This project is based upon the paper: Frazzini, A. & Pedersen, L. (2014). Betting against beta [(1)][1]. (referred to as "the paper" in the following content)

-

Datafolder stores the fetched data andData.py. -

Data.pyconsists of 2 parts: save tickers, get data. Tickers are processed through website information, data are fetched using 'pandas-datareader'.

-

main.pycontains all the functions. -

figure.pyis for drawing plots.

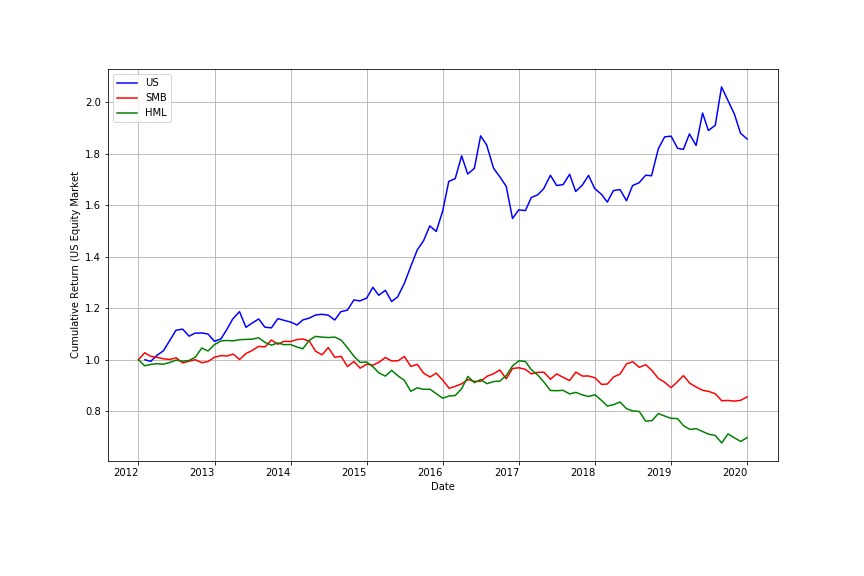

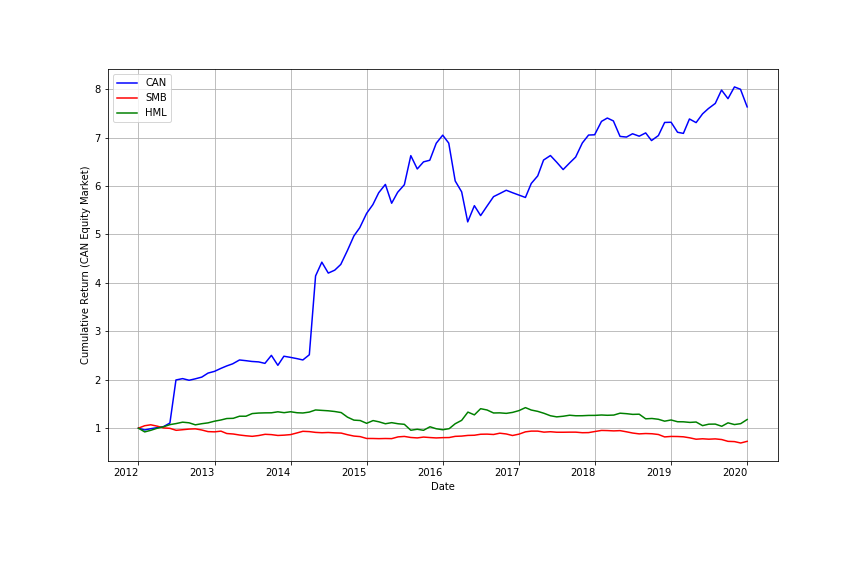

The strategy was back-tested on SP500 stocks and TSX (Toronto Stock Exchange) stocks and compared with two other similar factors presented in the Fama French 3-factor model: one is the SMB (small minus big), the other is the HML (high minus low). (SMB and HML data are collected from [Ken French’s data library][https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html])

