There is a lot of stuff below on what ESOP is, how vesting works etc. If you are just interested in smart contract info go here, for info on testing and deployment go here. For the reasoning behind this idea, read this Medium post.

ESOP stands for Employees Stock Options Plan. Many companies decide to allow employees to participate in company's long-term upside by offering them stock. Stock is typically available in form of options (mostly due to tax reasons) that are converted directly into cash when company has an IPO or gets acquired. There is a lot of interesting reasoning behind various ESOP structures and discussion when it works and when not. Here is a nice introduction: https://www.accion.org/sites/default/files/Accion%20Venture%20Lab%20-%20ESOP%20Best%20Practices.pdf

Neufund eats its own food and offers employees ESOP via a smart contract where options are represented as Ethereum tokens. Employees are still provided with ESOP terms in readable English (we call it ESOP Terms & Conditions Document) which is generated from before mentioned smart contract. Such construct replaces paper agreement employee signs and adds many interesting things on top.

- Process of assigning options, vesting and converting are immutable and transparent (including rules on changing rules). Trustless trust is to large degree provided.

- It is enforceable in off-chain court like standard paper agreement, however as smart contracts are self-enforcing a need for legal action should be negligible.

- Typical criticism of ESOP is that you need to wait till the exit or IPO to get your shares and money. This is too long for being a real incentive. This is not the case with tokenized options. Use of Ethereum token extends opportunities to profit from options. For example you can convert them into ERC20 compliant tokens when company is doing its ICO or make options directly trade-able (via migration mechanism described later).

- Smart contracts are self-enforcing and do all calculations and bookkeeping. They are very cheap once written and tested. ESOP d-app UI (https://github.com/Neufund/ESOP-ui) is easy to deploy with minimal maintenance costs.

There are two main roles in ESOP project:

companywhich represents the company management. Transactions signed by this role are deemed to be executed by Neufund (in case of our ESOP deployment).employeewhich corresponds to employee receiving and exercising options.

Employee life within ESOP starts when company offers him/her options. Employee should sign the offer within provided deadline. This starts his/her employment period (counted from so called issue date) If employee leaves company then he goes to terminated state which also stops the vesting. Employee may be also fired in which case s/he is removed from contract. Finally when exit/ICO etc. happens, conversion offer is made by company to employee which when accepted puts employee in converted state.

The states in the contract are:

WaitingForSignature: The employee needs to sign the ESOP contract.Employed: The company and employee have and agreement. This is the main state for the duration of employment.Terminated: The employee leaves the company or is fired. The contract distinguishes two types of terminating events: a.Regular: The employee leaves, but keeps options subject to fade-out. (More about this later.) b.BadLeaver: The employee leaves without any rights to options.OptionsExercised: When the company decides, options can be converted. When the employee has done this s/he goes into this final state.

ESOP itself has simple lifecycle. When deployed, it is in new state. It changes to open by providing configuration parameters by company role. At that point all actions involving employees may happen. When there is conversion event like exit, company will switch ESOP into conversion state in which options may be exercised by employees.

Options are assigned to employees in two ways:

pool options: There is a pool of 1 000 000 options of which employee 1 gets 10% which is 100 000. Employee 2 gets 10% of what remains in the pool (that is 900 000 options) which equals 90 000 and so on and so on.extra options: Additional options allocated at discretion of the company.

The pool options allocates more to employees that came to work for us earlier, this is our preferred method for rewarding the risk taken. Both methods can be combined, then pool options + extra options == issued options

Employee will not get all his/her options at the moment they are issued (however you can configure our smart contract to act in such way). Smart contract will release options up to all issued options with an algorithm called vesting.

