Read this in other languages: English.

详细文档:https://zvt.readthedocs.io/en/latest/

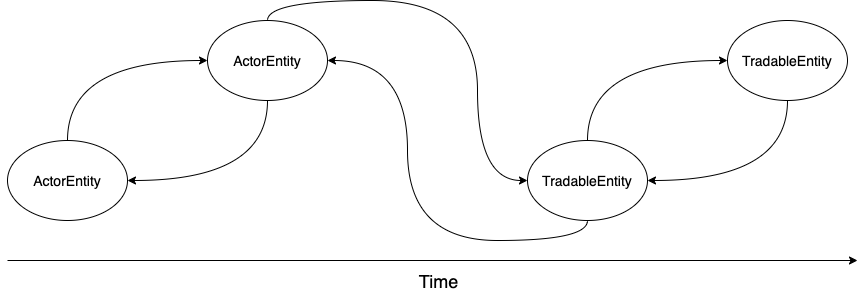

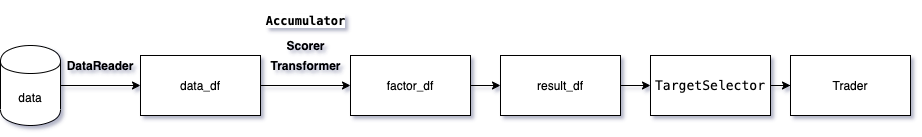

ZVT 将市场抽象为如下的模型:

- TradableEntity (交易标的)

- ActorEntity (市场参与者)

- EntityEvent (交易标的 和 市场参与者 发生的事件)

python3 -m pip install -U zvt

安装完成后,在命令行下输入 zvt

zvt这里展示的例子依赖后面的下载历史数据,数据更新请参考后面文档

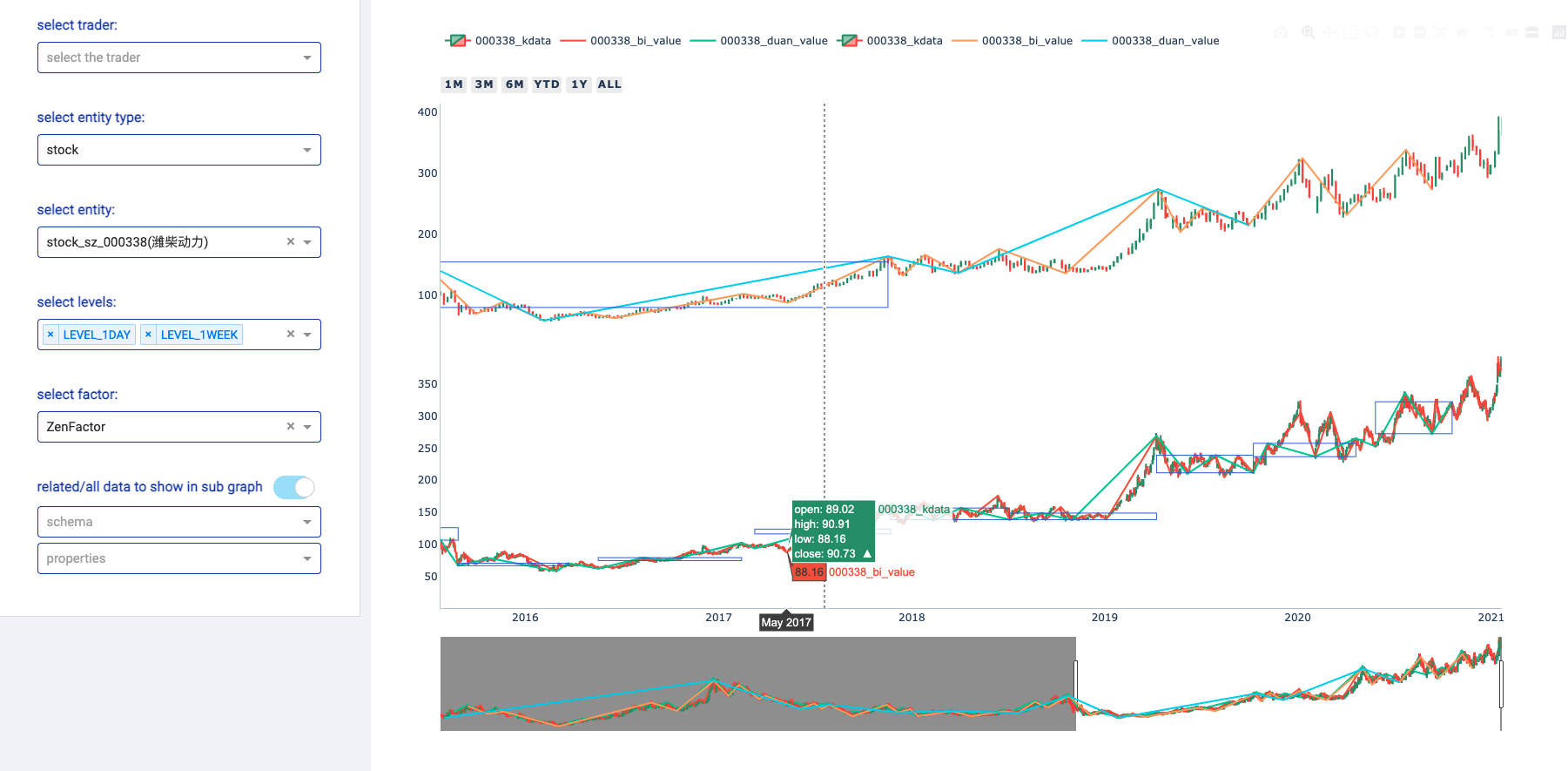

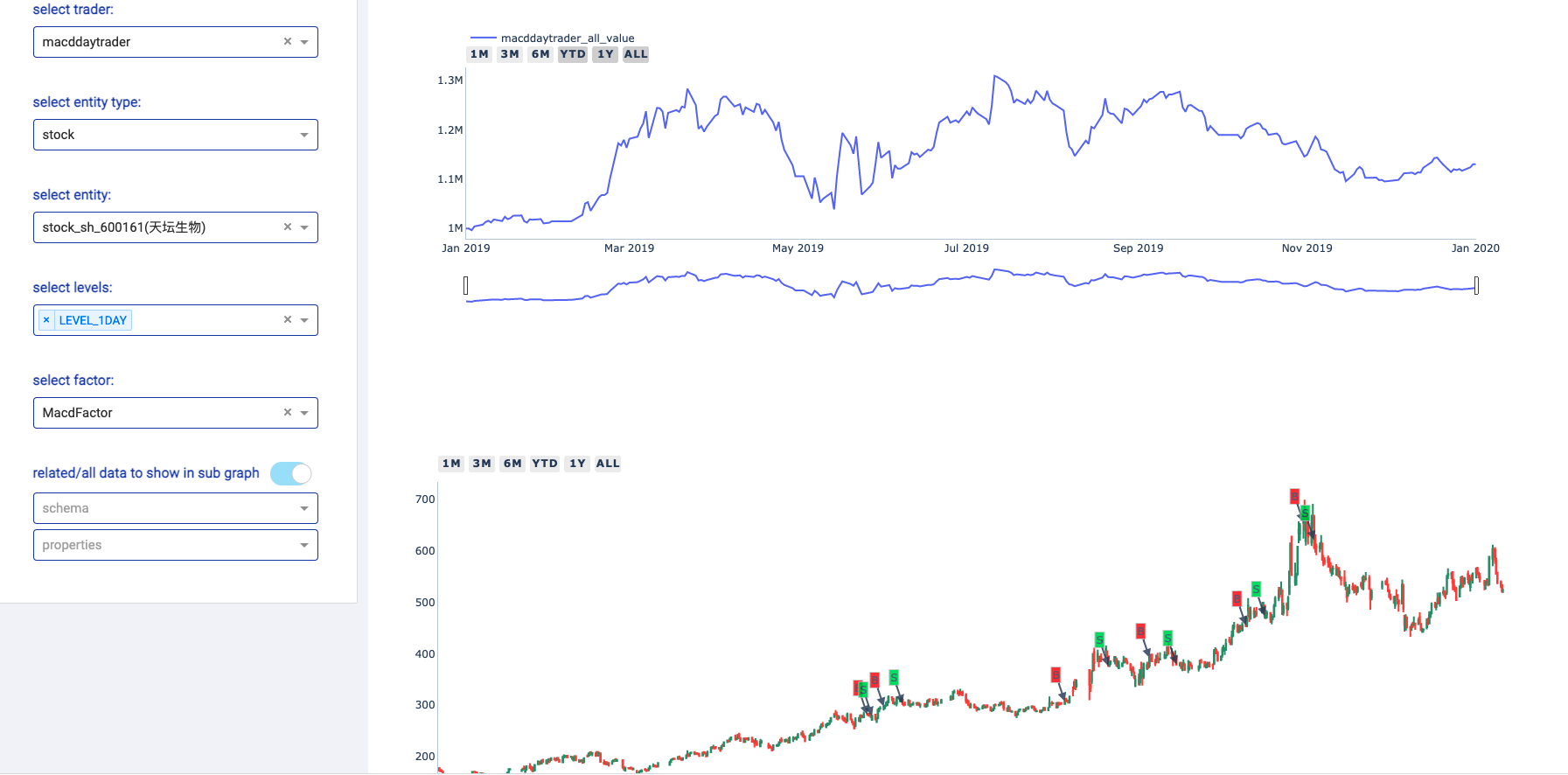

系统的核心概念是可视化的,界面的名称与其一一对应,因此也是统一可扩展的。

你可以在你喜欢的ide里编写和运行策略,然后运行界面查看其相关的标的,因子,信号和净值展示。

>>> from zvt.domain import Stock, Stock1dHfqKdata

>>> from zvt.ml import MaStockMLMachine

>>> Stock.record_data(provider="em")

>>> entity_ids = ["stock_sz_000001", "stock_sz_000338", "stock_sh_601318"]

>>> Stock1dHfqKdata.record_data(provider="em", entity_ids=entity_ids, sleeping_time=1)

>>> machine = MaStockMLMachine(entity_ids=["stock_sz_000001"])

>>> machine.train()

>>> machine.predict()

>>> machine.draw_result(entity_id="stock_sz_000001")

以上几行代码实现了:数据的抓取,持久化,增量更新,机器学习,预测,展示结果。 熟悉系统的核心概念后,可以应用到市场中的任何标的。

>>> from zvt.domain import *

>>> Stock.record_data()

>>> df = