This is an open source initiative to make available the tools required for building your own optimal Markowitz portfolios and finding the best rebalancing strategy factoring in your transaction costs. The financial world is moving towards zero cost ETFs, which make even the lowest-cost robo-advisors in the industry seem expensive.

The mission of this project is to put industry leading portfolio management tools into the hands of individuals for zero cost.

In this example we build a portfolio with no asset size constraints. Meaning, a single ETF or stock from our list can be 100% of the portfolio.

from roboadvisor.optimizer import PortfolioOptimizer

assets=['TLT','SPY','GDX','AAPL','FXI','GLD','VDE','UUP','VT']

optimal_portfolio=PortfolioOptimizer(assets, portfolio_size=5,max_pos=1.0, min_pos=0.0)...Maximum position size: 100%

...Minimum position size: 0%

...Number of unique asset combinations: 126

...Analyzing 126 of 126 asset combinations...

...Omitted assets: []

-----------------------------------------------

----- Portfolio Optimized for Sharpe Ratio ----

-----------------------------------------------

('TLT', 0.3207)

('SPY', 0.1373)

('AAPL', 0.1723)

('GLD', 0.0711)

('UUP', 0.2987)

Optimal Portfolio Return: 7.4065

Optimal Portfolio Volatility: 7.1075

Optimal Portfolio Sharpe Ratio: 1.0421

-----------------------------------------------

----- Portfolio Optimized for Pure Return -----

-----------------------------------------------

('AAPL', 1.0)

('GLD', 0.0)

('VDE', 0.0)

('UUP', 0.0)

('VT', 0.0)

Optimal Portfolio Return: 22.6168

Optimal Portfolio Volatility: 29.8647

Optimal Portfolio Sharpe Ratio: 0.7573

-----------------------------------------------------

----- Portfolio Optimized for Minimal Volatility ----

-----------------------------------------------------

('TLT', 0.1644)

('SPY', 0.0)

('GLD', 0.1268)

('UUP', 0.5449)

('VT', 0.1638)

Optimal Portfolio Return: 2.755

Optimal Portfolio Volatility: 4.651

Optimal Portfolio Sharpe Ratio: 0.5924

In this example we're going to constrain the maximum position size of a single asset to be 30%, and the minumum size to be 5%.

assets = ['TLT','SPY','GDX','AAPL','FXI','GLD','VDE','UUP','VT','IYF','EWI','TIP']

optimal_portfolio = PortfolioOptimizer(assets, portfolio_size = 5, max_pos = 0.30, min_pos = 0.05)...Maximum position size: 30%

...Minimum position size: 5%

...Number of unique asset combinations: 792

...Analyzing 792 of 792 asset combinations...

...Omitted assets: []

-----------------------------------------------

----- Portfolio Optimized for Sharpe Ratio ----

-----------------------------------------------

('TLT', 0.1981)

('SPY', 0.1089)

('AAPL', 0.1495)

('UUP', 0.2435)

('TIP', 0.3)

Optimal Portfolio Return: 6.5281

Optimal Portfolio Volatility: 6.1652

Optimal Portfolio Sharpe Ratio: 1.0589

-----------------------------------------------

----- Portfolio Optimized for Pure Return -----

-----------------------------------------------

('TLT', 0.05)

('SPY', 0.3)

('AAPL', 0.3)

('VT', 0.05)

('IYF', 0.3)

Optimal Portfolio Return: 12.1792

Optimal Portfolio Volatility: 21.8554

Optimal Portfolio Sharpe Ratio: 0.5573

-----------------------------------------------------

----- Portfolio Optimized for Minimal Volatility ----

-----------------------------------------------------

('TLT', 0.1276)

('SPY', 0.1693)

('GLD', 0.1031)

('UUP', 0.3)

('TIP', 0.3)

Optimal Portfolio Return: 3.6682

Optimal Portfolio Volatility: 4.3676

Optimal Portfolio Sharpe Ratio: 0.8399

The intention of the rebalancer class is to understand, probabilistically, how the portfolio should be maintained going forward. It also reveals how much value might be added for the client depending on the advisory model and management principles.

The class can account for the following parameters:

- High Threshold: The upper deviation, as a percentage, that a single issue can drift before rebalancing is triggered.

- Low Threshold: The lower deviation, as a percentage, that a single issue can drift before rebalancing is triggered.

- Trade cost: Cost to execute a single trade, including commissions.

- Fractional Units: Whether or not you are permitted to buy fractional units.

- Starting cash balance: The cash balance to begin the portfolio simulation with.

- Slippage (optional): A custom function can be presented to represent deviations from bid/ask.