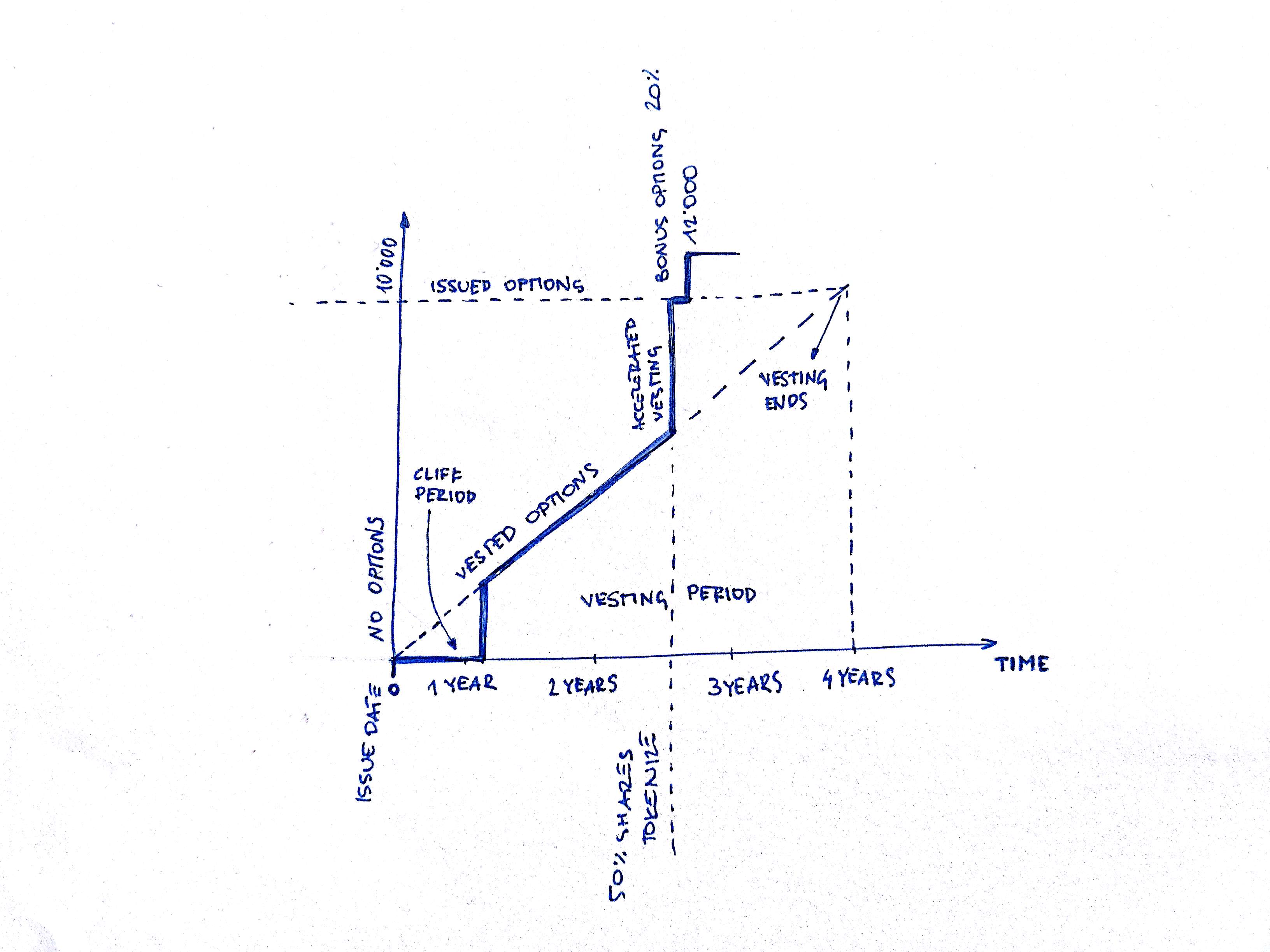

As you can see there is a period of time called

As you can see there is a period of time called cliff period during which employee does not get any options. In the example it is one year, but it is configurable and can be set to zero.

Then during the vesting period (period configurable, also may be 0), number of options increases up until issued options. In case of exit, IPO, ICO etc. additional bonus options (for example 20%, configurable) are added on top of issued options.

Please note that if exit, ICO etc. happens before vesting period is over, employee gets all issued options + bonus (we call this case accelerated vesting).

Sometimes people leave and ESOP smart contract handles that as well.

