This project intends to leverage deep reinforcement learning in portfolio management. The framework structure is inspired by Q-Trader. The reward for agents is the net unrealized (meaning the stocks are still in portfolio and not cashed out yet) profit evaluated at each action step. For inaction at each step, a negtive penalty is added to the portfolio as the missed opportunity to invest in "risk-free" Treasury bonds. A lot of new features and improvements are made in the training and evaluation pipelines. All evaluation metrics and visualizations are built from scratch.

Key assumptions and limitations of the current framework:

- trading has no impact on the market

- only single stock type is supported

- only 3 basic actions: buy, hold, sell (no short selling or other complex actions)

- the agent performs only 1 action for portfolio reallocation at the end of each trade day

- all reallocations can be finished at the closing prices

- no missing data in price history

- no transaction cost

Key challenges of the current framework:

- implementing algorithms from scratch with a thorough understanding of their pros and cons

- building a reliable reward mechanism (learning tends to be stationary/stuck in local optima quite often)

- ensuring the framework is scalable and extensible

Currently, the state is defined as the normalized adjacent daily stock price differences for n days plus [stock_price, balance, num_holding].

In the future, we plan to add other state-of-the-art deep reinforcement learning algorithms, such as Proximal Policy Optimization (PPO), to the framework and increase the complexity to the state in each algorithm by constructing more complex price tensors etc. with a wider range of deep learning approaches, such as convolutional neural networks or attention mechanism. In addition, we plan to integrate better pipelines for high quality data source, e.g. from vendors like Quandl; and backtesting, e.g. zipline.

To install all libraries/dependencies used in this project, run

pip3 install -r requirements.txtTo train a DDPG agent or a DQN agent, e.g. over S&P 500 from 2010 to 2015, run

python3 train.py --model_name=model_name --stock_name=stock_namemodel_nameis the model to use: eitherDQNorDDPG; default isDQNstock_nameis the stock used to train the model; default is^GSPC_2010-2015, which is S&P 500 from 1/1/2010 to 12/31/2015window_sizeis the span (days) of observation; default is10num_episodeis the number of episodes used for training; default is10initial_balanceis the initial balance of the portfolio; default is50000

To evaluate a DDPG or DQN agent, run

python3 evaluate.py --model_to_load=model_to_load --stock_name=stock_namemodel_to_loadis the model to load; default isDQN_ep10; alternative isDDPG_ep10etc.stock_nameis the stock used to evaluate the model; default is^GSPC_2018, which is S&P 500 from 1/1/2018 to 12/31/2018initial_balanceis the initial balance of the portfolio; default is50000window_sizeis the span (days) of observation; default is10

where stock_name can be referred in data directory and model_to_laod can be referred in saved_models directory.

To visualize training loss and portfolio value fluctuations history, run:

tensorboard --logdir=logs/model_eventswhere model_events can be found in logs directory.