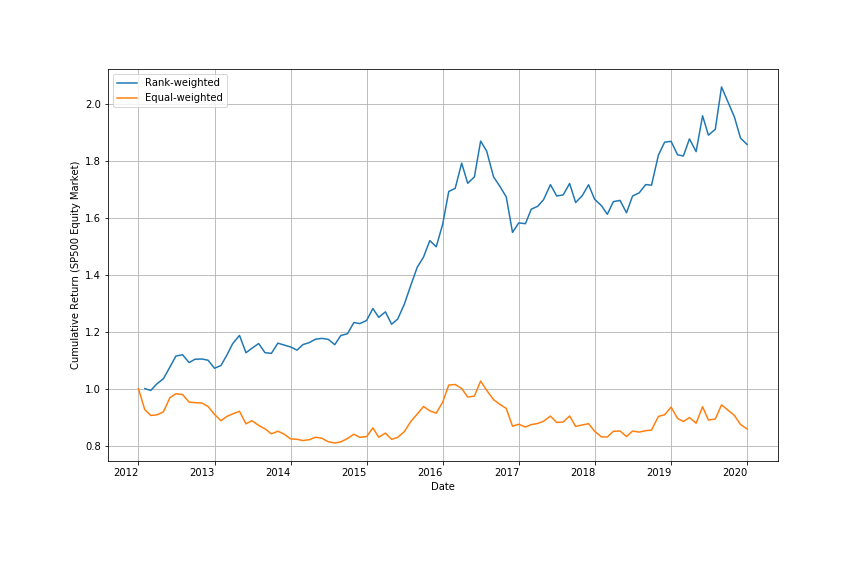

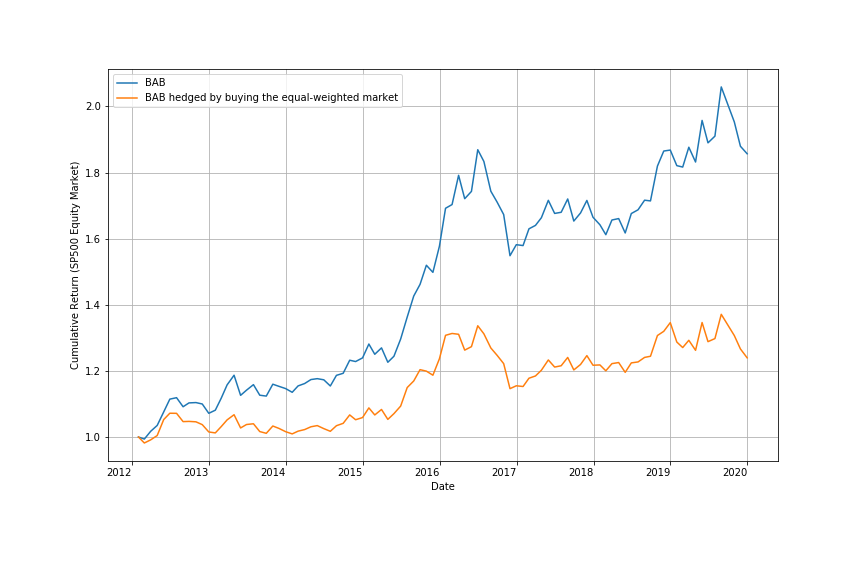

Cumulative Return with $1 invested in the beginning in the SP500 (shown as US) equity market (in comparison with the SMB and HML factors)

Cumulative Return with $1 invested in the beginning in the SP500 (shown as US) equity market (in comparison with the SMB and HML factors)

Cumulative Return with $1 invested in the beginning in the TSX (shown as CAN) equity market (in comparison with the SMB and HML factors)

Cumulative Return with $1 invested in the beginning in the TSX (shown as CAN) equity market (in comparison with the SMB and HML factors)

Looking at the actual weights the strategy puts on stocks with different market cap, we find out small-cap stocks are overweighted, causing significant implementation issues because the smallest stocks usually have limited capacity and are expensive to trade.

- Andrea Frazzini and Lasse Heje Pedersen. Betting against beta. Journal of Financial Economics, 111(1):1–25, 2014