The dataset is taken from library yahoo_historical. That consists of Open, High, Low, Closing and Volume of several banks (Bank BCA, Bank BRI, Bank BNI and Bank Mandiri) from 12th July 2012 until 12th July 2019 with total 1739 rows in each stock. Variabel that used for prediction is Open Price.

from yahoo_historical import Fetcher

namasaham = "bbca"

namasaham = namasaham.upper()

saham = Fetcher(namasaham+".JK", [2012,7,12], [2019,7,12], interval="1d")

saham = saham.getHistorical()

# Open Price

saham = saham.iloc[:,1:2] -

Remove rows with NA values in Open Price

saham = saham.dropna()

-

Describe data

- BBCA

count mean std min 25% 50% 75% max Open 1739.0 15829.700978 5896.481231 7450.0 11025.0 13625.0 20887.5 30100.0

- BBRI

count mean std min 25% 50% 75% max Open 1739.0 2476.138585 778.166236 1270.0 1927.5 2300.0 3025.0 4510.0

- BBNI

count mean std min 25% 50% 75% max Open 1739.0 2476.138585 778.166236 1270.0 1927.5 2300.0 3025.0 4510.0

- BMRI

count mean std min 25% 50% 75% max Open 1739.0 2476.138585 778.166236 1270.0 1927.5 2300.0 3025.0 4510.0

-

Split dataset into data training and data testing with train size=75% and test size=25 %

percent_train = 0.75 trainingset = saham.iloc[:int(len(saham)*percent_train),:] testset = saham.iloc[int(len(saham)*percent_train):,:]

-

Normalized data between zero and one with MinMaxScaler

from sklearn.preprocessing import MinMaxScaler sc = MinMaxScaler() trainingset = sc.fit_transform(trainingset) testset = sc.fit_transform(testset)

-

Build trainX, trainY, testX and testY (with window = 3)

def createDataset(data, window): dataX, dataY = [], [] for i in range(len(data)-window): temp = [] for j in range(i, i+window): temp.append(data[j,0]) dataX.append(temp) dataY.append(data[i+window,0]) return np.array(dataX), np.array(dataY)

- Dropout = 0.2

- Epochs = 500

- LSTM 50

# Model Sequential regressor=Sequential() # Hidden layer (4) regressor.add(LSTM(units=50,activation='tanh',return_sequences=True, input_shape=(trainX.shape[1],1))) regressor.add(Dropout(0.2)) regressor.add(LSTM(units=50, return_sequences=True)) regressor.add(Dropout(0.2)) regressor.add(LSTM(units=50, return_sequences=True)) regressor.add(Dropout(0.2)) regressor.add(LSTM(units=50)) regressor.add(Dropout(0.2)) # Output layer (1) regressor.add(Dense(units = 1)) regressor.compile(optimizer='adam',loss='mean_squared_error') regressor.fit(trainX,trainY,epochs=500)

predict_price = regressor.predict(testX)testY = sc.inverse_transform(testY.reshape(-1,1))

predict_price = sc.inverse_transform(predict_price)

trainingset = sc.inverse_transform(trainingset)

testset = sc.inverse_transform(testset)with Directional Statistics (Dstat) that more accurate commonly used in special financial economic fields.

def dstat(x,y):

dstat = 0

n = len(y)

for i in range(n-1):

if ((x[i+1]-y[i])*(y[i+1]-y[i]))>0 :

dstat += 1

Dstat = (float(1/(n-1))*dstat)*100

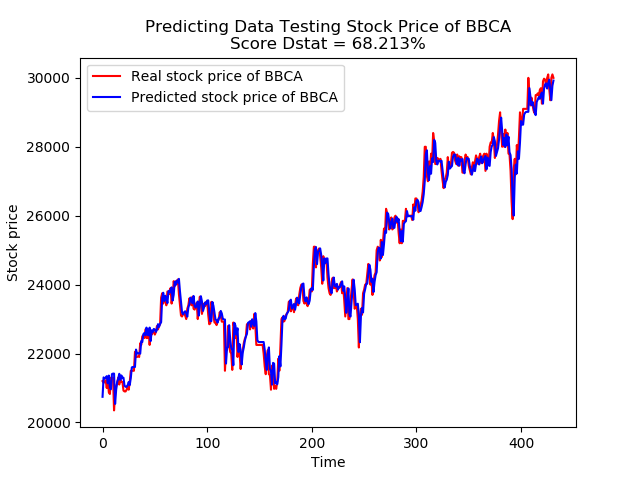

return float(Dstat)# plot real data testing

plt.plot(np.arange(len(testY)),testY,color='red',label='Real stock price of {}'.format(namasaham))

# plot predict data testing

plt.plot(np.arange(len(predict_price)),predict_price,color='blue',label='Predicted stock price of {}'.format(namasaham))

plt.title('Predicting Data Testing Stock Price of {}\nScore Dstat ={}%'.format(namasaham,round(dstat(testY,predict_price),3)))

plt.xlabel('Time')

plt.ylabel('Stock price')

plt.legend()

plt.savefig('/templates/testing_predict_{}.png'.format(namasaham))

plt.show()