A sophisticated AI-powered investment agent system for US stock market analysis and trading decisions, leveraging yfinance for market data and AlphaVantage for news sentiment analysis.

🌏 English | 简体中文

This project is for educational and research purposes only.

- Not intended for real trading or investment

- No warranties or guarantees provided

- Past performance does not indicate future results

- Creator assumes no liability for financial losses

- Consult a financial advisor for investment decisions

By using this software, you agree to use it solely for learning purposes.

- Real-time US stock market data analysis using yfinance

- News sentiment analysis through AlphaVantage API

- AI-powered trading decision making

- Comprehensive backtesting capabilities

- Detailed reasoning for investment decisions

- Support for multiple trading strategies

The system employs multiple AI agents working together to make investment decisions:

graph TD

MD[Market Data Agent] --> TA[Technical Analyst]

MD --> FA[Fundamentals Analyst]

MD --> SA[Sentiment Analyst]

TA --> RM[Risk Manager]

FA --> RM

SA --> RM

RM --> PM[Portfolio Manager]

PM --> Decision[Final Decision]

-

Market Data Agent

- Gathers historical price data from yfinance

- Collects financial metrics and statements

- Preprocesses data for other agents

-

Technical Analyst

- Analyzes price trends and patterns

- Calculates technical indicators

- Generates technical trading signals

-

Fundamentals Analyst

- Evaluates company financial health

- Analyzes growth metrics

- Provides fundamental analysis signals

-

Sentiment Analyst

- Fetches news from AlphaVantage

- Analyzes news sentiment using Gemini

- Generates sentiment-based signals

-

Risk Manager

- Integrates signals from all analysts

- Evaluates potential risks

- Sets position limits

- Provides risk-adjusted recommendations

-

Portfolio Manager

- Makes final trading decisions

- Manages position sizing

- Balances risk and reward

- Generates executable orders

- Market Data Agent collects all necessary data

- Three analysts (Technical, Fundamental, Sentiment) work in parallel

- Risk Manager combines and evaluates all signals

- Portfolio Manager makes the final decision

Free_US_Investment_Agent_System/

├── src/ # Source code

│ ├── agents/ # AI agents implementation

│ ├── tools/ # Utility tools

│ ├── utils/ # Helper functions

│ ├── data/ # Data storage

│ ├── img/ # Image resources

│ ├── backtester.py # Backtesting implementation

│ ├── main.py # Main application entry

│ └── test_*.py # Test files

├── logs/ # Application logs

├── .env.example # Environment variables template

├── pyproject.toml # Poetry dependency management

├── poetry.lock # Poetry lock file

└── LICENSE # MIT License

The system generates two types of logs:

api_calls_[date].log: Records all API calls and their responsesbacktest_[ticker]_[date]_[start]_[end].log: Records backtesting results and analysis

The system stores data in JSON format:

- News data:

src/data/stock_news/[ticker]/[date]_news.json(Note: The date in filename represents the day before the analysis date, as we use historical news to make current day's decisions)

{

"date": "2024-12-10",

"news": [

{

"title": "Tesla Stock Surges Post-Trump Win",

"content": "Musk-Trump ties and autonomous driving growth...",

"publish_time": "2024-12-10 20:05:00",

"source": "Zacks Commentary",

"url": "https://www.zacks.com/..."

}

]

}- Sentiment cache:

src/data/sentiment_cache.json

{

"2024-12-09": 0.1, // Sentiment score: -1 (very negative) to 1 (very positive)

"2024-12-10": 0.6

}- Python 3.11

- Poetry for dependency management

- AlphaVantage API key (Get your free API key from AlphaVantage)

- Note: Free API key has a limit of 25 requests per day for news data

- Gemini API key (Get your free API key from Google AI Studio)

The investment strategy implemented in this system is for educational purposes only. Users are encouraged to:

- Develop and implement their own trading strategies

- Customize the analysis parameters

- Modify the decision-making logic

- Test thoroughly before any real trading

- Install Poetry:

(Invoke-WebRequest -Uri https://install.python-poetry.org -UseBasicParsing).Content | py -curl -sSL https://install.python-poetry.org | python3 -- Clone the repository:

git clone https://github.com/24mlight/Free_US_Investment_Agent_System.git

cd Free_US_Investment_Agent_System- Install dependencies:

poetry install- Set up your environment variables:

You can set up your environment variables in two ways:

a) Directly edit the .env file (Recommended):

cp .env.example .envThen edit the .env file:

ALPHA_VANTAGE_API_KEY=your_api_key_here

GEMINI_API_KEY=your_gemini_api_key_here

GEMINI_MODEL=gemini-1.5-flash

b) Via command line:

Unix/macOS:

export ALPHA_VANTAGE_API_KEY='your_api_key_here'

export GEMINI_API_KEY='your_gemini_api_key_here'

export GEMINI_MODEL='gemini-1.5-flash'Windows PowerShell:

$env:ALPHA_VANTAGE_API_KEY='your_api_key_here'

$env:GEMINI_API_KEY='your_gemini_api_key_here'

$env:GEMINI_MODEL='gemini-1.5-flash'The system predicts trading decisions for the next trading day based on current market data and historical news:

- Basic Usage

poetry run python src/main.py --ticker TSLA- Show Detailed Analysis

poetry run python src/main.py --ticker TSLA --show-reasoning- Custom Date and News Analysis

poetry run python src/main.py --ticker TSLA --show-reasoning --end-date 2024-12-13 --num-of-news 5Parameters:

--ticker: Stock symbol (e.g., TSLA for Tesla)--show-reasoning: Display AI reasoning for decisions--end-date: The date for which to predict next day's trading decision (YYYY-MM-DD format)--num-of-news: Number of historical news articles to analyze (default: 5, max: 100)--initial-capital: Initial cash amount (optional, default: 100,000)

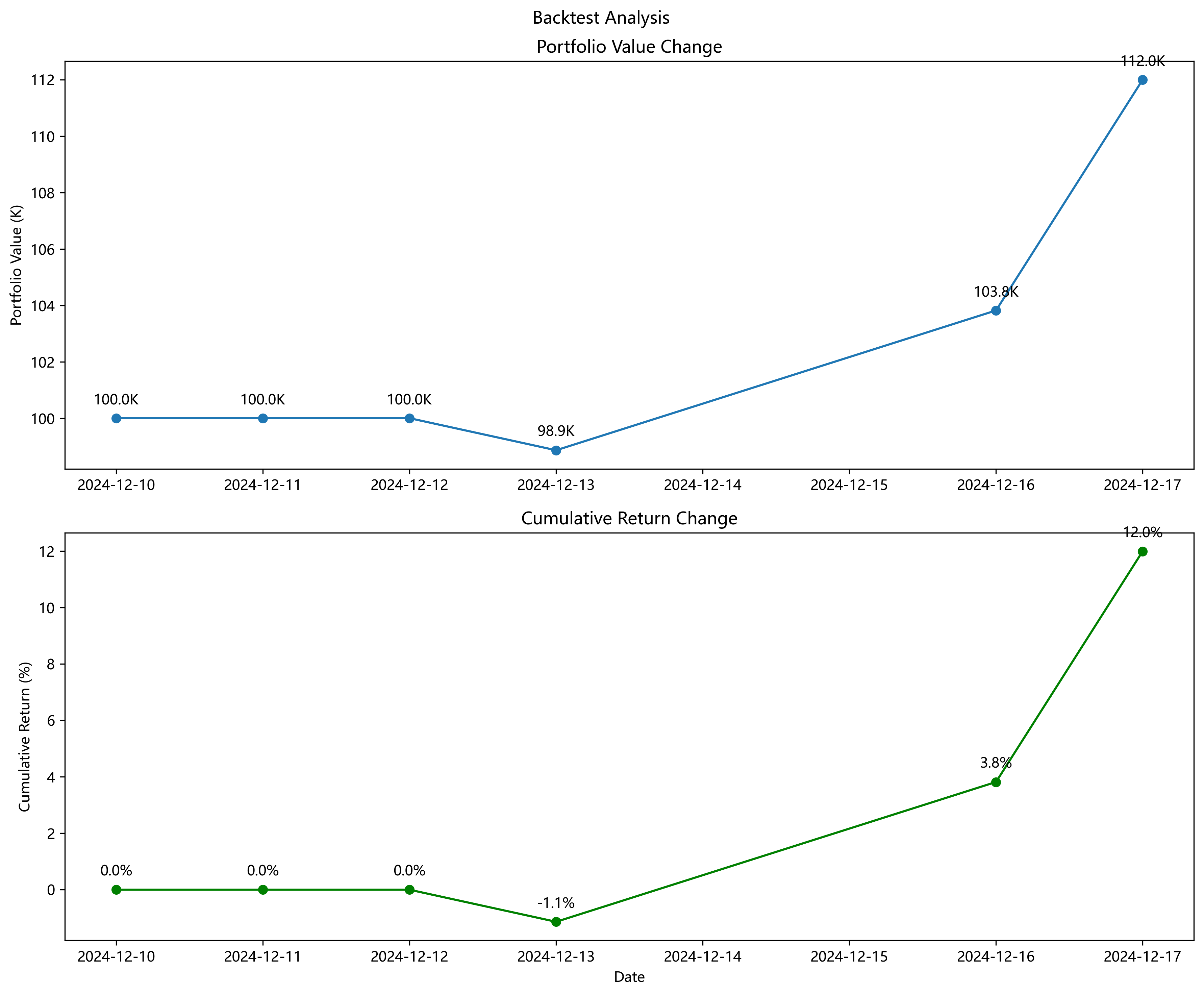

To run backtesting analysis:

poetry run python src/backtester.py --ticker TSLA --start-date 2024-12-10 --end-date 2024-12-17 --num-of-news 5Parameters:

--ticker: Stock symbol--start-date: Backtesting start date (YYYY-MM-DD format)--end-date: Backtesting end date (YYYY-MM-DD format)--num-of-news: Number of news articles to analyze (default: 5, max: 100)--initial-capital: Initial cash amount (optional, default: 100,000)

The system will output:

- Fundamental analysis results

- Technical analysis results

- Sentiment analysis results

- Risk management assessment

- Final trading decision

When using --show-reasoning, you'll see detailed analysis from each agent.

Example Output:

{

"action": "buy",

"quantity": 100,

"confidence": 0.75,

"agent_signals": [

{

"agent": "Technical Analysis",

"signal": "bullish",

"confidence": 0.8

},

{

"agent": "Sentiment Analysis",

"signal": "neutral",

"confidence": 0.6

}

],

"reasoning": "Technical indicators show strong upward momentum..."

}Here's an example of our backtesting results:

This project is licensed under the MIT License.

This project is modified from ai-hedge-fund. We sincerely thank the original authors for their excellent work and inspiration.

Additional acknowledgments:

- yfinance for market data

- AlphaVantage for news and sentiment analysis

If you find this project helpful, consider buying me a coffee!