Transactions are at the heart of Bitcoin. Transactions, simply put, are value transfers from one entity to another. We’ll see in [chapter_script] how "entities" in this case are really smart contracts. But we’re getting ahead of ourselves. Let’s first look at what Transactions in Bitcoin are, what they look like, and how they are parsed.

At a high level, a Transaction really only has 4 components. They are:

-

Version

-

Inputs

-

Outputs

-

Locktime

A general overview of these fields might be helpful. Version indicates what additional features the transaction uses, Inputs define what Bitcoins are being spent, Outputs define where the Bitcoins are going, and Locktime defines when this Transaction starts being valid. We’ll go through each component in depth.

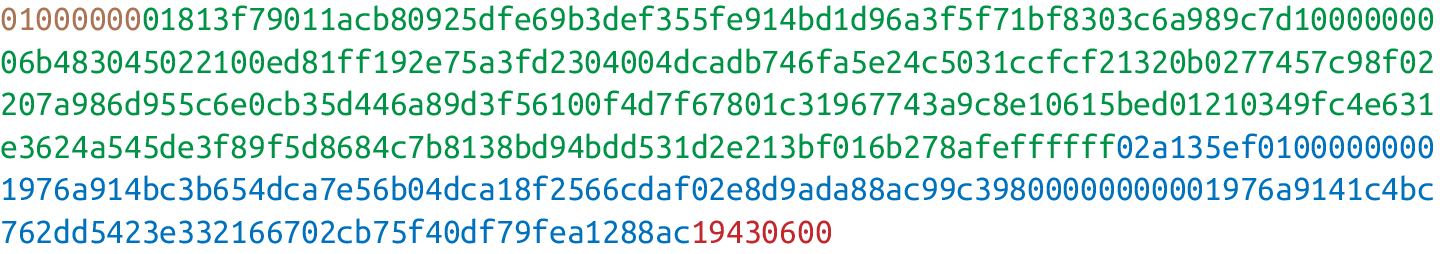

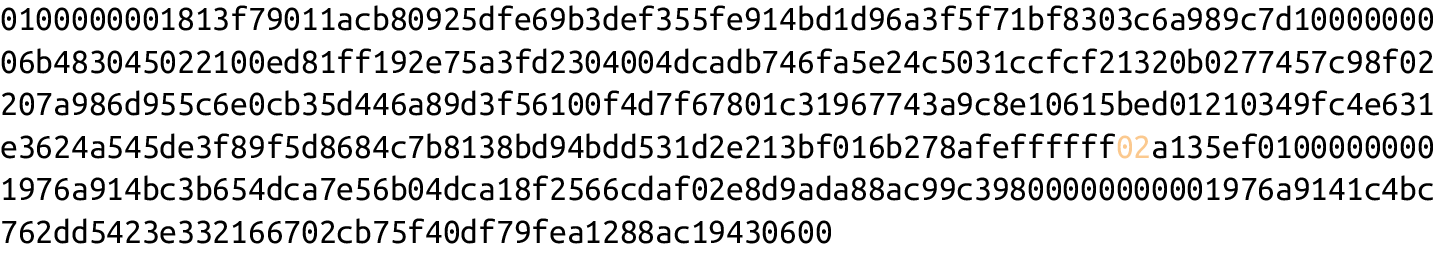

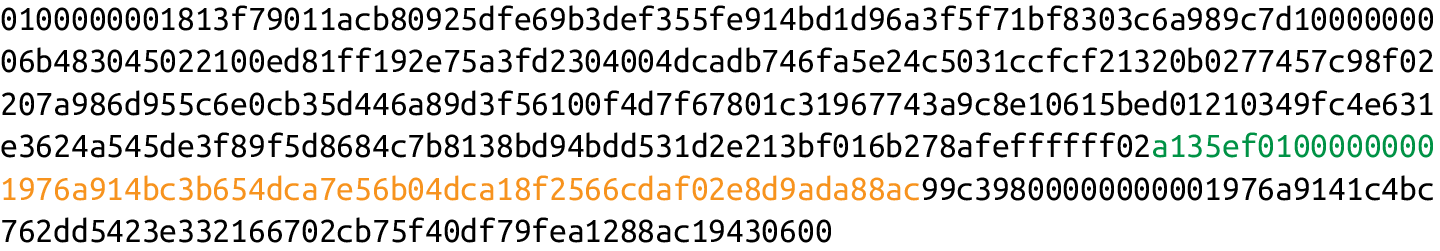

Transaction components: Version, Inputs, Output, and Locktime shows a hexadecimal dump of a typical transaction that shows which parts are which.