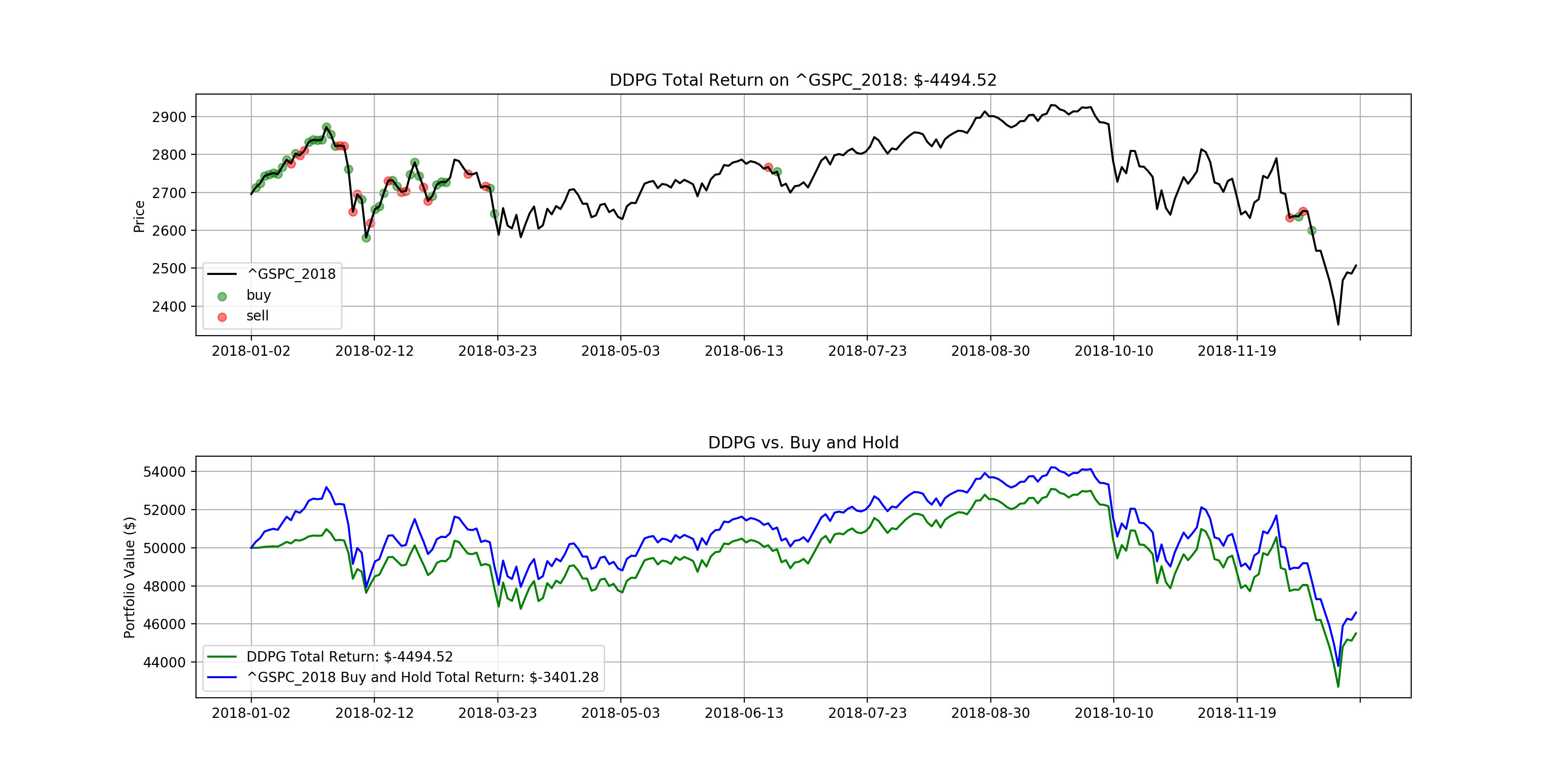

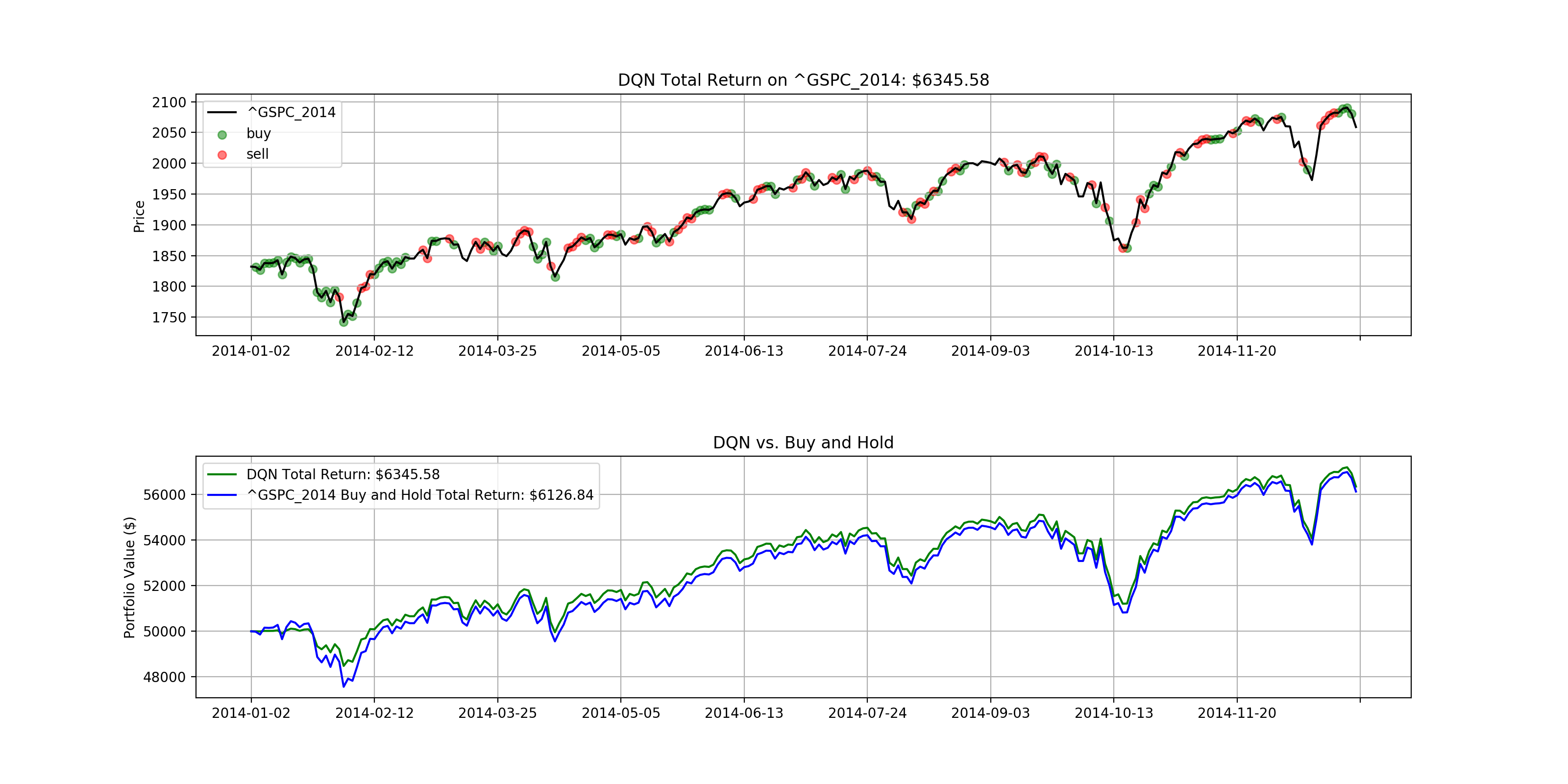

Note that the following results were obtained with 10 epochs of training only.

- How is this project different from other price prediction approaches, such as logistic regression or LSTM?

- Price prediction approaches like logistic regression have numerical outputs, which have to be mapped (through some interpretation of the predicted price) to action space (e.g. buy, sell, hold) separately. On the other hand, reinforcement learning approaches directly output the agent's action.

- Deep Q-Learning with Keras and Gym

- Double Deep Q Networks

- Using Keras and Deep Deterministic Policy Gradient to play TORCS

- Practical Deep Reinforcement Learning Approach for Stock Trading

- Introduction to Learning to Trade with Reinforcement Learning

- Adversarial Deep Reinforcement Learning in Portfolio Management

- A Deep Reinforcement Learning Framework for the Financial Portfolio Management Problem