Python library for visualizing options.

pandas, numpy, matplotlib, seaborn, yfinance

Use the package manager pip to install opstrat.

pip install opstratimport opstratop.__version__If you are using an older version upgrade to the latest package using:

pip install opstrat --upgradeUsed for plotting payoff diagram involving multiple options.

op_type: kind {'c','p'}, default:'c'

Opion type>> 'c': call option, 'p':put option

spot: int, float, default: 100

Spot Price

spot_range: int, float, optional, default: 5

Range of spot variation in percentage

strike: int, float, default: 102

Strike Price

tr_type: kind {'b', 's'} default:'b'

Transaction Type>> 'b': long, 's': short

op_pr: int, float, default: 10

Option Price

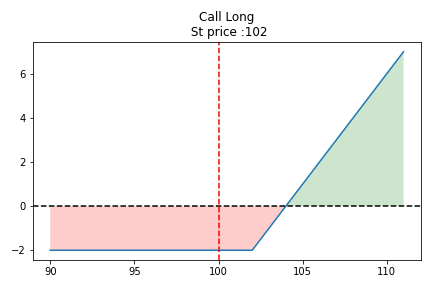

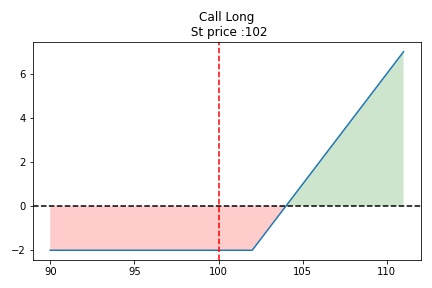

Option type : Call

Spot Price : 100

Spot range : +/- 5%

Strike price: 102

Position : Long

Option Premium: 10

op.single_plotter()Green : Profit

Red : Loss

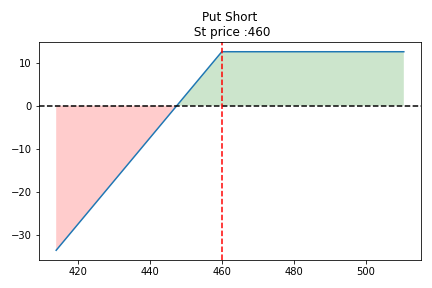

Strike Price : 450

Spot price : 460

Option type : Put Option

Position : Short

Option Premium : 12.5

op.single_plotter(spot=460, strike=460, op_type='p', tr_type='s', op_pr=12.5)spot: int, float, default: 100

Spot Price

spot_range: int, float, optional, default: 20

Range of spot variation in percentage

op_list: list of dictionary

Each dictionary must contiain following keys:

'strike': int, float, default: 720

Strike Price

'tr_type': kind {'b', 's'} default:'b'

Transaction Type>> 'b': long, 's': short

'op_pr': int, float, default: 10

Option Price

'op_type': kind {'c','p'}, default:'c'

Opion type>> 'c': call option, 'p':put option

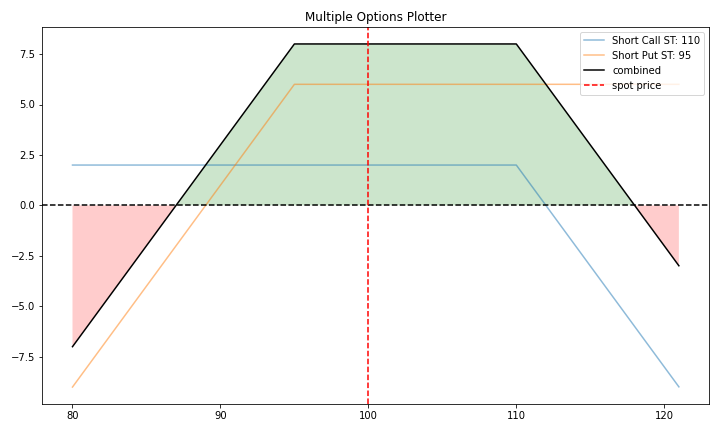

Options trading that involve:

(a)selling of a slightly out-of-the-money put and

(b)a slightly out-of-the-money call of the same underlying stock and expiration date.

spot_range=+/-20%

spot=100

Option 1:Short call at strike price 110

op_type: 'c','strike': 110 'tr_type': 's', 'op_pr': 2

Option 2 : Short put at strike price 95

'op_type': 'p', 'strike': 95, 'tr_type': 's', 'op_pr': 6

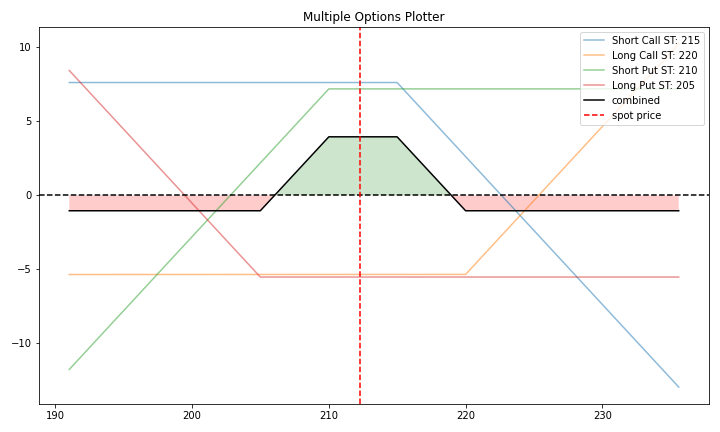

op.multi_plotter()An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date.

stock currently trading at 212.26 (Spot Price)

Option 1: Sell a call with a 215 strike, which gives 7.63 in premium

Option 2: Buy a call with a strike of 220, which costs 5.35.