- Company may remove employee from ESOP smart contract and cancel all his/her options. This is called

bad leaver eventin ESOP Terms & Conditions Document and may happen when for example employee breaks the law and needs to be fired. As you can expect such event cannot be defined in smart contract (there's no proper oracle yet in court system ;>) so this definition remains in Terms document. - Employee may just leave company and go working somewhere else. This case is more complicated.

As you can see, vesting stops at the moment employee stops working at the company and all vested options are issued to employee. From that time amount of

As you can see, vesting stops at the moment employee stops working at the company and all vested options are issued to employee. From that time amount of vested optionsis slowly decreasing down toresidual amountsometimes calledfloor. Such process is calledfadeoutand fadeout period equals period of time employee worked at company. Smart contract may be configured for full fadeout and to not do any fadeout at all.

Terminated employee has no rights to accelerated vesting and no rights to bonus options.

Here is the most interesting thing about ESOP smart contract. At some point in time (called conversion event), if company is successful it gets acquired or does an IPO and shareholders make a lot of money. This is what happens classically and we fully support it. We, however, extend this definition to any ICO, tokenization event or even further by allowing direct trade of vested options.

As you could expect there is no oracle for conversion events so those are defined in ESOP Terms & Conditions Document (see chapter 3). When such event happens employee may convert his/her options into shares, tokens or directly into EUR/ETH/BTC according to a Options Conversion Smart Contract (we have a few examples later) which will be provided by company when conversion event happens.

Here's how Neufund handles security when issuing options.

- All our employees get basic training in blockchain and security. We've published our training material here. May be pretty useful!

- All our employees get Nano Ledger and store their private keys in hardware wallets. We encourage employees to store their backup codes in some safe place (like at notary).

- Backup codes of Neufund admin's Nano Ledger which is used to deploy smart contract and company management Nano Ledger are kept in a safe at notary office.

- Options are offered via subscription forms implemented as d-app where we enforce usage of Nano Ledger for our employees (however, we support Metamask and other web3 providers).

Also it is clear for everyone that if you loose your private key you will loose all your options.

ESOP smart contracts handles employees' lifecycle, manages options' pool and handles conversion offer via calling provided implementation of options conversion contracts. Implementation is pretty straightforward and functions more or less correspond to provisions in ESOP Terms & Conditions Document. Terminology is also preserved.

All non-const functions return "logic" errors via return codes and can throw only in case of generic problems like no permission to call a function or invalid state of smart contracts. Return codes correspond to ReturnCode event, in case of OK return code, specific event is logged (like EmployeeSignedToESOP). I hope revert opcode gets implemented soon!

ESOP aggregates the following contracts:

OptionsCalculatorwhich handles all options calculations like computing vesting, fadeout etc. and after configuring provides just a set of public constant methods.EmployeesListthat contains iterable mapping of employees. Please note thatESOPis the sole writer toEmployeesListinstance.

ESOP inherits from following contracts (I skip some obvious things like Ownable)

TimeSourceprovides unified time source for all smart contracts in this project. It allows to mock-up time when not on mainnet.ESOPTypesdefinesEmployeestruct that is used everywhere in this project (I know, it should be a library)CodeUpdateableprovides method to lock ESOP contract state when migrating to updated code (see later)

Access control structure is worth mentioning. In ESOP and OptionsCalculator we have two managing accounts:

adminwhich deploys and upgrades code and corresponds toownerinOwnablebase class.companythat represents company's management

Please note that admin cannot execute any ESOP logic. S/he can deploy contracts and upgrade code but cannot open (activate) ESOP nor add employees.

| Description | Cliff Period | Vesting Period | Residual Amount % | Bonus Options % | New Employee Pool % |

|---|---|---|---|---|---|

| Neufund configuration | 1 year | 4 years | 50% | 20% | 10% |

| No cliff | 0 | 4 years | 20% | 20% | 10% |

| No fadeout | 1 year | 4 years | 100% | 20% | 10% |

| Full fadeout | 1 year | 4 years | 0 | 20% | 10% |

| Disable pool options, only extra* | 1 year | 4 years | 20% | 10% | 0 |

| Disable vesting, fadeout and bonus** | 0 | 2 weeks | 100% | 0 | 10% |

* in that case pool option size is ignored, you can set it to any allowed value

** this option was not thoroughly tested, 2 weeks vesting period equals deadline for employee signature, cannot be 0 as unit tests are not prepared for that.

