the F1-score - Review the free code winners of KAGGLE - Are 3 GrounsTrue detection tags sufficient or are subclasses required? - Remove columns that have more than 0.9 correlation between them - Architecture to Reinforcement Learning - MonoLabel vs MultiLabel - Show TF heat map of the detected decison - Use benefit evaluation function instead of Y target - Imagine the operating points (generative adversarial networks) - Testing the MachineLearning platforms of large IT companies - Add news sentiment indicator - Add balance sheets - Recommended reading LSTM plus stock price FAIL - Review of all forms of time series prediction: lstm,gru,cnn and rnn - Lighter improvements list of suggested

Table of contents generated with markdown-toc

This project is a very long mountain of work free, it is given to the public on one condition, if you make any major improvement, let me know via public or private ([email protected]), [the improvement will not be made public if you do not want it].

Any other kind of contact with us, please go to the ISSUES tab.

Before assembling everything check the tutorial code, the predictive models require improvement without cheating. (95% of the predictive code is in the tutorial). The stock market does not only work with technical patterns, you need to know more about the inner workings. Important to review the article: My neural network does not improve

The project is long and dense, trying to install it without understanding it is a mistake, the first thing to do is to run and understand the tutorial file, located in Tutorial/RUN_buy_sell_Tutorial_3W_5min_RT.py

it will show in a summarized way the global steps of the project RUN_buy_sell_Tutorial_3W_5min_RT

:

- [1] Reading OLHCV data

- [2] Extraction of all technical patterns

- [3] Calculation of the grount true, the Y_target to detect in real time (where to do nothing, do buy or do sell)

- [4] Remove unhelpful or noisy technical patterns

- [5] Normalise the data, for correct training the values must be normalised to between 0 and 1

- [6] Create 'windows' of time, for a Y_target prediction use +-4 hours later of technical patterns, not just the current value of the patterns

- [7] Splitting between training data and evaluation data

- [8] Ground True Y_target data are unbalanced Given that there is a lot of 'do nothing' 0, and very little 'do buy' 1 or 'do sell' 2," weight balancing is required, to give more importance to the minorities.

- [9] Creation of the TF model architecture

- [10] Start the TF training and save it

- [11] Evaluating the quality of the model

Note: inside the file Tutorial/RUN_buy_sell_Tutorial_3W_5min_RT.py , it is very important to understand the author's experience inside print() and #TIP comments.

RUN_buy_sell_Tutorial_3W_5min_RT

Points: 2,3,4,9,10 and 11 should be refined and improved. For more details about improvements there is point Possible improvements: .

IMPORTANT: Once executed and understood, join the community to avoid repeating work or try out useless developments already done.

Telegram GROUP: https://t.me/+3oG6U_hp93I2M2Ix

The stock market is moved by technical indicators, there are several types of volatility, cycle volume, candlesticks, supports, resistances, moving averages...

An excellent site to see all the stock market technical indicators is webull https://app.webull.com/trade?source=seo-google-home.

Image: webull with Stochastic, MACD and RSI indicators

On the stock market graphs have been invented EVERY possible way to predict the stock market, with mixed results, making clear the difficulty of predicting human behavior.

These indicators indicate where to buy and sell, there are many beliefs about them (we mean in beliefs, because if they always worked we would all be rich).

Any technical indicator can be obtained by means of programmable mathematical operations.

Three examples:

RSI or Relative Strength Index is an oscillator that reflects relative strength

Greater than 70 overbought, indicates that it will go down.

Less than 70 oversold, indicates that it will go higher

MACD is the acronym for Moving Average Convergence / Divergence. The MACD in the stock market is used to measure the robustness of the price movement. Through the crossing of the line of this indicator and the moving average

It operates on the basis of the crossovers between these two lines

Or it is operated when both exceed zero.

Candlestick: Morning Star The morning star pattern is considered a hopeful sign in a bearish market trend.

These indicators are present in refuted and popular websites like investing.com to be analyzed by the market https://es.investing.com/equities/apple-computer-inc-technical

In the video you can see the whales manipulating the price, does anyone think they can predict when the madman in the City of London hits the button? It is recommended to understand that there are NOT VISIBLE data, and if they are not visible TF can not do miracles (TV and politicians say that AI does miracles, what it does is massive statistics with data). If you don't understand this I think you should go to other projects. It is recommended to avoid this code in intervals less than 1 hour.

See the news A “fat-finger error” by a London-based trader at Citigroup that triggered a flash crash across European stock markets could cost the bank at least $50m (£39.8m). See video Chinese Whales Dumping Bitcoin or alternative . I ask the reader at this point, how is this predicted? I don't have the testosterone data of the London Kids XD . 😄😄

It is extremely difficult to predict the price of any stock. Inflation, wars, populism, all this conditions affect the economy, and it becomes difficult, if not impossible to predict what Vladimir Putin will do tomorrow.

Here enters the self-fulfilling prophecy principle of explained is, at first, a "false" definition of the situation, which awakens a new behavior that makes the original false conception of the situation become "true". Example:

The model to be able to train in detecting points of purchase and sale, creates the column buy_seel_point has value of: 0, -100, 100. These are detected according to the maximum changes, (positive 100, negative -100) in the history of the last months, this point will be with which the training is trained, also called the ground true.

Defining the GT (Ground True) is a subjective task, these numbers can be obtained in 2 ways:

-

Utils_buy_sell_points.get_buy_sell_points_Roll(default). Value will be assigned in buy_seel_point if the increase or decrease of the stock is greater than 2.5% in a period of 3 hours, using the get_buy_sell_points_Roll function. -

Utils_buy_sell_points.get_buy_sell_points_HT_pp(decomments the line) Inspired by the TraderView technical indicator "Pilots HL". -

For change the config to 1-day candlesticks (with frequent daily changes of +-1% defined in the variable

PER_VALEU_CHANGE = 1). You can see it in the methodget_GT_day_candle(df_kon)and extrarolling_buy_sell_val_BUY(df_ind)it is strongly recommended to use this other function to obtain the GT, file candlesticks GT day

On the graphic, you can see the difference being:

Blue the candle Close

Red the values obtained in get_buy_sell_points_Roll() the positive and negative peaks indicate sell and buy points.

The points obtained in get_buy_sell_points_HT_pp() are shown, the Orange peaks being the Buy points and the Green peaks being the Sell points.

Install requirements (to know the exact version Utils/requirements_x.y.z.txt)

pip install -r requirements.txt

By default (recommendation) the stock list will be used: "@CHILL": ["UBER", "PYPL"]

Run 0_API_alphavantage_get_old_history.py Optional. File generate example: d_price/RAW_alpha/alpha_UBER_15min_20230414__20230317.csv

Run BETTER get alpaca API key and 0_API_alpaca_historical.py

Run 1_Get_technical_indicators.py Files generate example: d_price/PYPL_PLAIN_stock_history_MONTH_3_AD.csv and plots_relations/best_selection_PYPL_both.json

Run 3_Model_creation_models_for_a_stock.py Files generate example models TF .h5: Models/TF_multi/TFm_UBER_neg_vgood16_mult_lstm.h5 , Models/TF_multi/UBER_neg_vgood16__per_score.csv and Models/TF_multi/Scalers/UBER_neg_good9_.scal

Run 4_Model_creation_scoring_multi.py Optional, evaluation the models predictions File generate: Models/TF_multi/_SCORE_ALL_multi_all.csv

Having reached this point, We would like to get to know you (this is a project of 11 months of work) and I would like you to tell me in Issues tab or Discussion tab what you think and if you see any utility in https://github.com/Leci37/stocks-prediction-Machine-learning-RealTime-telegram#possible-improvements.

At this point the file realtime_model_POOL_driver.py is required, you must ask for it .

Real-time forecasts:

Run Utils/Volume_WeBull_get_tikcers.py Ignore in case of using default configuration

Configure bot token see point 5**.2** Configuring chatID and tokens in Telegram

Run 5_predict_POOL_enque_Thread.py

It is possible to run it without configuring telegram point 5.2, in that case no alerts will be sent in telegram, but if the results were recorded in real time in: d_result/prediction_real_time.csv

Models with better accuracy are in Tutorial/RUN_5_models_0.61_accuracy.py

To do step 0, installation or correct errors in the installation there are also Step by step

(Running times are estimated for an intel i3 and 8GB of RAM)

0.0The interpreter with which the tutorial has been made is python 3.8 , IDE Pycharm, caution with the compatibility between versions of the library pandas and python For example: today do not use python 3.10 , as it is incompatible with pandas https://stackoverflow.com/questions/69586701/unable-to-install-pandas-for-python

0.1 Download and install requirements, the project is powerful and demanding in terms of libraries.

pip install -r requirements.txt

(to know the exact version Utils/requirements_x.y.z.txt)

0.2 Search all files for the string **DOCU**

this allows to watch all files that are executable from the startup tutorial easily

0.3 In the file _KEYS_DICT.py all the configurations are stored, look at the document and know where it is.

In it there is the dictionary DICT_COMPANYS

It contains the IDs (GameStops quotes with the ID: GME) of the companies to analyze. You can customize and create a class from the nasdaq tikers, by default the key @CHILL will be used which will analyze these 2 companies.

"@CHILL": ["UBER", "PYPL"],If more stock execution is desired, change to @FOLO3 o similar in file _KEYS_DICT.py

The API yfinance , if you want price to price intervals in 15min intervals is limited to 2 months, to get more time data up to 2 years back (more data better predictive models) use the free version of the API https://www.alphavantage.co/documentation/

Run 0_API_alphavantage_get_old_history.py

Run BETTER get alpaca API key and 0_API_alpaca_historical.py

The class is customizable: action intervals, months to ask, and ID action.

Note: being the free version, there is a portrait between request and request, to get a single 2 years history it takes 2-3 minutes per action.

Once executed, the folder: d_price/RAW_alpha will be filled with 2 years extra historical OHLCV .csv of share prices. These files will be read in the next step. Example path name: d_price/RAW_alpha/alpha_UBER_15min_20230414__20230317.csv

Check that one has been generated for each action in d_price/RAW_alpha.

As well as the history of technical patterns. It takes +-1 minute per share to calculate all technical patterns.

Run 1_Get_technical_indicators.py

ALL technical indicators in python you can find here, look the funtion extract_features(df: pd.DataFrame,extra_columns =False, shift=150, debug=False) inside https://github.com/Leci37/TensorFlow-stocks-prediction-Machine-learning-RealTime/blob/master/features_W3_old/v3.py some of the technical indicators take future data, be careful.

Once executed the folder: d_price will be filled with historical OHLCV .csv of share prices.

Three types of files are generated (Example of name type for action: AMD):

- AMD_SCALA_stock_stock_history_MONTH_3_AD.csv with all technical patterns calculated and applied a fit scaler(-100, 100), i.e. the stock prices are scaled (size: 30-90mb)

- d_price/min_max/AMD_min_max_stock_MONTH_3_AD.csv with scaling keys (size: 2-7kb)

- AMD_stock_history_MONTH_3_AD.csv the pure history of the OHLCVs (size: 2-7mb)

Note: MONTH_3_AD means 3 months of API yfinance plus the history collected from alphavantage. Point 1.0

Check that one has been generated for each action.

This step is done automatically and the variable GENERATED_JSON_RELATIONS (in get_technical_indicators.py) is set to True (default True).

It is necessary to separate the technical indicators which are related to buy or sell points and which are noise. 20 seconds per share

Run Feature_selection_create_json.py (uncommnet for l in list_stocks: )

Three files are generated for each action in the folder: plots_relations , relations for purchase "pos", relations for sale "neg" and relations for both "both".

- plots_relations/best_selection_AMD_both.json

These files contain a ranking of which technical indicator is best for each stock.

Check that three .json have been generated for each action in plots_relations .

Train the models, for each action 36 different models are trained. 15 minutes per share.

Run 3_Model_creation_models_for_a_stock.py Requires Declaration.py, request it https://github.com/Leci37

The following files are generated for each action:

Models/Sklearn_smote folder: [OBSOLETE]

- XGboost_AMD_yyy_xxx_.sav

- RandomForest_AMD_yyy_xxx_.sav

- XGboost_AMD_yyy_xxx_.sav

Models/TF_balance folder: [OBSOLETE]

- TF_AMD_yyy_xxx_zzz.h5

- TF_AMD_yyy_xxx_zzz.h5_accuracy_71.08%__loss_0.59__epochs_10[160].csv

Models/TF_multi folder:

- TFm_AMD_yyy_xxx_zzz.h5

- Purely saved TF model

- TFm_AMD_yyy_xxx_zzz.h5_accuracy_71.08%__loss_0.59__epochs_10[160].csv

- Training statistics lost, accuracy against unseen data "Validation", against unseen data "Test" and information , against seen data "Test" and information of input columns

- Scalers/AMD_yyy_xxx_.scal

- TF can only be entered with values from 0 to 1, the object containing the scaling patterns is saved in .scal format, it will be very useful in real time reading.

xxx can take value vgood16 good9 reg4 and low1

yyy can take value "pos" and "neg".

zzz can take value s28 s64 and s128

Check that all combinations of files exposed by each action have been generated in the /Models subfolders.

From the 36 models created for each OHLCV history of each stock, only the best ones will be run in real time, in order to select and evaluate those best ones.

Run 4_Model_creation_scoring_multi.py

You can see how around 36 TF .h5 models are generated per action, you have to evaluate the 36 and collect the 1-3 best models to use them in real time, this information will be dumped in the files:

- Models/TF_multi/_RESULTS_profit_multi_all.csv

- Models/TF_multi/_SCORE_ALL_multi_all.csv

Check that two have been generated for each action.

Having reached this point, We would like to get to know you (this is a project of 11 months of work) and I would like you to tell me in Issues tab or Discussion tab what you think and if you see any utility in https://github.com/Leci37/stocks-prediction-Machine-learning-RealTime-telegram#possible-improvements.

Run Model_predictions_Nrows.py

At this point the file realtime_model_POOL_driver.py is required, you must ask for it

This run generates the log file d_result/prediction_results_N_rows.csv Generates a sample file with predictions for the last week, data obtained with yfinance. Check that records exist

In case you want to predict actions in the @FOLO3 list, ignore this point.

It is difficult to get real time OHLCV, especially volume (yfinance gives real time volume, but this is not a correct value and after 1-2 hours it changes, making it unfeasible to use yfinance for real time predictions).

To get correct volumes in real time, queries are made to webull, for each stock every 2.5 minutes, a webull ID is required, the default ones @FOLO3 are cached and downloaded in a_manage_stocks_dict.py. DICT_WEBULL_ID

But if you want to use actions outside the list @FOLO3

In Utils/Volume_WeBull_get_tikcers.py

Change the example list:

list_stocks = ["NEWS", "STOCKS", "WEBULL", "IDs"]

By the nasdaq ticker, of the webull ID you want to get.

Run Utils/Volume_WeBull_get_tikcers.py

Once executed it will show a list on screen, that must be added in a_manage_stocks_dict.py.DICT_WEBULL_ID

"MELI" : 913323000,

"TWLO" : 913254000,

You have to get the telegram token and create a channel.

You can get the token by following the tutorial: https://www.siteguarding.com/en/how-to-get-telegram-bot-api-token

With the token update the variable of ztelegram_send_message_handle.py

#Get from telegram

TOKEN = **"00000000xxxxxxx"**Once the token has been obtained, the chatId of the users and administrator must be obtained.

Users only receive purchase and startup sale alerts, while the administrator receives alerts from users as well as possible problems.

To get the chatId of each user run ztelegram_send_message_UptateUser.py and then write any message to the bot, the chadID appears both in the console and in the user's chadID

*[>>> BOT] Message Send on 2022-11-08 22:30:31:31*

` `*Text: You "User nickname " send me:*

*"Hello world"*

` `*ChatId: "5058733760".*

` `*From: Bot name*

` `*Message ID: 915*

` `*CHAT ID: 500000760*

*-----------------------------------------------*

Pick up *CHAT ID: 500000760*

With the chatId of the desired users, add them to the LIST_PEOPLE_IDS_CHAT list.

in ztelegram_send_message_handle.py

It is possible to run it without configuring telegram, in that case no alerts will be sent in telegram, but the results will be recorded in real time in: d_result/prediction_real_time.csv

It will be reported in console via:

is_token_telegram_configurated() - Results will be recorded in real time, but no alert will be sent on telegram. File: d_result/prediction_real_time.csv

is_token_telegram_configurated() - There is no value for the telegram TOKEN, telegram is required to telegram one*

The criteria to send alert or not is defined in the method ztelegram_send_message.will_send_alert(). If more than half of the models have a score greater than 93% or the TF models have a score greater than 93%, an alert is sent to the consumer users.

Run 5_predict_POOL_enque_Thread.py

In this class there are 2 types of threads

- Producer , constantly asks for OHLCV data, once it is obtained, it enters it into a queue.

- Consumer (2 threads running simultaneously) are pulling OHLCV data from the queue, calculating technical parameters, making model predictions, registering them in zTelegram_Registers.csv, and if they meet the requirements they are sent by telegram.

would be to combine the power of the 17 models tested at https://github.com/huseinzol05/Stock-Prediction-Models predictive models with https://github.com/Leci37/stocks-Machine-learning-RealTime-telegram/tree/develop real-time pattern calculation and alerting capabilities.

Should be implemented in the method train_model_with_custom_columns(name_model, columns_list, csv_file_SCALA, op_buy_sell : a_manage_stocks_dict.Op_buy_sell):

For multidimension branch: get_dicts_models_multi_dimension(self).

another interesting improvement is the addition of PYTORCH, is the tensor flow "competence".

Even if the testing of the 17 models improves the result , the ML libraries, offer "tuners", tools that test all desired combinations and turn the ideal configuration for that data. For tensor flow, see https://www.tensorflow.org/tutorials/keras/keras_tuner

In the project there are several intents of use: Model_finetune_TF.py, Model_finetune_TF_2.py and Model_finetune_XGB.py.

Running the "tuners" code is very heavy on the computer.

You can add more models (the 17 for example) and tune them with keras_tuner.

Example of the multiple values that keras_tuner allows:

neurons = [2, 4,8,16,24,28,32,32,44,52,64,92,92]]

weight_constraint = [1.0, 3.0, 4.0, 5.0, 7.0]

dropout_rate = [0.0, 0.1, 0.2, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8, 0.9]

hp_learning_rate = hp.Choice('learning_rate', values=[1e-2, 1e-3, 1e-4, 1e-5])

param_grid = dict(model__dropout_rate=dropout_rate, model__weight_constraint=weight_constraint, model__neurons=neurons).

model = KerasClassifier(model=create_model_2, epochs=100, batch_size=10, verbose=2)More information: https://www.simplilearn.com/tutorials/deep-learning-tutorial/keras-tuner and https://machinelearningmastery.com/grid-search-hyperparameters-deep-learning-models-python-keras/

You can add to the alerts the summary of the financial information from TraderView.com, this image will always be loaded with the financial-analyst information in real time.

Image is generated by code __create_find_data_png_trader_view(path_png + "_TRAVIEW_finan.png")

Example of summary:

Solved Note 29-December 2022 in stocks-prediction-multi branch (ask for it without any problem). Improvements in TF predictive models using tensors (multiple matrices over time) and non-matrices (mono temporal, current design).

In the class Model_TF_definitions.ModelDefinition.py

Through it, the model configurations, density, number of neurons, etc. are obtained.

There are two methods:

get_dicts_models_One_dimension()is currently used and generates TF model configurations for arrays.get_dicts_models_multi_dimension()is not in use, it is set to give multiple model configurations using tensors.

There is the Utils.Utils_model_predict.df_to_df_multidimension_array(dataframe, BACHT_SIZE_LOOKBACK) method, which transforms 2-dimensional df [columns , rows] to 3-dimensional df [columns , files, BACHT_SIZE_LOOKBACK ].

BACHT_SIZE_LOOKBACK means how many records in the past tense are added to the df, the number is configurable and default value is eight.

To start the development must be to call the method with BACHT_SIZE_LOOKBACK with an integer value, the method will return a multidimensional df [columns, files, BACHT_SIZE_LOOKBACK ], with which to feed the TF models.

Utils_model_predict.scaler_split_TF_onbalance(df, label_name=Y_TARGET, BACHT_SIZE_LOOKBACK=8)

Improvement: Once these multidimensional arrays are returned, models are obtained with get_dicts_models_multi_dimension(), it is not possible to train a model and make a prediction with multidimensional arrays.

It is recommended to review the point "Ground True is the variable" of the documentation, to understand this point.

Before training the models the intervals (of 15min) are classified as buy point 100 or 101, sell point -100 or .-101 or no trade point 0, these values are entered in the column Y_TARGET = 'buy_sell_point' through the method Utils.Utils_buy_sell_points.get_buy_sell_points_Roll().

The variation is calculated with respect to the following 12 windows (15min * 12 = 3 hours), and from there the 8% points of greatest rise and greatest fall are obtained, and these points are assigned values other than 0.

To obtain the Y_TARGET there are 2 methods that are responsible for the strategy to follow once you buy and sell, in case of loss will opt for Stop Loss.

rolling_get_sell_price_POS() and rolling_get_sell_price_NEG()

Optional improvement: the current system decides by percentages, i.e. the 16% highest rises and falls (8% each) are ground true. I.e. there are rises or falls greater than 3% that can be left out if the stock is very volatile.

For unbalanced classes, you should look at the f1-score indicator https://datascience.stackexchange.com/questions/105089/how-f1-score-is-good-with-unbalanced-dataset

What we are trying to achieve with the F1-score metric is to find an equal balance between precision and recall, which is extremely useful in most scenarios when we are working with imbalanced datasets (i.e., a dataset with a non-uniform distribution of class labels).

A model with high recall but low precision score returns many positive results, but most of its predicted labels are incorrect when compared to the ground truth.

On the other hand, a model with high precision but low recall score returns very few results, but most of its predicted labels are correct when compared to the ground-truth.

An ideal scenario would be a model with high precision and high recall, meaning it will return many results, with all results labelled correctly. Unfortunately, in most cases, precision and recall are often in tension.

Review the free code of people who have been in the top10 winners of kaggle, the championship models teach a lot.

At the moment I'm inspired by the 3rd place of the "price of the house in paris", it's data from .csv and unbalanced https://www.kaggle.com/code/viktortaran/ps-s-3-e-6?scriptVersionId=119565159&cellId=129

( it's hard to find them most of the winners in kaggle don't publish in open)

For more CHAMPIONSHIP notebooks:

https://ndres.me/kaggle-past-solutions/

https://www.kaggle.com/code/sudalairajkumar/winning-solutions-of-kaggle-competitions

How do you know that GrounsTrue clustering (buy, sell, nothing) is similar and correct? Is it necessary to cluster with more labels (buy_A, sell_A , nothing_A, buy_B, sell_B , nothing_B, buy_C, sell_C)? How do I know the number of tags needed ? To solve this question you can use the "K-means Clustering" https://neptune.ai/blog/clustering-algorithms

Remove columns that have more than 0.9 correlation between them, as they are redundant. Inside the method

uncorrelate_selection(features_X_ALL, num_features=NUMS_FEATURES, split_ratio=SPLIT_RATIO_X_Y, column_path=f'data/columns_select/{symbol}_{REF_MODEL}.pkl')

# Look for the next line and try the correction

# Get the correlation table

corr = train_data.corr()More info help: https://machinelearningmastery.com/basic-data-cleaning-for-machine-learning/

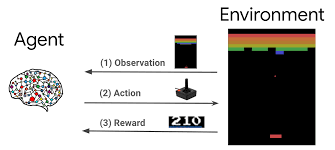

Another way to get a rebuild of the GT, is to change the architecture to Reinforcement Learning RL, which has the feature of not using GT, it learns after many trial and error attempts. There are three types of trades buy, sell or hold. the RL randomly tests them, collects results, and learns from the failures, when it is correct to buy, sell or hold.

The main project that uses RL is https://github.com/AI4Finance-Foundation/FinRL. Especially the tutorial to make RL with OHLCV data and 2 technical patterns. https://github.com/AI4Finance-Foundation/FinRL/blob/master/examples/Stock_NeurIPS2018_SB3.ipynb

That project does not have good tools for real time data collection, alert system, it also works with daily OHLCV data (instead of the intra day 5min, 15min, 1h of this project), which leaves you very exposed to news and financial results.

To start getting familiar with this POWERFUL tool, we recommend the following tools and tutorials

- From 0 : https://gymnasium.farama.org/tutorials/training_agents/blackjack_tutorial/

- Beginner: https://github.com/AminHP/gym-anytrading

- Intermediate-advanced: https://github.com/AminHP/gym-mtsim

- Professional: https://github.com/AI4Finance-Foundation/FinRL

The models are binary, i.e., some POS models are generated to detect only points of purchase and other NEG to detect only points of sale, these predictive models only detect True or False.

You can try to add a multi-label detection, this would translate into Buy, Sell, Nothing preconditions.

Hint: look for activation='sigmoid' and implement https://stackoverflow.com/questions/55936546/binary-and-multi-class-classification-code-change

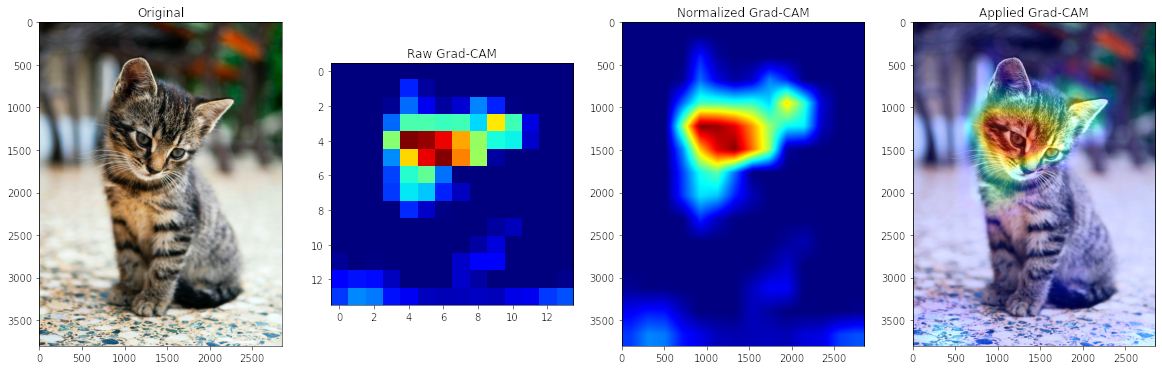

When making TF image predictions, it provides the heat map, i.e., what pixels it looked at to make the decision. Which of the technical patterns provided (in 3d array format)? forming the heat map, of the given preconditions Example for TF cat detection:

Search for better correlations strength https://gmarti.gitlab.io/ml/2019/10/13/tf-dcgan-financial-correlation-matrices.html

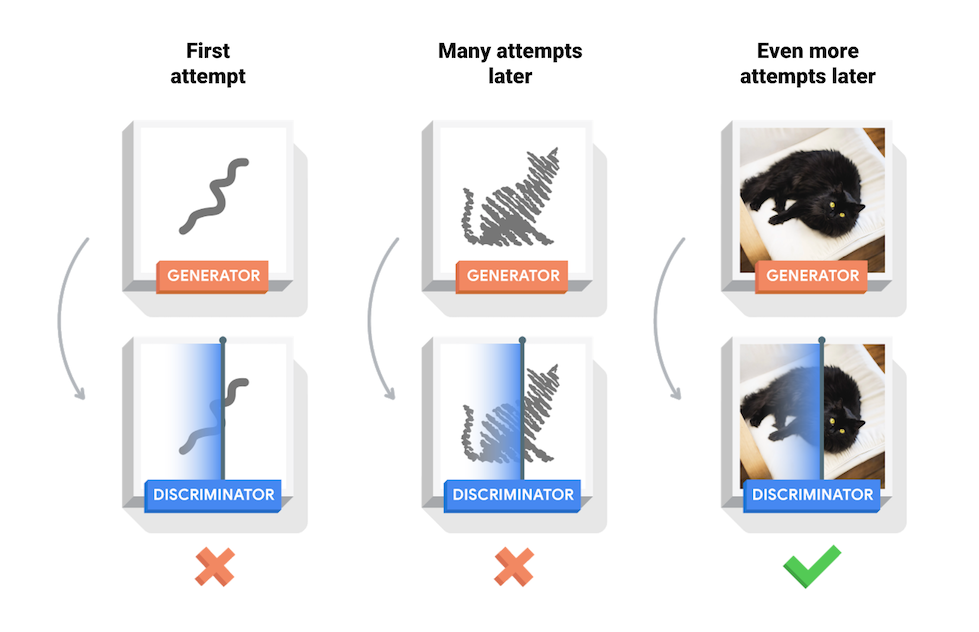

Instead of using the ground true, i.e. the objective "y", it can be disguised, i.e. at each step of the training it is not evaluated against the "y" but against the function "benefit obtained" (which would have to be created). For this it is necessary to create callback decorators in the training function like https://www.tensorflow.org/guide/keras/customizing_what_happens_in_fit?hl=es-419#wrapping_up_an_end-to-end_gan_example

This is the strangest improvement, and the one that makes me most curious

Tensor Flow allows to create fictitious images by means of the system of two neural networks fighting (one neural network "artist" and the other "critic"). The artist creates small modifications and the critic tells him to go closer or farther away. This tactic is called GAN (generative adversarial networks) https://www.tensorflow.org/tutorials/generative/dcgan Example of real time creation of fictional anime GAN images

The multidimensional training data of the stocks-prediction-multi branch, are 3d arrays (a .png .jpg ... is also a 3d array), with that data you can create the fight between "artist" and "critic". This totally changes the way of preceding, currently you collect data and ask the TF model, is it a point of buying and selling? With this change, it works like:

- TF model receives a request "generate-imagine" buying points

- TFmodel returns many fictional arrays3d

- when in real time appears an array3d similar to the imagined one, the buy-sell alert is launched.

Once you have obtained the history (example named GOOG_PLAIN_stock_history_MONTH_3.csv) with the technical patterns of the stock you can try using the prediction services of the big IT companies:

- Google: https://cloud.google.com/vertex-ai/docs/beginner/beginners-guide

- Microsotf Azure: https://learn.microsoft.com/es-es/azure/machine-learning/how-to-use-automated-ml-for-ml-models

- AWS: https://aws.amazon.com/es/getting-started/hands-on/machine-learning-tutorial-automatically-create-models/

Usage experience:

Dic-2022 (Azure and Google allow you to export locally from model and make predictions locally without relying on the clouds, AWS for the moment forces you to make predictions in their cloud, making the cost of maintenance much more expensive (I have not tested AWS in depth for that reason).

Azure takes a lot of time (more than 15h) tests many more models, many fail and you have to pay for the time it takes to fail.

ERROR: Unexpected bus error encountered in worker. This might be caused by insufficient shared memory (shm).

Google goes faster, but does not support for the moment any result better than the one obtained locally.

Both allow you to easily download the models created, Azure with .py files for guidance.

More models, more power Azure, it is also more expensive.

You get the news for each stock with news_get_data_NUTS.get_news_sentiment_data() this method gets all the associated news from: INVESTING.com, YAHOO.com and FINVIZ.COM.

News is obtained from yahoo and finviz.com, (see file https://github.com/Leci37/TensorFlow-stocks-prediction-Machine-learning-RealTime/blob/master/news_sentiment/news_get_data_NUTS.py ) NO NEWS FROM TWITTER in this version, just publish result on it. While news are obtained, the news are not valued by the TensorFlow models as of today. (providers with little and poor data).

( it uses investpy API , which recently october 2022 has started to fail , probably due to investing.com blocking https://github.com/alvarobartt/investpy )

Once these news items are obtained, the method news_sentiment_va_and_txtBlod.get_sentiment_predictorS() proceeds to evaluate and score from -100 negative to 100 positive, using 4 models. It is convenient to introduce more news pages

The models are downloaded from the internet, either via AI models or libraries, you can find the references in:

news_sentiment_flair.get_sentiment_flair

news_sentiment_t5.get_sentiment_t5

news_sentiment_t5.get_sentiment_t5Be

get_sentiment_textBlod

Run news_get_data_NUTS.get_json_news_sentimet()

A .csv and .json file is generated, with action date the four models, the score and the news collected Example: d_sentiment/stock_news_DATE_MELI.csv

Improvement: Once the sentiment-news score file is obtained, introduce it in the predictive models together with the technical indicators, it must be done in real time.

Economic balances can be added easily using the yahoo API

https://github.com/ranaroussi/yfinance

# show financials

msft.financials

msft.quarterly_financials

These balances are updated every quarter.

You can get the dates of publication of results in yahoo API

# show next event (earnings, etc)

msft.calendar

# show all earnings dates

msft.earnings_dates

This does not understand the principle of self-fulfilling prophecy (explained at the beginning), but it is worth considering. LSTM time series + stock price prediction = FAIL https://www.kaggle.com/code/carlmcbrideellis/lstm-time-series-stock-price-prediction-fail

Laurence Moroney has extensive tutorials in his book on how to correctly make temporary preditions (LSTM; GRU; RNN; CNN; ). https://github.com/lmoroney/tfbook/tree/master/chapter11

A good google brain tutorial Laurence Moroney https://github.com/MoRebaie/Sequences-Time-Series-Prediction-in-Tensorflow/blob/master/Course_4_Week_4_Exercise_Question.ipynb

Allow to analyze stocks outside the nasdaq, change in :

yhoo_history_stock._select_dowload_time_config()

Utils/API_alphavantage_get_old_history.py

Redirect remaining print() to Logger.logr.debug()

Translate through https://www.deepl.com/ the possible remaining messages in Spanish to English.

The plots generated in the plots_relations/plot folder by

Change the operation of the bot, that is enough to send the command \start, and remove the case of execution of ztelegram_send_message_UptateUser.py described in point: 5.2

Send real time email alert

Revise Stock prediction fail LSTM , Solved in stocks-prediction-multi branch

Find the explanation of what indicators and values the AI model takes, to predict what it predicts and give a small explanation-schema, for example random forest models if you can print the sequence that makes the prediction.

(green buy, red do not trade) https://stackoverflow.com/questions/40155128/plot-trees-for-a-random-forest-in-python-with-scikit-learn

-

RealTime Twitter https://twitter.com/Whale__Hunters

-

RealTime Telegram @Whale_Hunter_Alertbot this group is limited, to receive alert to sign up ask via github or twitter

The models have been trained in 15 min intervals with , i.e. the alerts expire in about 7 minutes, that means that once the tweet goes out, you have +-7 minutes to decide whether to trade or not. also that the models should be used on intra-day trade.Never blindly follow the alerts, check first. The alerts indicate points where only technical patterns have brought strong trend changes in the last 5 months, i.e. if these models were applied to the last 5 months they would hit 91% of the BUY SELL points, in the future no one can know. In other words, it is not an absolute truth.

The alerts are designed for INTRADAY operations, for the moment only with technical patterns, that is to say at the end of the day it is recommended to close them, in the future no one can know.

- Can be BUY or SELL.

- The id of the stock, always from the USA market, in case of crypto will have the termination -USD. In case of Tesla, it is TSLA, in case of doubt with the company id , a simple google search "Stocks XXX".

- Link to Investing.com news, check before making the final decision.

- Link to the candlesticks through TraderView.com, is the image shown attached with the alert.

- 𝙈𝙤𝙙𝙚𝙡 𝙏𝙧𝙪𝙨𝙩:⬆⬇, level of strength indicating whether there is a positive or negative trend and behind / number of models used to obtain the percentage. It may be the case that both the uptrend POS and downtrend NEG have a high score, indicating increased volatility.

- 📊⚙𝙉𝙖𝙢𝙚𝙨: The name of the selected models with which the prediction has been made and the percentage of strength.

OHLCV :An opening-high-low-closing-volume chart is a type of chart that is typically used to illustrate movements in the price of a financial instrument over time.

Functions:

- Collection of historical stocks OHLCV data for the last years and calculation of technical patterns (momentums, volatility, Japanese candlesticks, statistics...), 1068 patterns.

- Calculations of which of the 1068 are the most valuable, and most relevant for the detection of good trading points (buy-sell).

- Training of several machine learning models using powerful libraries:Google Tensor Flow Sklearn and XGB

- Evaluation of the multiple models, to discard the less reliable ones.

- OHLCV data collection and making predictions from the models in real time, when any of the multiple predictions (buy-sell stocks) is considered valid, sending real-time alert to Telegram and Mail.

Remember the scalability of the project, it receives OHLCV data but can receive any type of data in .csv or excel for predictions, with few changes (check the structure), it would be nice to complete the development so that it can receive predictions of any type, with open source. I am willing to help. The predictive models generated by the solution are binary, i.e. they detect True or False.

See article in medium.com https://medium.com/@LuisCasti33/lectrade-machine-learning-with-technical-patterns-and-real-time-alerts-for-buying-and-selling-in-b4ecc59b29cb

USE THE SOFTWARE AT YOUR OWN RISK THE AUTHORS AND ALL AFFILIATES ASSUME NO RESPONSIBILITY FOR YOUR TRADING RESULTS

USE THE SOFTWARE AT YOUR OWN RISK THE AUTHORS AND ALL AFFILIATES ASSUME NO RESPONSIBILITY FOR YOUR TRADING RESULTS. Do not risk money which you are afraid to lose. There might be bugs in the code - this software DOES NOT come with ANY warranty. Permitted, free use and modification, but no commercialization to third parties, without authorization. All rights reserved. Improvements or changes by third parties must be notified

ALL technical indicators in python you can find here, look the funtion extract_features(df: pd.DataFrame,extra_columns =False, shift=150, debug=False) inside https://github.com/Leci37/TensorFlow-stocks-prediction-Machine-learning-RealTime/blob/master/features_W3_old/v3.py some of the technical indicators take future data, be careful.