The differently highlighted parts represent Version, Inputs, Outputs and Locktime respectively.

With this in mind, we can start constructing the Transaction class, which we’ll call Tx:

link:code-ch05/tx.py[role=include]-

Input and Output are very generic terms so we specify what kind of inputs they are. We’ll define the specific object types they are later.

-

We need to know which network this transaction is on to be able to validate it fully.

-

The

idis what block explorers use for looking up transactions. It’s the hash256 of the transaction in hexadecimal format. -

The hash is the hash256 of the serialization in Little-Endian. Note we don’t have the

serializemethod yet, so until we do, this won’t work.

The rest of this chapter will be concerned with parsing Transactions. We could, at this point, write code like this:

class Tx:

...

@classmethod # (1)

def parse(cls, serialization):

version = serialization[0:4] # (2)

...-

This method has to be a class method as the serialization will return a new instance of a

Txobject. -

We assume here that the variable

serializationis a byte array.

This could definitely work, but the transaction may be very large. Ideally, we want to be able to parse from a stream instead. This will allow us to not need the entire serialized transaction before we start parsing and that allows us to fail early and be more efficient. Thus, the code for parsing a transaction will look more like this:

class Tx:

...

@classmethod

def parse(cls, stream):

serialized_version = stream.read(4) # (1)

...-

The

readmethod will allow us to parse on the fly as we won’t have to wait on I/O.

This is advantageous from an engineering perspective as the stream can be a socket connection on the network or a file handle.

We can start parsing the stream right away instead of waiting for the whole thing to be transmitted or read first.

Our method will be able to handle any sort of stream and return the Tx object that we need.

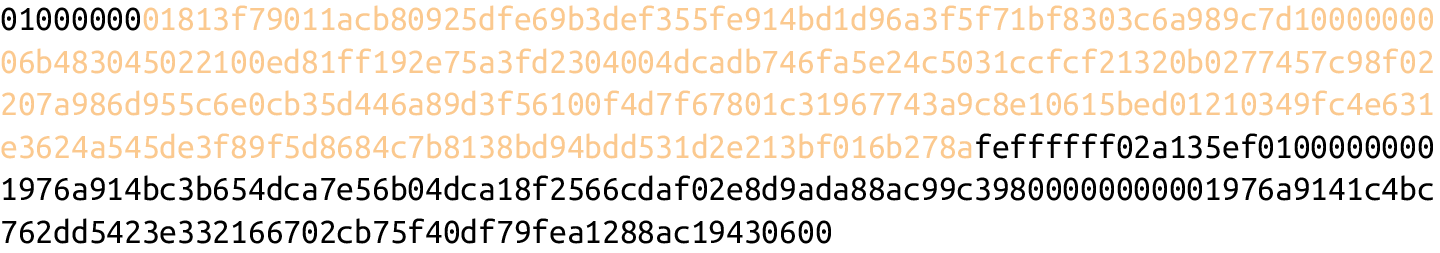

When you see a version number in something (Version shows an example), it’s meant to give the receiver information about what the versioned thing is supposed to represent. If, for example, you are running Windows 3.1, that’s a version number that’s very different than Windows 8 or Windows 10. You could specify just "Windows", but specifying the version number after the operating system helps you know what features it has and what APIs you can program against.

Similarly, Bitcoin transactions have version numbers.

In Bitcoin’s case, the transaction version is generally 1, but there are cases where it can be 2 (transactions using an opcode called OP_CHECKSEQUENCEVERIFY as defined in BIP112 require use of version > 1).

You may notice here that the actual value in hexadecimal is 01000000, which doesn’t look like 1.

Interpreted as a Little-Endian integer, however, this number is actually 1 (recall the discussion from [chapter_serialization]).

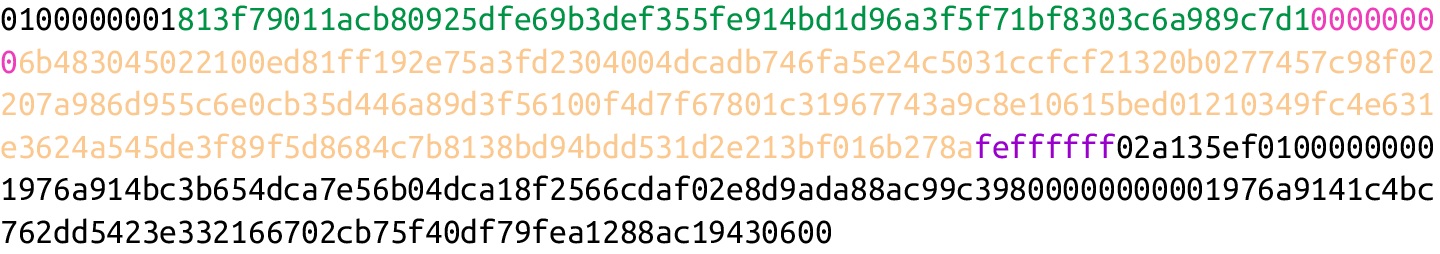

Each input points to an output of a previous transaction (see Inputs). This fact requires more explanation as it’s not intuitively obvious at first.

Bitcoin’s inputs are spending outputs of a previous transaction. That is, you need to have received Bitcoins first to spend something. This makes intuitive sense. You cannot spend money unless you received money first. The inputs refer to Bitcoins that belong to you. Each input needs two things:

-

A reference to the previous Bitcoins you received

-

Proof that these are yours to spend

The second part uses ECDSA ([chapter_elliptic_curve_cryptography]). You don’t want people to be able to forge this, so most inputs contain signatures that only the owner(s) of the private key(s) can produce.

The inputs field can contain more than one input. This is analogous to using either a single $100 bill to pay for a $70 meal or a $50 and a $20. The former only requires one input ("bill"); the latter requires two. There are situations where there could be even more. In our analogy, we can pay for a $70 meal with fourteen 5-dollar bills or even 7,000 pennies. This would be analogous to 14 inputs or 7,000 inputs.

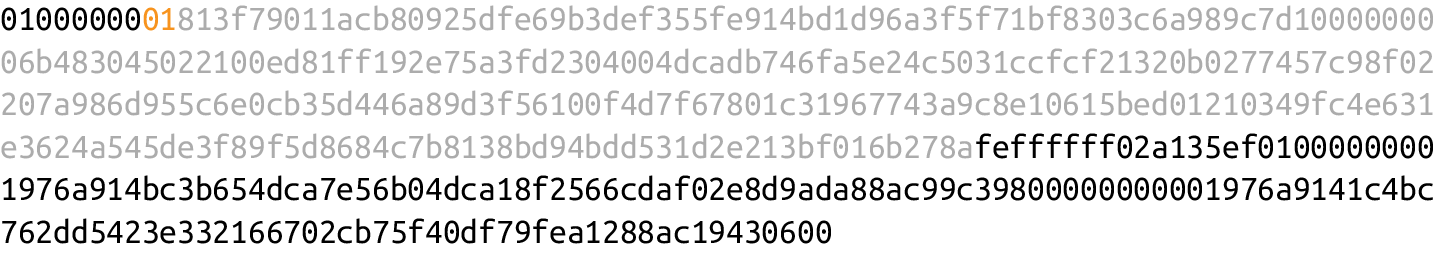

The number of inputs is the next part of the transaction shown in Number of inputs:

We can see that the byte is actually 01, which means that this transaction has one input.

It may be tempting here to assume that it’s always a single byte, but it’s not.

A single byte has 8 bits, so this means that anything over 255 inputs would not be expressible in a single byte.

This is where varint comes in. Varint is shorthand for variable integer, which is a way to encode an integer into bytes that range from 0 to 264 – 1. We could, of course, always reserve 8 bytes for the number of inputs, but that would be a lot of wasted space if we expect the number of inputs to be a relatively small number (say under 200). This is the case with the number of inputs in a normal transaction, so using varint helps to save space. You can see how they work in the following sidebar.