Neufund configuration sets options pool size to 1000080 and options per share to 360. When you set your own values please make sure that options pool size is evenly divisible by options per share so options correspond to integer number of shares. ESOP UI app will however prevent you from making this mistake.

RoT is an immutable, deployed-once contract that points to other contracts that are deemed currently "supported/official/endorsed by company" etc. At this moment RoT points to current ESOP implementation (see code update and migration procedures). Our d-app uses RoT address (which never changes) to infer all other addresses it needs.

The right to choose new ESOP implementation and current owner RoT is with company not admin.

Options converter implementation will correspond to given conversion scenario (for example cash payout after exit is different from getting tokens in ICO). However, each such contract must derive from BaseOptionsConverter which is provided to ESOP smart contract by company role. According to ESOP Terms & Conditions Document this is on par with making with options conversion offer to employees so at this point ESOP goest into conversion state and stops accepting new employees.

At minimum exerciseOptions function must be implemented (except two getters) that will be called by ESOP smart contract on behalf of employee when s/he decides to execute options. Please note that employee can burn his/her options - see comments in base class for details.

We provide two implementations of BaseOptionsConverter:

ERC20OptionsConverterwhich converts options into ERC20 tokens.ProceedsOptionsConverterthat adds proceeds payouts via withdrawal pattern with several payouts made by company. Token trading is still enabled.

Both example converters are nicely tested but they are not considered production grade so beware.

Code update is strictly defined in ESOP Terms & Conditions Document chapter 8 and is reserved for bugfixing, optimization etc. where "spirit of the agreement" is not changed.

Code update starts via calling methods defined in CodeUpdateable base class from which ESOP contract derives. During code update only constant method of this contract are available so state cannot be changed. Whole procedure ends with replacing ESOP contract address in RoT contract instance.

There is a nice test/example of the whole procedure in js_tests/test.CodeUpdate.js, example updated ESOP is provided in js_tests/UpdatedESOP.sol and concept of data structure migration (EmployeesList) is demonstrated by js_tests/UpdatedESOP.sol.

Please note that all old ESOP contracts (including ESOP, EmployeesList and OptionsCalculator) selfdestruct at the end.

Employee and company may agree to migrate to ESOP with different terms and conditions. This happens via ESOPMigration smart contract that is provided by company and then accepted by employee. Please check comments around allowEmployeeMigration and employeeMigratesToNewESOP functions in ESOP for many interesting details.

Migration process is strictly defined in ESOP Terms & Conditions Document.

ESOPTypesshould be a library that definesEmployeetype. Update is simple howeverdappletest framework does not appear to support libraries anymore and currently I will not port all the test to truffle (which lacks many useful features - see later).- Options pool management functions (fadeout and options re-distribution, see

removeEmployeesWithExpiredSignaturesAndReturnFadeout) should go to separate library. - Port all solidity tests from

dapple(which is sadly discontinued) totruffle. - Let employees allow company to recover their options if they loose their private key.

- Implement option strike price as per employee variable.

- Generate instance of the legal wrapper during option offer transaction, upload to IPFS and store the hash with options-offer transation. Then use this document to print. WARNING: this will make ESOP-ui dependent on some backend microservice. It's rather a good idea for future Neufund platform.

Terms document establishes ESOP and accompanying smart contracts as legally binding in off-chain legal system. Please read the source document in /legal folder, it is really interesting!

A fundamental problem we had to solve is which contract form should prevail in case of conflict: computer code vs. terms in Terms document. It's a story similar to multi-lingual legal documents (like you sign your ESOP with Chinese company which is originally in Chinese but translated to English).