All patterns used

Date buy_sell_point Open High Low Close Volume per_Close per_Volume has_preMarket

per_preMarket olap_BBAND_UPPER olap_BBAND_MIDDLE olap_BBAND_LOWER olap_BBAND_UPPER_crash

olap_BBAND_LOWER_crash olap_BBAND_dif olap_HT_TRENDLINE olap_MIDPOINT olap_MIDPRICE olap_SAR

olap_SAREXT mtum_ADX mtum_ADXR mtum_APO mtum_AROON_down mtum_AROON_up mtum_AROONOSC mtum_BOP

mtum_CCI mtum_CMO mtum_DX mtum_MACD mtum_MACD_signal mtum_MACD_list mtum_MACD_crash mtum_MACD_ext

mtum_MACD_ext_signal mtum_MACD_ext_list mtum_MACD_ext_crash mtum_MACD_fix mtum_MACD_fix_signal

mtum_MACD_fix_list mtum_MACD_fix_crash mtum_MFI mtum_MINUS_DI mtum_MINUS_DM mtum_MOM

mtum_PLUS_DI mtum_PLUS_DM mtum_PPO mtum_ROC mtum_ROCP mtum_ROCR mtum_ROCR100

mtum_RSI mtum_STOCH_k mtum_STOCH_d mtum_STOCH_kd mtum_STOCH_crash mtum_STOCH_Fa_k

mtum_STOCH_Fa_d mtum_STOCH_Fa_kd mtum_STOCH_Fa_crash mtum_STOCH_RSI_k mtum_STOCH_RSI_d

mtum_STOCH_RSI_kd mtum_STOCH_RSI_crash mtum_TRIX mtum_ULTOSC mtum_WILLIAMS_R volu_Chaikin_AD

volu_Chaikin_ADOSC volu_OBV vola_ATR vola_NATR vola_TRANGE cycl_DCPERIOD cycl_DCPHASE

cycl_PHASOR_inph cycl_PHASOR_quad cycl_SINE_sine cycl_SINE_lead cycl_HT_TRENDMODE cdl_2CROWS

cdl_3BLACKCROWS cdl_3INSIDE cdl_3LINESTRIKE cdl_3OUTSIDE cdl_3STARSINSOUTH cdl_3WHITESOLDIERS

cdl_ABANDONEDBABY cdl_ADVANCEBLOCK cdl_BELTHOLD cdl_BREAKAWAY cdl_CLOSINGMARUBOZU

cdl_CONCEALBABYSWALL cdl_COUNTERATTACK cdl_DARKCLOUDCOVER cdl_DOJI cdl_DOJISTAR

cdl_DRAGONFLYDOJI cdl_ENGULFING cdl_EVENINGDOJISTAR cdl_EVENINGSTAR cdl_GAPSIDESIDEWHITE

cdl_GRAVESTONEDOJI cdl_HAMMER cdl_HANGINGMAN cdl_HARAMI cdl_HARAMICROSS cdl_HIGHWAVE

cdl_HIKKAKE cdl_HIKKAKEMOD cdl_HOMINGPIGEON cdl_IDENTICAL3CROWS cdl_INNECK cdl_INVERTEDHAMMER

cdl_KICKING cdl_KICKINGBYLENGTH cdl_LADDERBOTTOM cdl_LONGLEGGEDDOJI cdl_LONGLINE

cdl_MARUBOZU cdl_MATCHINGLOW cdl_MATHOLD cdl_MORNINGDOJISTAR cdl_MORNINGSTAR cdl_ONNECK

cdl_PIERCING cdl_RICKSHAWMAN cdl_RISEFALL3METHODS cdl_SEPARATINGLINES cdl_SHOOTINGSTAR

cdl_SHORTLINE cdl_SPINNINGTOP cdl_STALLEDPATTERN cdl_STICKSANDWICH cdl_TAKURI

cdl_TASUKIGAP cdl_THRUSTING cdl_TRISTAR cdl_UNIQUE3RIVER cdl_UPSIDEGAP2CROWS

cdl_XSIDEGAP3METHODS sti_BETA sti_CORREL sti_LINEARREG sti_LINEARREG_ANGLE sti_LINEARREG_INTERCEPT

sti_LINEARREG_SLOPE sti_STDDEV sti_TSF sti_VAR ma_DEMA_5 ma_EMA_5 ma_KAMA_5 ma_SMA_5 ma_T3_5 ma_TEMA_5

ma_TRIMA_5 ma_WMA_5 ma_DEMA_10 ma_EMA_10 ma_KAMA_10 ma_SMA_10 ma_T3_10 ma_TEMA_10 ma_TRIMA_10

ma_WMA_10 ma_DEMA_20 ma_EMA_20 ma_KAMA_20 ma_SMA_20 ma_T3_20 ma_TEMA_20 ma_TRIMA_20 ma_WMA_20

ma_DEMA_50 ma_EMA_50 ma_KAMA_50 ma_SMA_50 ma_T3_50 ma_TEMA_50 ma_TRIMA_50 ma_WMA_50

ma_DEMA_100 ma_EMA_100 ma_KAMA_100 ma_SMA_100 ma_T3_100 ma_TEMA_100 ma_TRIMA_100 ma_WMA_100 trad_s3 trad_s2 trad_s1

trad_pp trad_r1 trad_r2 trad_r3 clas_s3 clas_s2 clas_s1 clas_pp clas_r1 clas_r2 clas_r3 fibo_s3 fibo_s2 fibo_s1 fibo_pp fibo_r1

fibo_r2 fibo_r3 wood_s3 wood_s2 wood_s1 wood_pp wood_r1 wood_r2 wood_r3 demark_s1 demark_pp demark_r1 cama_s3 cama_s2

cama_s1 cama_pp cama_r1 cama_r2 cama_r3 ti_acc_dist ti_chaikin_10_3 ti_choppiness_14 ti_coppock_14_11_10

ti_donchian_lower_20 ti_donchian_center_20 ti_donchian_upper_20 ti_ease_of_movement_14 ti_force_index_13

ti_hma_20 ti_kelt_20_lower ti_kelt_20_upper ti_mass_index_9_25 ti_supertrend_20 ti_vortex_pos_5

ti_vortex_neg_5 ti_vortex_pos_14 ti_vortex_neg_14 cycl_EBSW_40_10 mtum_AO_5_34 mtum_BIAS_SMA_26

mtum_AR_26 mtum_BR_26 mtum_CFO_9 mtum_CG_10 mtum_CTI_12 mtum_DMP_14 mtum_DMN_14 mtum_ER_10

mtum_BULLP_13 mtum_BEARP_13 mtum_FISHERT_9_1 mtum_FISHERTs_9_1 mtum_INERTIA_20_14 mtum_K_9_3 mtum_D_9_3 mtum_J_9_3

mtum_PGO_14 mtum_PSL_12 mtum_PVO_12_26_9 mtum_PVOh_12_26_9 mtum_PVOs_12_26_9 mtum_QQE_14_5_4236_RSIMA

mtum_QQEl_14_5_4236 mtum_QQEs_14_5_4236 mtum_RSX_14 mtum_STC_10_12_26_05 mtum_STCmacd_10_12_26_05

mtum_STCstoch_10_12_26_05 mtum_SMI_5_20_5 mtum_SMIs_5_20_5 mtum_SMIo_5_20_5 olap_ALMA_10_60_085 olap_HWMA_02_01_01

olap_JMA_7_0 olap_MCGD_10 olap_PWMA_10 olap_SINWMA_14 olap_SSF_10_2 olap_SWMA_10 olap_VMAP olap_VWMA_10

perf_CUMLOGRET_1 perf_CUMPCTRET_1 perf_z_30_1 perf_ha sti_ENTP_10 sti_KURT_30 sti_TOS_STDEVALL_LR sti_TOS_STDEVALL_L_1

sti_TOS_STDEVALL_U_1 sti_TOS_STDEVALL_L_2 sti_TOS_STDEVALL_U_2 sti_TOS_STDEVALL_L_3 sti_TOS_STDEVALL_U_3

sti_ZS_30 tend_LDECAY_5 tend_PSARl_002_02 tend_PSARs_002_02 tend_PSARaf_002_02 tend_PSARr_002_02 tend_VHF_28

vola_HWM vola_HWU vola_HWL vola_KCLe_20_2 vola_KCBe_20_2 vola_KCUe_20_2 vola_RVI_14 vola_THERMO_20_2_05

vola_THERMOma_20_2_05 vola_THERMOl_20_2_05 vola_THERMOs_20_2_05 vola_TRUERANGE_1 vola_UI_14 volu_EFI_13

volu_NVI_1 volu_PVI_1 volu_PVOL volu_PVR volu_PVT mtum_murrey_math mtum_td_seq mtum_td_seq_sig tend_hh

tend_hl tend_ll tend_lh tend_hh_crash tend_hl_crash tend_ll_crash tend_lh_crash ichi_tenkan_sen ichi_kijun_sen

ichi_senkou_a ichi_senkou_b ichi_isin_cloud ichi_crash ichi_chikou_span tend_renko_TR tend_renko_ATR

tend_renko_brick tend_renko_change pcrh_trad_s3 pcrh_trad_s2 pcrh_trad_s1 pcrh_trad_pp pcrh_trad_r1

pcrh_trad_r2 pcrh_trad_r3 pcrh_clas_s3 pcrh_clas_s2 pcrh_clas_s1 pcrh_clas_pp pcrh_clas_r1

pcrh_clas_r2 pcrh_clas_r3 pcrh_fibo_s3 pcrh_fibo_s2 pcrh_fibo_s1 pcrh_fibo_pp pcrh_fibo_r1

pcrh_fibo_r2 pcrh_fibo_r3 pcrh_wood_s3 pcrh_wood_s2 pcrh_wood_s1 pcrh_wood_pp pcrh_wood_r1

pcrh_wood_r2 pcrh_wood_r3 pcrh_demark_s1 pcrh_demark_pp pcrh_demark_r1 pcrh_cama_s3 pcrh_cama_s2

pcrh_cama_s1 pcrh_cama_pp pcrh_cama_r1 pcrh_cama_r2 pcrh_cama_r3 mcrh_DEMA_5_DEMA_10 mcrh_DEMA_5_EMA_10

mcrh_DEMA_5_KAMA_10 mcrh_DEMA_5_SMA_10 mcrh_DEMA_5_T3_10 mcrh_DEMA_5_TEMA_10 mcrh_DEMA_5_TRIMA_10

mcrh_DEMA_5_WMA_10 mcrh_DEMA_5_DEMA_20 mcrh_DEMA_5_EMA_20 mcrh_DEMA_5_KAMA_20 mcrh_DEMA_5_SMA_20 mcrh_DEMA_5_T3_20