Option 3: Sell a put with a strike of 210 with premium received 7.20

Option 4: Buy a put with a strike of 205 costing 5.52.

op1={'op_type': 'c', 'strike': 215, 'tr_type': 's', 'op_pr': 7.63}

op2={'op_type': 'c', 'strike': 220, 'tr_type': 'b', 'op_pr': 5.35}

op3={'op_type': 'p', 'strike': 210, 'tr_type': 's', 'op_pr': 7.20}

op4={'op_type': 'p', 'strike': 205, 'tr_type': 'b', 'op_pr': 5.52}

op_list=[op1, op2, op3, op4]

op.multi_plotter(spot=212.26,spot_range=10, op_list=op_list)ticker: string, default: 'msft' stock ticker for Microsoft.Inc

Stock Ticker

exp: string default: next option expiration date

Option expiration date in 'YYYY-MM-DD' format

spot_range: int, float, optional, default: 10

Range of spot variation in percentage

op_list: list of dictionary

Each dictionary must contiain following keys

'strike': int, float, default: 720

Strike Price

'tr_type': kind {'b', 's'} default:'b'

Transaction Type>> 'b': long, 's': short

'op_type': kind {'c','p'}, default:'c'

Opion type>> 'c': call option, 'p':put option

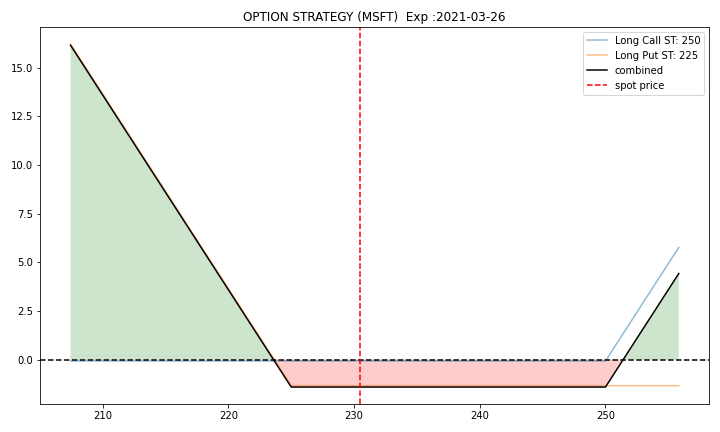

Strangle on Microsoft stock

Stock ticker : msft(Microsoft Inc.)

Option 1: Buy Call at Strike Price 250

Option 2: Buy Put option at Strike price 225

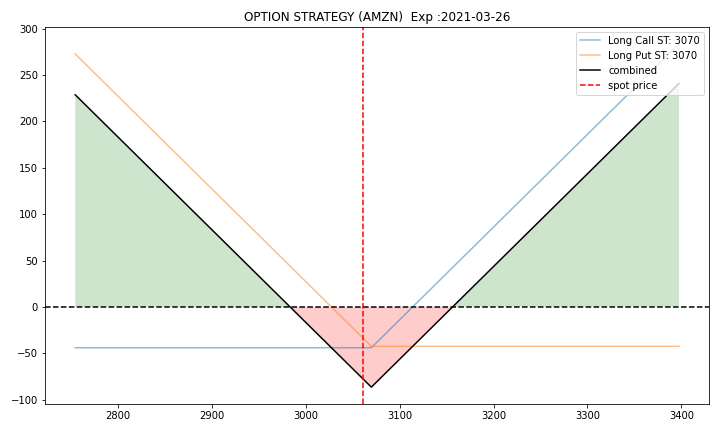

op.yf_plotter()Strangle:

A simultaneous purchase of options to buy and to sell a security or commodity at a fixed price, allowing the purchaser to make a profit whether the price of the security or commodity goes up or down.

Stock ticker : AMZN(Amazon Inc.)

Option 1: Buy Call at Strike Price 3070

Option 2: Buy Put option at Strike price 3070

op_1={'op_type': 'c', 'strike':3070, 'tr_type': 'b'}

op_2={'op_type': 'p', 'strike':3070, 'tr_type': 'b'}

op.yf_plotter(ticker='amzn',

exp='default',

op_list=[op_1, op_2])Figure can be saved in the current directory setting save=True

Filename with extension has to be provided as file.

If no filename is provided, the figure will be saved as fig in png format.

op.single_plotter(save=True,file='simple_option.jpeg')Pull requests are welcome. For major changes, please open an issue first to discuss what you would like to change.

Please make sure to update tests as appropriate.

Stackoverflow Community

Ran Aroussi : yfinance

Daniel Goldfarb : mplfinance