- In case of ESOP agreement we have an asymmetric situation in terms of information and power. Employees are considered at disadvantage in both. In such case, to make agreement legally binding, it must be proven that employee could understand what s/he was signing. Thus we had to make ESOP Terms & Conditions Document to prevail over smart contract as it is easy for an employee to prove s/he could not understood the Solidity code and make court take his/her side. If there are any conflicts, English language is to prevail. This situation will persist until there is a smart contract language that people are able to understand or they all learn Solidity. Whichever happens first.

- In case of b2b agreements like when Limited Partner joins VC Fund, there is a symmetry both in information and power. This allows a smart contract to prevail (if you are rich person you can always ask your developer buddies to check the contract for you, still it may be much cheaper than to ask lawyers to do the same). In case of b2b the document with the Terms may be limited to just the most important business terms and still hold in court.

Other fundamental problem is a possible conflict of spirit and letter of the law (remember TheDAO?). Can we have bugs in the code or all code is law? We are clearly on the side of spirit of law prevailing and our Term document (and corresponding smart contract code!) contains bug fixing provision and provision to change ESOP rules in chapter 8.

The same chapter defines a few other blockchain-related provisions like what we do in case of fork and what should happen when employee looses his/her private key (in short: s/he looses all their options so keep your keys safe).

Technically, wrapper is just a text document stored in IPFS, whose hash is added to ESOP smart contract. This document is filled with employee-specific variables and may be printed for reference. As you could expect we do not translate EVM bytecode to English.

Document is available in Word (docx) and html (converted from Word, do not expect too much!). This document is a template within which several tags marked with curly braces needs to be replaced before document is stored in IPFS. We provide a simple python utility legal/replace-tags.py and a dictionary of tags to be replaced in legal/ipfs_tags.json.

You should store customized document in IPFS (https://ipfs.io/), to make sure that is never forgotten by the network you should run your own node, add Terms to it and pin. We are using go implementation (https://github.com/ipfs/go-ipfs). The hash you obtain should be passed to ESOP smart contract by company role.

Please note that some tags will be replaced in the d-app when Terms are generated for a given employee. You can inspect this list of tags in legal/sc_tags.rv.

It's here. Please note that options subscription form has terminology and content defined in ESOP Terms & Conditions Document and d-app UI conforms to that.

We use solc 0.4.8. Dapple framework that we use for Solidity tests compiles with c++ solc that you should install from repo: http://solidity.readthedocs.io/en/develop/installing-solidity.html.

We use truffle v3.2.1 for integration tests and compilation of deployed artifacts, which is using emscripten 0.4.8 solc build.

(FYI: bytecode produced by c++ and emscripten is identical: https://github.com/ethereum/solidity-test-bytecode)

Solidity tests are run with dapple. This is unfortunate as dapple is discontinued and does not support libraries. There are a few things I liked about it: debug output, writing to CSV files from Solidity (nice thing for financial simulations), test for events and throws. Anyway, I'll never use it again and I plan to port current tests to truffle.

Solidity tests can be found in sol_tests, there are also shell scripts to make testing easier.

./test.sh <test name> will execute all test cases from test with given name. if name is not provided then all tests will be executed. For example ./test.sh ReturnToPool will run tests from ./sol_tests/Test.ReturnToPool.sol file.

There are a few interesting test contracts defined:

EmpTesterwhich is a employee's proxy to ESOP contract that allows you to call its method with different senders.ESOPMakerwhich createdESOPsmart contract with and necessary dependencies. Here you can mainpulateESOPandOptionsCalculatorparameters to match your case.EmpReentrythat is doing re-entry attack onProceedsOptionsConverter

There is also an ESOP simulator that stores results in ./solc/simulations.csv, you can run it from ./simulate.sh script.

We use integration tests when we want to check smart contract behavior that spans many blocks, contracts are created and destroyed etc. Those tests are run in truffle from ./js_test.sh script. Tests are defined in ./js_tests. There is a network defined in truffle.js called test for which deployment scripts are deploying example options converters and opening the ESOP.

Run tests with:

./js_test.sh --network test

with testrepc run with

testrpc --gasLimit=0x1500000 -i=192837992

test.CodeUpdate.js is a notable test that demonstrated a whole procedure of code update of ESOP smart contract.