mcrh_DEMA_5_TEMA_20 mcrh_DEMA_5_TRIMA_20 mcrh_DEMA_5_WMA_20 mcrh_DEMA_5_DEMA_50 mcrh_DEMA_5_EMA_50

mcrh_DEMA_5_KAMA_50 mcrh_DEMA_5_SMA_50 mcrh_DEMA_5_T3_50 mcrh_DEMA_5_TEMA_50 mcrh_DEMA_5_TRIMA_50

mcrh_DEMA_5_WMA_50 mcrh_DEMA_5_DEMA_100 mcrh_DEMA_5_EMA_100 mcrh_DEMA_5_KAMA_100 mcrh_DEMA_5_SMA_100

mcrh_DEMA_5_T3_100 mcrh_DEMA_5_TEMA_100 mcrh_DEMA_5_TRIMA_100 mcrh_DEMA_5_WMA_100 mcrh_DEMA_5_ti_h20

mcrh_EMA_5_DEMA_10 mcrh_EMA_5_EMA_10 mcrh_EMA_5_KAMA_10 mcrh_EMA_5_SMA_10 mcrh_EMA_5_T3_10 mcrh_EMA_5_TEMA_10

mcrh_EMA_5_TRIMA_10 mcrh_EMA_5_WMA_10 mcrh_EMA_5_DEMA_20 mcrh_EMA_5_EMA_20 mcrh_EMA_5_KAMA_20 mcrh_EMA_5_SMA_20

mcrh_EMA_5_T3_20 mcrh_EMA_5_TEMA_20 mcrh_EMA_5_TRIMA_20 mcrh_EMA_5_WMA_20 mcrh_EMA_5_DEMA_50 mcrh_EMA_5_EMA_50

mcrh_EMA_5_KAMA_50 mcrh_EMA_5_SMA_50 mcrh_EMA_5_T3_50 mcrh_EMA_5_TEMA_50 mcrh_EMA_5_TRIMA_50 mcrh_EMA_5_WMA_50

mcrh_EMA_5_DEMA_100 mcrh_EMA_5_EMA_100 mcrh_EMA_5_KAMA_100 mcrh_EMA_5_SMA_100 mcrh_EMA_5_T3_100 mcrh_EMA_5_TEMA_100

mcrh_EMA_5_TRIMA_100 mcrh_EMA_5_WMA_100 mcrh_EMA_5_ti_h20 mcrh_KAMA_5_DEMA_10 mcrh_KAMA_5_EMA_10 mcrh_KAMA_5_KAMA_10

mcrh_KAMA_5_SMA_10 mcrh_KAMA_5_T3_10 mcrh_KAMA_5_TEMA_10 mcrh_KAMA_5_TRIMA_10 mcrh_KAMA_5_WMA_10

mcrh_KAMA_5_DEMA_20 mcrh_KAMA_5_EMA_20 mcrh_KAMA_5_KAMA_20 mcrh_KAMA_5_SMA_20 mcrh_KAMA_5_T3_20 mcrh_KAMA_5_TEMA_20

mcrh_KAMA_5_TRIMA_20 mcrh_KAMA_5_WMA_20 mcrh_KAMA_5_DEMA_50 mcrh_KAMA_5_EMA_50 mcrh_KAMA_5_KAMA_50 mcrh_KAMA_5_SMA_50

mcrh_KAMA_5_T3_50 mcrh_KAMA_5_TEMA_50 mcrh_KAMA_5_TRIMA_50 mcrh_KAMA_5_WMA_50 mcrh_KAMA_5_DEMA_100 mcrh_KAMA_5_EMA_100

mcrh_KAMA_5_KAMA_100 mcrh_KAMA_5_SMA_100 mcrh_KAMA_5_T3_100 mcrh_KAMA_5_TEMA_100 mcrh_KAMA_5_TRIMA_100

mcrh_KAMA_5_WMA_100 mcrh_KAMA_5_ti_h20 mcrh_SMA_5_DEMA_10 mcrh_SMA_5_EMA_10 mcrh_SMA_5_KAMA_10 mcrh_SMA_5_SMA_10

mcrh_SMA_5_T3_10 mcrh_SMA_5_TEMA_10 mcrh_SMA_5_TRIMA_10 mcrh_SMA_5_WMA_10 mcrh_SMA_5_DEMA_20 mcrh_SMA_5_EMA_20

mcrh_SMA_5_KAMA_20 mcrh_SMA_5_SMA_20 mcrh_SMA_5_T3_20 mcrh_SMA_5_TEMA_20 mcrh_SMA_5_TRIMA_20 mcrh_SMA_5_WMA_20

mcrh_SMA_5_DEMA_50 mcrh_SMA_5_EMA_50 mcrh_SMA_5_KAMA_50 mcrh_SMA_5_SMA_50 mcrh_SMA_5_T3_50 mcrh_SMA_5_TEMA_50

mcrh_SMA_5_TRIMA_50 mcrh_SMA_5_WMA_50 mcrh_SMA_5_DEMA_100 mcrh_SMA_5_EMA_100 mcrh_SMA_5_KAMA_100 mcrh_SMA_5_SMA_100

mcrh_SMA_5_T3_100 mcrh_SMA_5_TEMA_100 mcrh_SMA_5_TRIMA_100 mcrh_SMA_5_WMA_100 mcrh_SMA_5_ti_h20 mcrh_T3_5_DEMA_10

mcrh_T3_5_EMA_10 mcrh_T3_5_KAMA_10 mcrh_T3_5_SMA_10 mcrh_T3_5_T3_10 mcrh_T3_5_TEMA_10 mcrh_T3_5_TRIMA_10

mcrh_T3_5_WMA_10 mcrh_T3_5_DEMA_20 mcrh_T3_5_EMA_20 mcrh_T3_5_KAMA_20 mcrh_T3_5_SMA_20 mcrh_T3_5_T3_20

mcrh_T3_5_TEMA_20 mcrh_T3_5_TRIMA_20 mcrh_T3_5_WMA_20 mcrh_T3_5_DEMA_50 mcrh_T3_5_EMA_50 mcrh_T3_5_KAMA_50

mcrh_T3_5_SMA_50 mcrh_T3_5_T3_50 mcrh_T3_5_TEMA_50 mcrh_T3_5_TRIMA_50 mcrh_T3_5_WMA_50 mcrh_T3_5_DEMA_100

mcrh_T3_5_EMA_100 mcrh_T3_5_KAMA_100 mcrh_T3_5_SMA_100 mcrh_T3_5_T3_100 mcrh_T3_5_TEMA_100 mcrh_T3_5_TRIMA_100

mcrh_T3_5_WMA_100 mcrh_T3_5_ti_h20 mcrh_TEMA_5_DEMA_10 mcrh_TEMA_5_EMA_10 mcrh_TEMA_5_KAMA_10 mcrh_TEMA_5_SMA_10

mcrh_TEMA_5_T3_10 mcrh_TEMA_5_TEMA_10 mcrh_TEMA_5_TRIMA_10 mcrh_TEMA_5_WMA_10 mcrh_TEMA_5_DEMA_20 mcrh_TEMA_5_EMA_20

mcrh_TEMA_5_KAMA_20 mcrh_TEMA_5_SMA_20 mcrh_TEMA_5_T3_20 mcrh_TEMA_5_TEMA_20 mcrh_TEMA_5_TRIMA_20 mcrh_TEMA_5_WMA_20

mcrh_TEMA_5_DEMA_50 mcrh_TEMA_5_EMA_50 mcrh_TEMA_5_KAMA_50 mcrh_TEMA_5_SMA_50 mcrh_TEMA_5_T3_50 mcrh_TEMA_5_TEMA_50

mcrh_TEMA_5_TRIMA_50 mcrh_TEMA_5_WMA_50 mcrh_TEMA_5_DEMA_100 mcrh_TEMA_5_EMA_100 mcrh_TEMA_5_KAMA_100

mcrh_TEMA_5_SMA_100 mcrh_TEMA_5_T3_100 mcrh_TEMA_5_TEMA_100 mcrh_TEMA_5_TRIMA_100 mcrh_TEMA_5_WMA_100

mcrh_TEMA_5_ti_h20 mcrh_TRIMA_5_DEMA_10 mcrh_TRIMA_5_EMA_10 mcrh_TRIMA_5_KAMA_10 mcrh_TRIMA_5_SMA_10

mcrh_TRIMA_5_T3_10 mcrh_TRIMA_5_TEMA_10 mcrh_TRIMA_5_TRIMA_10 mcrh_TRIMA_5_WMA_10 mcrh_TRIMA_5_DEMA_20

mcrh_TRIMA_5_EMA_20 mcrh_TRIMA_5_KAMA_20 mcrh_TRIMA_5_SMA_20 mcrh_TRIMA_5_T3_20 mcrh_TRIMA_5_TEMA_20

mcrh_TRIMA_5_TRIMA_20 mcrh_TRIMA_5_WMA_20 mcrh_TRIMA_5_DEMA_50 mcrh_TRIMA_5_EMA_50 mcrh_TRIMA_5_KAMA_50

mcrh_TRIMA_5_SMA_50 mcrh_TRIMA_5_T3_50 mcrh_TRIMA_5_TEMA_50 mcrh_TRIMA_5_TRIMA_50 mcrh_TRIMA_5_WMA_50

mcrh_TRIMA_5_DEMA_100 mcrh_TRIMA_5_EMA_100 mcrh_TRIMA_5_KAMA_100 mcrh_TRIMA_5_SMA_100 mcrh_TRIMA_5_T3_100

mcrh_TRIMA_5_TEMA_100 mcrh_TRIMA_5_TRIMA_100 mcrh_TRIMA_5_WMA_100 mcrh_TRIMA_5_ti_h20 mcrh_WMA_5_DEMA_10

