Advanced Risk and Portfolio Management Resources

This repo contains material from the Advanced Risk and Portfolio Management (ARPM) Bootcamp developed by Attilio Meucci. It includes the covered ARPM theory, review sessions, guest presentations and the code. In order to apply the code, one should first go through the relevant material.

Theory: go to Research Library (Mendeley) -> rARPM

Code: arpym (ARPM bootcamp specific library with functions), functions_legacy (ARPM legacy functions), scripts/sources (Case studies applying the theory)

The following material is divided into 4 modules:

- Data Science for Finance

- Financial Engineering for Investment

- Quantitative Risk Management

- Quantitative Portfolio Management

It covers the most advanced quantitative techniques in data science & machine learning, market modelling, factor modelling, portfolio construction, algorithmic training, investment risk management, liquidity modelling and enterprise risk management.

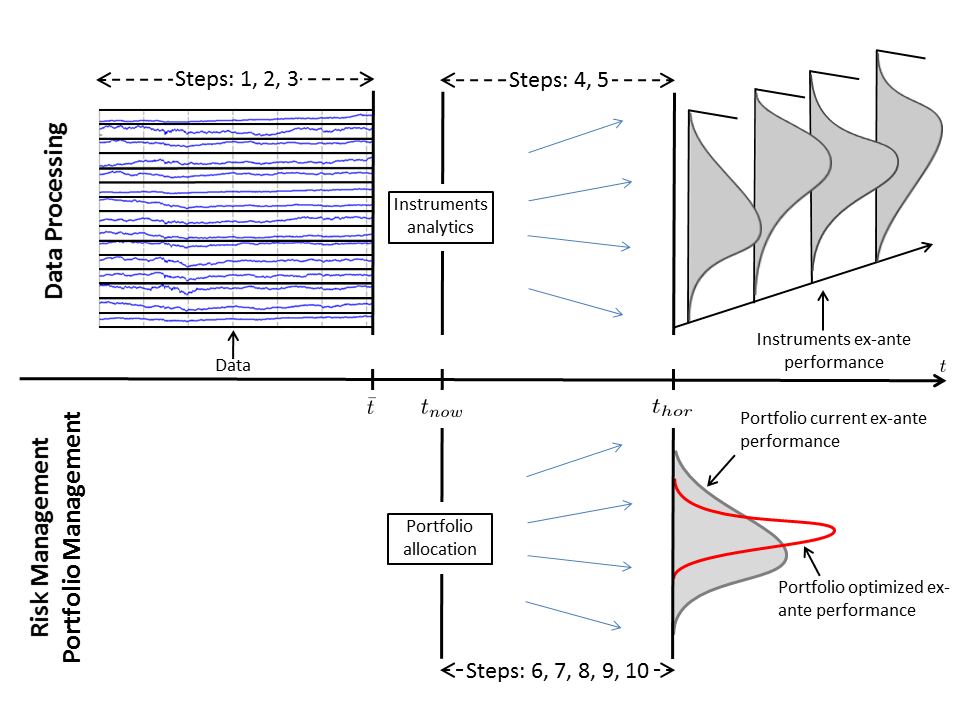

The "Checklist" consists of 10 sequential steps to model, assess and improve the performance of the portfolio. By following these steps in the checklist, one can avoid common pitfalls and ensure not to miss important features in the models. The 10 sequential steps are summarised graphically:

The checklist can be explained by examining a portfolio at time

- Risk management: measure the risk between

$t_{now}$ and the investment horizon$t_{hor}$ - Portfolio management: optimise future performance over horizon

To achieve this, you have to accumulate all data up to

-

Data Processing (steps 1-5): These steps show how to transform raw data for different financial instruments into tractable time series; how to perform estimation on such time series using econometric techniques; and how to revert back to the joint predictive distribution of the performance of each instrument over the future investment horizon.

-

Risk Management (steps 6-8): How to aggregate the ex-ante performance of each instrument into a portfolio performance; how to evaluate the riskiness of a portfolio using metrics such as VaR, Tracking-Error etc. or by performing stress-testing; and how to attribute portfolio risk to different sources.

-

Portfolio Management (steps 9-10): How to construct a portfolio using simple mean-variance or more complex objectives; how to strengthen the construction process to address estimation risk; how to optimally execute trades; and how to perform dynamic rebalancing in multi-period strategies.

To install the repo, start a new project and clone the repo. Then, do the following steps:

-

Setup the virtual environment for python. To do this, go to File -> Settings -> Project:arpmRes -> Project Interpreter -> Show All (dropdown) -> Add -> New environment (check 'Inherit global site-packages') -> OK

-

Install all package dependencies. In the Terminal: pip install -r requirements.txt