We have defined following test deployments:

test_deployment where block gas limit approximates mainnet limit Run testrpc with:

testrpc --gasLimit=4100000 -i=192837991 --port=8546

then run

truffle deploy --network test_deployment

test to run integration tests, see chapter above.

- run local parity (https://parity.io/) node configured for ropsten or mainnet. if you want extended Nano Ledger support, use Neufund's parity fork (https://github.com/Neufund/parity)

# run parity on ropsten with custom derivation path (remove --hardware-wallet-key-path)

parity ui --chain ropsten --jsonrpc-cors "http://localhost:8081" --jsonrpc-hosts="all" --jsonrpc-port 8444 --hardware-wallet-key-path "44'/60'/103'/0"

# run parity on mainnet

- create account for the

adminrole (at Neufund we use hardware wallet for that). insertadminaddress into network definition in truffle.js

ropsten: {

host: "localhost", // local parity ropsten node with nano attached

port: 8444,

network_id: "3",

from: '0xDba5a21D0B5DEAD8D63d5A4edf881005751211C2' // public key of admin role

},

- create account for the

companyrole and place it in deployment scriptmigrations/2_deploy_ESOP.js

if (network === 'live') {

// provide company address that will manage contract on live network

companyAddress = '';

}

else if (network === 'ropsten') {

// company role public address on ropsten

companyAddress = '0x1078291bbcc539f51559f14bc57d1575d3801df8';

}

else {

// 0 is default account, make company to use account 1

companyAddress = accounts[1];

}

- make sure

adminaccount has some ether and then deploy withtruffle deploy --network ropsten - push artifact to build/ropsten so ESOP-ui can use it

- Put all contract files in one .sol files, remove imports etc. (is there Solidity preprocessor?)

- Put this code into form in Etherscan, choose a compiler version

- If smart contract has a constructor first obtain constructor parameters like for ESOP those would be

0x279084bb08100eebdb76b5d4eb250ecf0f12f29d options

0x54bd298c02177d717617d643bf9aedab7314b576 emp

0xa88828cbbd18244592f4bdd5f536648f95293427 rot

0x1078291bbcc539f51559f14bc57d1575d3801df8 comp

- Insert combined file into Remix, then Create contract by giving parameters, put addresses in quotes like

"0x1078291bbcc539f51559f14bc57d1575d3801df8", "0xa88828cbbd18244592f4bdd5f536648f95293427", "0x279084bb08100eebdb76b5d4eb250ecf0f12f29d", "0x54bd298c02177d717617d643bf9aedab7314b576" - Use debugger to check callcode of create transaction. At the end of the Call Data, you'll find constructor parameters

- You'll find them by comparing with bytecode, example

0000000000000000000000001078291bbcc539f51559f14bc57d1575d3801df8000000000000000000000000a88828cbbd18244592f4bdd5f536648f95293427000000000000000000000000279084bb08100eebdb76b5d4eb250ecf0f12f29d00000000000000000000000054bd298c02177d717617d643bf9aedab7314b576 - Paste this into Etherescan and run,

truffle 3.2.5 uses non standard number of optimizer runs (solc 0.4.11) and you will not be able to verify source code with etherscan. modify truffle-compile to get standard behavior ethereum/solidity#2245

scratchbook

RoT.at(RoT.address).ESOPAddress()

ESOP.at(ESOP.address).rootOfTrust()

RoT.deployed().then(function(i) { rot = i; } )

# setting up dev chain on parity and get some eth

parity --chain dev --jsonrpc-port 8444 ui

https://github.com/paritytech/parity/wiki/Private-development-chain

# run parity with unlocked account (deployment)

parity --chain dev --jsonrpc-cors "http://localhost:8081" --jsonrpc-hosts="all" --jsonrpc-port 8444 --unlock 0x00a329c0648769A73afAc7F9381E08FB43dBEA72,0x81866642828E92Aa2659F49925575827596b3443 --password ~/paritypass

# deploy with truffle

truffle migrate --network paritydev

# when you get `RPC io error: Address already in use (os error 98)` in parity remove pipe

rm /home/rudolfix/.local/share/io.parity.ethereum/jsonrpc.ipc