mcrh_WMA_5_EMA_10 mcrh_WMA_5_KAMA_10 mcrh_WMA_5_SMA_10 mcrh_WMA_5_T3_10 mcrh_WMA_5_TEMA_10 mcrh_WMA_5_TRIMA_10

mcrh_WMA_5_WMA_10 mcrh_WMA_5_DEMA_20 mcrh_WMA_5_EMA_20 mcrh_WMA_5_KAMA_20 mcrh_WMA_5_SMA_20 mcrh_WMA_5_T3_20

mcrh_WMA_5_TEMA_20 mcrh_WMA_5_TRIMA_20 mcrh_WMA_5_WMA_20 mcrh_WMA_5_DEMA_50 mcrh_WMA_5_EMA_50 mcrh_WMA_5_KAMA_50

mcrh_WMA_5_SMA_50 mcrh_WMA_5_T3_50 mcrh_WMA_5_TEMA_50 mcrh_WMA_5_TRIMA_50 mcrh_WMA_5_WMA_50 mcrh_WMA_5_DEMA_100

mcrh_WMA_5_EMA_100 mcrh_WMA_5_KAMA_100 mcrh_WMA_5_SMA_100 mcrh_WMA_5_T3_100 mcrh_WMA_5_TEMA_100 mcrh_WMA_5_TRIMA_100

mcrh_WMA_5_WMA_100 mcrh_WMA_5_ti_h20 mcrh_DEMA_10_DEMA_20 mcrh_DEMA_10_EMA_20 mcrh_DEMA_10_KAMA_20

mcrh_DEMA_10_SMA_20 mcrh_DEMA_10_T3_20 mcrh_DEMA_10_TEMA_20 mcrh_DEMA_10_TRIMA_20 mcrh_DEMA_10_WMA_20

mcrh_DEMA_10_DEMA_50 mcrh_DEMA_10_EMA_50 mcrh_DEMA_10_KAMA_50 mcrh_DEMA_10_SMA_50 mcrh_DEMA_10_T3_50

mcrh_DEMA_10_TEMA_50 mcrh_DEMA_10_TRIMA_50 mcrh_DEMA_10_WMA_50 mcrh_DEMA_10_DEMA_100 mcrh_DEMA_10_EMA_100

mcrh_DEMA_10_KAMA_100 mcrh_DEMA_10_SMA_100 mcrh_DEMA_10_T3_100 mcrh_DEMA_10_TEMA_100 mcrh_DEMA_10_TRIMA_100

mcrh_DEMA_10_WMA_100 mcrh_DEMA_10_ti_h20 mcrh_EMA_10_DEMA_20 mcrh_EMA_10_EMA_20 mcrh_EMA_10_KAMA_20 mcrh_EMA_10_SMA_20

mcrh_EMA_10_T3_20 mcrh_EMA_10_TEMA_20 mcrh_EMA_10_TRIMA_20 mcrh_EMA_10_WMA_20 mcrh_EMA_10_DEMA_50 mcrh_EMA_10_EMA_50

mcrh_EMA_10_KAMA_50 mcrh_EMA_10_SMA_50 mcrh_EMA_10_T3_50 mcrh_EMA_10_TEMA_50 mcrh_EMA_10_TRIMA_50 mcrh_EMA_10_WMA_50

mcrh_EMA_10_DEMA_100 mcrh_EMA_10_EMA_100 mcrh_EMA_10_KAMA_100 mcrh_EMA_10_SMA_100 mcrh_EMA_10_T3_100

mcrh_EMA_10_TEMA_100 mcrh_EMA_10_TRIMA_100 mcrh_EMA_10_WMA_100 mcrh_EMA_10_ti_h20 mcrh_KAMA_10_DEMA_20

mcrh_KAMA_10_EMA_20 mcrh_KAMA_10_KAMA_20 mcrh_KAMA_10_SMA_20 mcrh_KAMA_10_T3_20 mcrh_KAMA_10_TEMA_20

mcrh_KAMA_10_TRIMA_20 mcrh_KAMA_10_WMA_20 mcrh_KAMA_10_DEMA_50 mcrh_KAMA_10_EMA_50 mcrh_KAMA_10_KAMA_50

mcrh_KAMA_10_SMA_50 mcrh_KAMA_10_T3_50 mcrh_KAMA_10_TEMA_50 mcrh_KAMA_10_TRIMA_50 mcrh_KAMA_10_WMA_50

mcrh_KAMA_10_DEMA_100 mcrh_KAMA_10_EMA_100 mcrh_KAMA_10_KAMA_100 mcrh_KAMA_10_SMA_100 mcrh_KAMA_10_T3_100

mcrh_KAMA_10_TEMA_100 mcrh_KAMA_10_TRIMA_100 mcrh_KAMA_10_WMA_100 mcrh_KAMA_10_ti_h20 mcrh_SMA_10_DEMA_20

mcrh_SMA_10_EMA_20 mcrh_SMA_10_KAMA_20 mcrh_SMA_10_SMA_20 mcrh_SMA_10_T3_20 mcrh_SMA_10_TEMA_20 mcrh_SMA_10_TRIMA_20

mcrh_SMA_10_WMA_20 mcrh_SMA_10_DEMA_50 mcrh_SMA_10_EMA_50 mcrh_SMA_10_KAMA_50 mcrh_SMA_10_SMA_50 mcrh_SMA_10_T3_50

mcrh_SMA_10_TEMA_50 mcrh_SMA_10_TRIMA_50 mcrh_SMA_10_WMA_50 mcrh_SMA_10_DEMA_100 mcrh_SMA_10_EMA_100

mcrh_SMA_10_KAMA_100 mcrh_SMA_10_SMA_100 mcrh_SMA_10_T3_100 mcrh_SMA_10_TEMA_100 mcrh_SMA_10_TRIMA_100

mcrh_SMA_10_WMA_100 mcrh_SMA_10_ti_h20 mcrh_T3_10_DEMA_20 mcrh_T3_10_EMA_20 mcrh_T3_10_KAMA_20 mcrh_T3_10_SMA_20

mcrh_T3_10_T3_20 mcrh_T3_10_TEMA_20 mcrh_T3_10_TRIMA_20 mcrh_T3_10_WMA_20 mcrh_T3_10_DEMA_50 mcrh_T3_10_EMA_50

mcrh_T3_10_KAMA_50 mcrh_T3_10_SMA_50 mcrh_T3_10_T3_50 mcrh_T3_10_TEMA_50 mcrh_T3_10_TRIMA_50 mcrh_T3_10_WMA_50

mcrh_T3_10_DEMA_100 mcrh_T3_10_EMA_100 mcrh_T3_10_KAMA_100 mcrh_T3_10_SMA_100 mcrh_T3_10_T3_100 mcrh_T3_10_TEMA_100

mcrh_T3_10_TRIMA_100 mcrh_T3_10_WMA_100 mcrh_T3_10_ti_h20 mcrh_TEMA_10_DEMA_20 mcrh_TEMA_10_EMA_20

mcrh_TEMA_10_KAMA_20 mcrh_TEMA_10_SMA_20 mcrh_TEMA_10_T3_20 mcrh_TEMA_10_TEMA_20 mcrh_TEMA_10_TRIMA_20

mcrh_TEMA_10_WMA_20 mcrh_TEMA_10_DEMA_50 mcrh_TEMA_10_EMA_50 mcrh_TEMA_10_KAMA_50 mcrh_TEMA_10_SMA_50

mcrh_TEMA_10_T3_50 mcrh_TEMA_10_TEMA_50 mcrh_TEMA_10_TRIMA_50 mcrh_TEMA_10_WMA_50 mcrh_TEMA_10_DEMA_100

mcrh_TEMA_10_EMA_100 mcrh_TEMA_10_KAMA_100 mcrh_TEMA_10_SMA_100 mcrh_TEMA_10_T3_100 mcrh_TEMA_10_TEMA_100

mcrh_TEMA_10_TRIMA_100 mcrh_TEMA_10_WMA_100 mcrh_TEMA_10_ti_h20 mcrh_TRIMA_10_DEMA_20 mcrh_TRIMA_10_EMA_20

mcrh_TRIMA_10_KAMA_20 mcrh_TRIMA_10_SMA_20 mcrh_TRIMA_10_T3_20 mcrh_TRIMA_10_TEMA_20 mcrh_TRIMA_10_TRIMA_20

mcrh_TRIMA_10_WMA_20 mcrh_TRIMA_10_DEMA_50 mcrh_TRIMA_10_EMA_50 mcrh_TRIMA_10_KAMA_50 mcrh_TRIMA_10_SMA_50

mcrh_TRIMA_10_T3_50 mcrh_TRIMA_10_TEMA_50 mcrh_TRIMA_10_TRIMA_50 mcrh_TRIMA_10_WMA_50 mcrh_TRIMA_10_DEMA_100

mcrh_TRIMA_10_EMA_100 mcrh_TRIMA_10_KAMA_100 mcrh_TRIMA_10_SMA_100 mcrh_TRIMA_10_T3_100 mcrh_TRIMA_10_TEMA_100

mcrh_TRIMA_10_TRIMA_100 mcrh_TRIMA_10_WMA_100 mcrh_TRIMA_10_ti_h20 mcrh_WMA_10_DEMA_20 mcrh_WMA_10_EMA_20

mcrh_WMA_10_KAMA_20 mcrh_WMA_10_SMA_20 mcrh_WMA_10_T3_20 mcrh_WMA_10_TEMA_20 mcrh_WMA_10_TRIMA_20 mcrh_WMA_10_WMA_20

mcrh_WMA_10_DEMA_50 mcrh_WMA_10_EMA_50 mcrh_WMA_10_KAMA_50 mcrh_WMA_10_SMA_50 mcrh_WMA_10_T3_50 mcrh_WMA_10_TEMA_50

mcrh_WMA_10_TRIMA_50 mcrh_WMA_10_WMA_50 mcrh_WMA_10_DEMA_100 mcrh_WMA_10_EMA_100 mcrh_WMA_10_KAMA_100