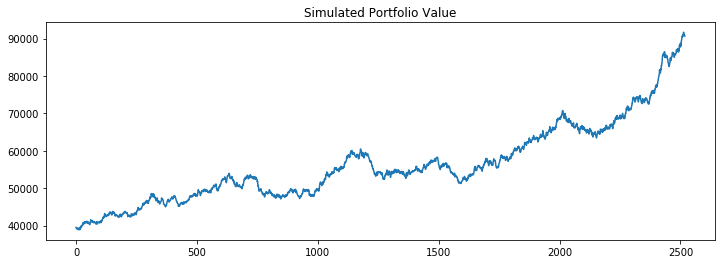

The rebalancer class takes a portfolio object as an argument as well. The simulation in this example runs over 10 years (2520 trading days).

from roboadvisor.rebalancer import RebalancingSimulator

from roboadvisor.optimizer import PortfolioOptimizer

assets = ['GLD', 'SPY', 'TLT', 'QQQ', 'XLI']

portfolio = PortfolioOptimizer(assets , portfolio_size = 5, max_pos = 0.3, min_pos = 0.05)

rebalancer = RebalancingSimulator(portfolio, frac_units=False, trade_cost=5.99, starting_cash=20000, max_thresh=1.1, min_thresh=0.9)

rebalancer.run_simulation()SIMULATION PARAMETERS:

...fractional share purchases permitted? False

...portfolio size: 5 assets

...trade cost: $5.99

...max position size: 30%

...min position size: 5%

...beginning cash value: $20,000

...upper rebalance trigger: 10% above allocation

...lower rebalance trigger: 10% below allocation

...Cash balance after portfolio initialization: $388.99

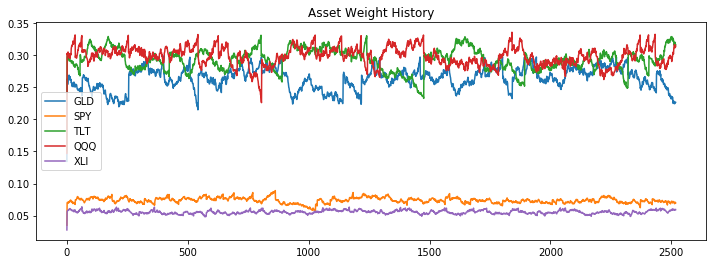

Target weights: [('GLD', 26.93%), ('SPY', 7.51%), ('TLT', 30%), ('QQQ', 30%), ('XLI', 5.57%)]

SIMULATION REPORT

-----------------

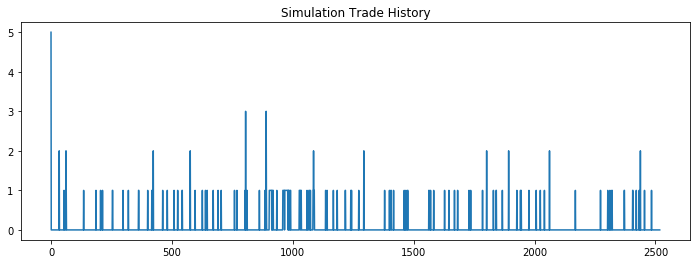

Rebalancing simulation finished in: 0.73 seconds

Total number of trades executed: 178

Cost per trade: 5

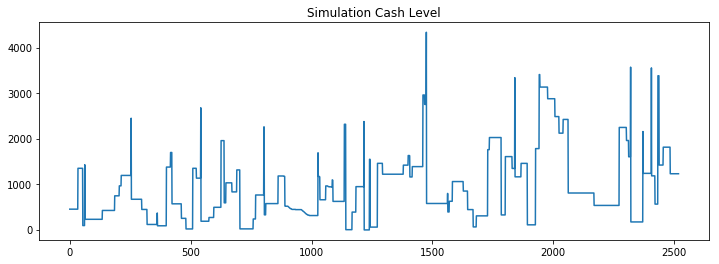

Total trading costs: 890

Maximum cash balance: 4337.12

Minimum cash balance: -5.96

Average cash balance: 881.49

Fractional units allowed? False

Weight metrics for: GLD

-------------------------

Target portfolio weight: 0.2693

Standard deviation of GLD portfolio weight: 0.0168

Maximum weight reached for GLD: 0.2989

Minimum weight reached for GLD: 0.1347

Average of GLD portfolio weight: 0.2637

Weight metrics for: SPY

-------------------------

Target portfolio weight: 0.0751

Standard deviation of SPY portfolio weight: 0.0043

Maximum weight reached for SPY: 0.089

Minimum weight reached for SPY: 0.035

Average of SPY portfolio weight: 0.0738

Weight metrics for: TLT

-------------------------

Target portfolio weight: 0.3

Standard deviation of TLT portfolio weight: 0.0173

Maximum weight reached for TLT: 0.3314

Minimum weight reached for TLT: 0.1489

Average of TLT portfolio weight: 0.2929

Weight metrics for: QQQ

-------------------------

Target portfolio weight: 0.3

Standard deviation of QQQ portfolio weight: 0.0147

Maximum weight reached for QQQ: 0.3361

Minimum weight reached for QQQ: 0.1471

Average of QQQ portfolio weight: 0.2985

Weight metrics for: XLI

-------------------------

Target portfolio weight: 0.0557

Standard deviation of XLI portfolio weight: 0.0027

Maximum weight reached for XLI: 0.0637

Minimum weight reached for XLI: 0.0276

Average of XLI portfolio weight: 0.0556