Variable integers work by these rules:

-

If the number is below 253, encode that number as a single byte (e.g., 100 →

0x64). -

If the number is between 253 and 216 – 1, start with the 253 byte (

fd) and then encode the number in 2 bytes in Little-Endian (e.g., 255 →0xfdff00, 555 →0xfd2b02). -

If the number is between 216 and 232 – 1, start with the 254 byte (

fe) and then encode the number in 4 bytes in Little-Endian (e.g., 70015 →0xfe7f110100). -

If the number is between 232 and 264 – 1, start with the 255 byte (

ff) and then encode the number in 8 bytes in Little-Endian (e.g., 18005558675309 →0xff6dc7ed3e60100000).

Two functions from helper.py will be used to parse and serialize varint fields:

link:code-ch05/helper.py[role=include]read_varint will read from a stream and return the integer that was encoded.

encode_varint will do the opposite, which is to take an integer and return the varint byte representation.

Each input contains four fields. The first two fields point to the previous transaction output and the last two fields define how the previous transaction output can be spent. The fields are as follows:

-

Previous transaction ID

-

Previous transaction index

-

ScriptSig

-

Sequence

As just explained, each input has a reference to a previous transaction’s output. The previous transaction ID is the hash256 of the previous transaction’s contents. The previous transaction ID uniquely defines the previous transaction, as the probability of a hash collision is impossibly low. As we’ll see below, each transaction has to have at least one output, but may have many. Thus, we need to define exactly which output within a transaction that we’re spending, which is captured in the previous transaction index.

Note that the previous transaction ID is 32 bytes and that the previous transaction index is 4 bytes. Both are in Little-Endian.

ScriptSig has to do with Bitcoin’s smart contract language Script, discussed more thoroughly in [chapter_script]. For now, think of ScriptSig as opening a locked box—something that can only be done by the owner of the transaction output. The ScriptSig field is a variable-length field, not a fixed-length field like most of what we’ve seen so far. A variable-length field requires us to define exactly how long the field will be, which is why the field is preceded by a varint telling us how long the field is.

Sequence was originally intended as a way to do what Satoshi called "high-frequency trades" with the Locktime field (see Sequence and Locktime), but is currently used with Replace-By-Fee and OP_CHECKSEQUENCEVERIFY.

Sequence is also in Little-Endian and takes up 4 bytes.

The fields of the input look like The fields of an input: Previous transaction ID, previous index, ScriptSig, and sequence.

Originally, Satoshi wanted Sequence and Locktime to be used for something called "high-frequency trades."

What Satoshi envisioned was a way to do payments back and forth with another party without making lots of on-chain transactions.

For example, if Alice pays Bob x Bitcoins for something and then Bob pays Alice y Bitcoins for something else (say x > y), then Alice can just pay Bob x-y, instead of two separate transactions on-chain.

We could do the same thing if Alice and Bob had 100 transactions between them—that is, compress a bunch of transactions into a single transaction.

That’s the idea that Satoshi had: a continuously updating mini-ledger between the two parties involved that gets settled on-chain. Satoshi’s intent was to use Sequence and Locktime to update the "high-frequency trade" transaction every time a new payment between the two parties occurred. The trade transaction would have two inputs (one from Alice and one from Bob) and two outputs (one to Alice and one to Bob). The trade transaction would start with sequence at 0 with a far-away Locktime (say 500 blocks from now), valid in 500 blocks. This would be the base transaction where Alice and Bob get the same amounts as they put in.

After the first transaction where Alice pays Bob x Bitcoins, the sequence of each input would be 1.

After the second transaction where Bob pays Alice y Bitcoins, the sequence of each input would be 2.

Using this method, we could have lots of payments compressed into a single on-chain transaction as long as they happened before the Locktime became valid.

Unfortunately, as clever as this is, it turns out that it’s quite easy for a miner to cheat.

In our example, Bob could be a miner, ignore the updated trade transaction with sequence number 2, and mine the trade transaction with sequence number 1 and cheat Alice out of y Bitcoins.

A much better design was created later with "payment channels," which is the basis for the Lightning Network.

Now that we know what the fields are, we can start creating a TxIn class in Python:

link:code-ch05/tx.py[role=include]-

We default to an empty ScriptSig.

A couple things to note here. The amount of each input is not specified. We have no idea how much is being spent unless we look up in the blockchain for the transaction(s) that we’re spending. Furthermore, we don’t even know if the transaction is unlocking the right box, so to speak, without knowing about the previous transaction. Every node must verify that this transaction unlocks the right box and that it doesn’t spend nonexistent Bitcoins. How we do that is further discussed in [chapter_tx].

We’ll delve more deeply into how Script is parsed in [chapter_script], but for now, here’s how you get a Script object from hexadecimal in Python:

link:code-ch05/examples.py[role=include]-

Note that the

Scriptclass will be more thoroughly explored in [chapter_script]. For now, please trust that theScript.parsemethod will create the object that we need.

As hinted in the previous section, outputs define where the Bitcoins are going. Each transaction must have one or more outputs. Why would anyone have more than one output? An exchange may batch transactions, for example, and pay out a lot of people at once instead of generating a single transaction for every single person that requests Bitcoins.

Like inputs, the outputs serialization starts with how many outputs there are as a varint, as shown in Number of outputs.

Each output has two fields: Amount and ScriptPubKey. Amount is the amount of Bitcoin being assigned and is specified in satoshis, or 1/100,000,000th of a Bitcoin. This allows us to divide Bitcoin very finely, down to 1/300th of a penny in USD terms as of this writing. The absolute maximum for the amount is the asymptotic limit of Bitcoin (21 million Bitcoins) in satoshis, which is 2,100,000,000,000,000 (2,100 trillion) satoshis. This number is greater than 232 (4.3 billion or so) and is thus stored in 64 bits, or 8 bytes. Amount is serialized in Little-Endian.

ScriptPubKey, like ScriptSig, has to do with Bitcoin’s smart contract language Script. Think of ScriptPubKey as the locked box that can only be opened by the holder of the key. ScriptPubKey can be thought of as a one-way safe that can receive deposits from anyone, but can only be opened by the owner of the safe. We’ll explore what this is in more detail in [chapter_script]. Like ScriptSig, ScriptPubKey is a variable-length field and is preceded by the length of the field in a varint.

A complete output looks like A complete output field, showing Amount and ScriptPubKey. This one is at index 0..

UTXO stands for Unspent Transaction Output. The entire set of unspent transaction outputs at any given moment is called the UTXO Set. The reason why UTXOs are important is because at any moment in time, they represent all the Bitcoins that are available to be spent. In other words, these are the Bitcoins that are in circulation. Full nodes on the network must keep track of the UTXO set, and keeping the UTXO indexed makes validating new transactions much faster.

For example, it’s easy to enforce a no-double-spending rule by looking up the previous transaction output in the UTXO set. If the input of a new transaction is using a transaction output that’s not in the UTXO set, that’s an attempt at a double-spend or a nonexistent output and thus invalid. Keeping the UTXO set handy is also very useful for validating transactions. As we’ll see in [chapter_script], we need to look up the Amount and ScriptPubKey from the previous transaction output to validate transactions, so having these UTXOs handy can speed up transaction validation.

We can now start coding the TxOut class:

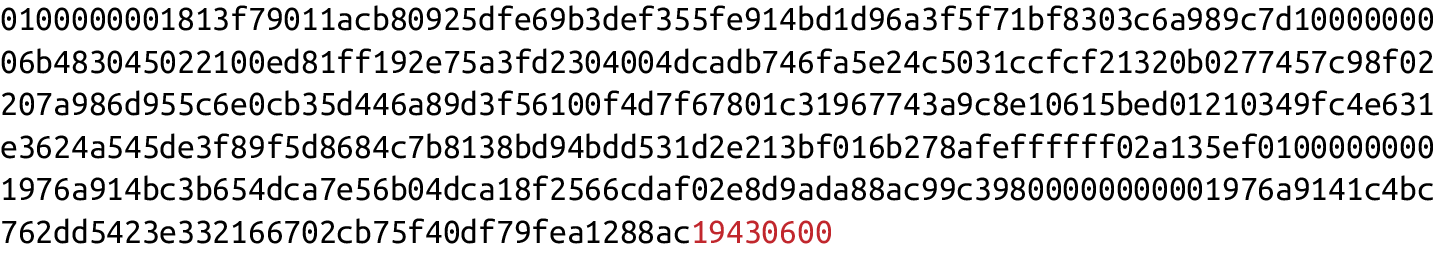

link:code-ch05/tx.py[role=include]Locktime is a way to time-delay a transaction. A transaction with a Locktime of 600,000 cannot go into the blockchain until block 600,001. This was originally construed as a way to do "high-frequency trades" (see Sequence and Locktime), which turned out to be insecure. If the Locktime is greater than or equal to 500,000,000, Locktime is a UNIX timestamp. If Locktime is less than 500,000,000, it is a block number. This way, transactions can be signed, but unspendable until a certain point in UNIX time or block height.

|

Warning

|

When Locktime is Ignored

Note that Locktime is ignored if the sequence numbers for every input is |

The serialization is in Little-Endian and 4-bytes (Locktime).

The main problem with using Locktime is that the recipient of the transaction has no certainty that the transaction will be good when the Locktime comes. This is similar to a postdated bank check, which has the possibility of bouncing. The sender can spend the inputs prior to the Locktime transaction getting into the blockchain, thus invalidating the transaction at Locktime.

The uses before BIP0065 were limited.

BIP0065 introduced OP_CHECKLOCKTIMEVERIFY, which makes Locktime more useful by making an output unspendable until a certain Locktime.

We’ve parsed the transaction; now we want to do the opposite, which is serializing the transaction.

Let’s start with TxOut:

class TxOut:

...

link:code-ch05/tx.py[role=include]-

We’re going to serialize the TxOut object to a bunch of bytes.

We can proceed to TxIn:

class TxIn:

...

link:code-ch05/tx.py[role=include]Last, we can serialize Tx:

class Tx:

...

link:code-ch05/tx.py[role=include]We’ve used the serialize methods of both TxIn and TxOut to serialize Tx.

Note that the transaction fee is not specified anywhere! This is because the fee is an implied amount. Fee is the total of the input amounts minus the total of the output amounts.

One of the consensus rules of Bitcoin is that for any non-Coinbase Transactions (more on Coinbase Transactions in [chapter_p2sh]), the sum of the inputs has to be greater than or equal to the sum of the outputs. You may be wondering why the inputs and outputs can’t just be forced to be equal. This is because if every transaction had zero cost, there wouldn’t be any incentive for miners to include transactions in blocks (see [chapter_blocks]). Fees are a way to incentivize miners to include transactions. Transactions not in blocks (so-called mempool transactions) are not part of the blockchain and are not final.

The transaction fee is simply the sum of the inputs minus the sum of the outputs. This difference is what the miner gets to keep. As inputs don’t have an amount field, we have to look up the amount. This requires access to the blockchain, specifically the UTXO set. If you are not running a full node, this can be tricky, as you now need to trust some other entity to provide you with this information.

We are creating a new class to handle this, called TxFetcher:

link:code-ch05/tx.py[role=include]-

We check that the ID is what we expect it to be.

You may be wondering why we don’t get just the specific output for the transaction and instead get the entire transaction. This is because we don’t want to be trusting a third party! By getting the entire transaction, we can verify the transaction ID (hash256 of its contents) and be sure that we are indeed getting the transaction we asked for. This is impossible unless we receive the entire transaction.

|

Warning

|

Why We Minimize Trusting Third Parties

As Nick Szabo eloquently wrote in his seminal essay "Trusted Third Parties are Security Holes", trusting third parties to provide correct data is not a good security practice. The third party may be behaving well now, but you never know when they may get hacked, may have an employee go rogue, or start implementing policies that are against your interests. Part of what makes Bitcoin secure is in not trusting, but verifying the data that we’re given. |

We can now create the appropriate method in TxIn to fetch the previous transaction and methods to get the previous transaction output’s amount and ScriptPubkey (the latter to be used in [chapter_script]):

class TxIn:

...

link:code-ch05/tx.py[role=include]Now that we have the amount method in TxIn that lets us access how many Bitcoins are in each transaction input, we can calculate the fee for a transaction.

We’ve covered exactly how to parse and serialize transactions and defined what the fields mean. There are two fields that require more explanation, both related to Bitcoin’s smart contract language, Script. To that topic we go in [chapter_script].