mcrh_WMA_10_SMA_100 mcrh_WMA_10_T3_100 mcrh_WMA_10_TEMA_100 mcrh_WMA_10_TRIMA_100 mcrh_WMA_10_WMA_100

mcrh_WMA_10_ti_h20 mcrh_DEMA_20_DEMA_50 mcrh_DEMA_20_EMA_50 mcrh_DEMA_20_KAMA_50 mcrh_DEMA_20_SMA_50

mcrh_DEMA_20_T3_50 mcrh_DEMA_20_TEMA_50 mcrh_DEMA_20_TRIMA_50 mcrh_DEMA_20_WMA_50 mcrh_DEMA_20_DEMA_100

mcrh_DEMA_20_EMA_100 mcrh_DEMA_20_KAMA_100 mcrh_DEMA_20_SMA_100 mcrh_DEMA_20_T3_100 mcrh_DEMA_20_TEMA_100

mcrh_DEMA_20_TRIMA_100 mcrh_DEMA_20_WMA_100 mcrh_EMA_20_DEMA_50 mcrh_EMA_20_EMA_50 mcrh_EMA_20_KAMA_50

mcrh_EMA_20_SMA_50 mcrh_EMA_20_T3_50 mcrh_EMA_20_TEMA_50 mcrh_EMA_20_TRIMA_50 mcrh_EMA_20_WMA_50

mcrh_EMA_20_DEMA_100 mcrh_EMA_20_EMA_100 mcrh_EMA_20_KAMA_100 mcrh_EMA_20_SMA_100 mcrh_EMA_20_T3_100

mcrh_EMA_20_TEMA_100 mcrh_EMA_20_TRIMA_100 mcrh_EMA_20_WMA_100 mcrh_KAMA_20_DEMA_50 mcrh_KAMA_20_EMA_50

mcrh_KAMA_20_KAMA_50 mcrh_KAMA_20_SMA_50 mcrh_KAMA_20_T3_50 mcrh_KAMA_20_TEMA_50 mcrh_KAMA_20_TRIMA_50

mcrh_KAMA_20_WMA_50 mcrh_KAMA_20_DEMA_100 mcrh_KAMA_20_EMA_100 mcrh_KAMA_20_KAMA_100 mcrh_KAMA_20_SMA_100

mcrh_KAMA_20_T3_100 mcrh_KAMA_20_TEMA_100 mcrh_KAMA_20_TRIMA_100 mcrh_KAMA_20_WMA_100 mcrh_SMA_20_DEMA_50

mcrh_SMA_20_EMA_50 mcrh_SMA_20_KAMA_50 mcrh_SMA_20_SMA_50 mcrh_SMA_20_T3_50 mcrh_SMA_20_TEMA_50 mcrh_SMA_20_TRIMA_50

mcrh_SMA_20_WMA_50 mcrh_SMA_20_DEMA_100 mcrh_SMA_20_EMA_100 mcrh_SMA_20_KAMA_100 mcrh_SMA_20_SMA_100

mcrh_SMA_20_T3_100 mcrh_SMA_20_TEMA_100 mcrh_SMA_20_TRIMA_100 mcrh_SMA_20_WMA_100 mcrh_T3_20_DEMA_50

mcrh_T3_20_EMA_50 mcrh_T3_20_KAMA_50 mcrh_T3_20_SMA_50 mcrh_T3_20_T3_50 mcrh_T3_20_TEMA_50 mcrh_T3_20_TRIMA_50

mcrh_T3_20_WMA_50 mcrh_T3_20_DEMA_100 mcrh_T3_20_EMA_100 mcrh_T3_20_KAMA_100 mcrh_T3_20_SMA_100 mcrh_T3_20_T3_100

mcrh_T3_20_TEMA_100 mcrh_T3_20_TRIMA_100 mcrh_T3_20_WMA_100 mcrh_TEMA_20_DEMA_50 mcrh_TEMA_20_EMA_50

mcrh_TEMA_20_KAMA_50 mcrh_TEMA_20_SMA_50 mcrh_TEMA_20_T3_50 mcrh_TEMA_20_TEMA_50 mcrh_TEMA_20_TRIMA_50

mcrh_TEMA_20_WMA_50 mcrh_TEMA_20_DEMA_100 mcrh_TEMA_20_EMA_100 mcrh_TEMA_20_KAMA_100 mcrh_TEMA_20_SMA_100

mcrh_TEMA_20_T3_100 mcrh_TEMA_20_TEMA_100 mcrh_TEMA_20_TRIMA_100 mcrh_TEMA_20_WMA_100 mcrh_TRIMA_20_DEMA_50

mcrh_TRIMA_20_EMA_50 mcrh_TRIMA_20_KAMA_50 mcrh_TRIMA_20_SMA_50 mcrh_TRIMA_20_T3_50 mcrh_TRIMA_20_TEMA_50

mcrh_TRIMA_20_TRIMA_50 mcrh_TRIMA_20_WMA_50 mcrh_TRIMA_20_DEMA_100 mcrh_TRIMA_20_EMA_100 mcrh_TRIMA_20_KAMA_100

mcrh_TRIMA_20_SMA_100 mcrh_TRIMA_20_T3_100 mcrh_TRIMA_20_TEMA_100 mcrh_TRIMA_20_TRIMA_100 mcrh_TRIMA_20_WMA_100

mcrh_WMA_20_DEMA_50 mcrh_WMA_20_EMA_50 mcrh_WMA_20_KAMA_50 mcrh_WMA_20_SMA_50 mcrh_WMA_20_T3_50 mcrh_WMA_20_TEMA_50

mcrh_WMA_20_TRIMA_50 mcrh_WMA_20_WMA_50 mcrh_WMA_20_DEMA_100 mcrh_WMA_20_EMA_100 mcrh_WMA_20_KAMA_100

mcrh_WMA_20_SMA_100 mcrh_WMA_20_T3_100 mcrh_WMA_20_TEMA_100 mcrh_WMA_20_TRIMA_100 mcrh_WMA_20_WMA_100

mcrh_DEMA_50_DEMA_100 mcrh_DEMA_50_EMA_100 mcrh_DEMA_50_KAMA_100 mcrh_DEMA_50_SMA_100 mcrh_DEMA_50_T3_100

mcrh_DEMA_50_TEMA_100 mcrh_DEMA_50_TRIMA_100 mcrh_DEMA_50_WMA_100 mcrh_DEMA_50_ti_h20 mcrh_EMA_50_DEMA_100

mcrh_EMA_50_EMA_100 mcrh_EMA_50_KAMA_100 mcrh_EMA_50_SMA_100 mcrh_EMA_50_T3_100 mcrh_EMA_50_TEMA_100

mcrh_EMA_50_TRIMA_100 mcrh_EMA_50_WMA_100 mcrh_EMA_50_ti_h20 mcrh_KAMA_50_DEMA_100 mcrh_KAMA_50_EMA_100

mcrh_KAMA_50_KAMA_100 mcrh_KAMA_50_SMA_100 mcrh_KAMA_50_T3_100 mcrh_KAMA_50_TEMA_100 mcrh_KAMA_50_TRIMA_100

mcrh_KAMA_50_WMA_100 mcrh_KAMA_50_ti_h20 mcrh_SMA_50_DEMA_100 mcrh_SMA_50_EMA_100 mcrh_SMA_50_KAMA_100

mcrh_SMA_50_SMA_100 mcrh_SMA_50_T3_100 mcrh_SMA_50_TEMA_100 mcrh_SMA_50_TRIMA_100 mcrh_SMA_50_WMA_100

mcrh_SMA_50_ti_h20 mcrh_T3_50_DEMA_100 mcrh_T3_50_EMA_100 mcrh_T3_50_KAMA_100 mcrh_T3_50_SMA_100 mcrh_T3_50_T3_100

mcrh_T3_50_TEMA_100 mcrh_T3_50_TRIMA_100 mcrh_T3_50_WMA_100 mcrh_T3_50_ti_h20 mcrh_TEMA_50_DEMA_100 mcrh_TEMA_50_EMA_100

mcrh_TEMA_50_KAMA_100 mcrh_TEMA_50_SMA_100 mcrh_TEMA_50_T3_100 mcrh_TEMA_50_TEMA_100 mcrh_TEMA_50_TRIMA_100

mcrh_TEMA_50_WMA_100 mcrh_TEMA_50_ti_h20 mcrh_TRIMA_50_DEMA_100 mcrh_TRIMA_50_EMA_100 mcrh_TRIMA_50_KAMA_100

mcrh_TRIMA_50_SMA_100 mcrh_TRIMA_50_T3_100 mcrh_TRIMA_50_TEMA_100 mcrh_TRIMA_50_TRIMA_100 mcrh_TRIMA_50_WMA_100

mcrh_TRIMA_50_ti_h20 mcrh_WMA_50_DEMA_100 mcrh_WMA_50_EMA_100 mcrh_WMA_50_KAMA_100 mcrh_WMA_50_SMA_100

mcrh_WMA_50_T3_100 mcrh_WMA_50_TEMA_100 mcrh_WMA_50_TRIMA_100 mcrh_WMA_50_WMA_100 mcrh_WMA_50_ti_h20

mcrh_DEMA_100_ti_h20 mcrh_EMA_100_ti_h20 mcrh_KAMA_100_ti_h20 mcrh_SMA_100_ti_h20 mcrh_T3_100_ti_h20

mcrh_TEMA_100_ti_h20 mcrh_TRIMA_100_ti_h20 mcrh_WMA_100_ti_h20 NQ_Close NQ_Volume NQ_per_Close

NQ_per_Volume NQ_SMA_20 NQ_SMA_100```

**https://github.com/Leci37/LecTrade LecTrade is a tool created by github user @Leci37. instagram @luis__leci Shared on 2022/11/12 . . No warranty, rights reserved**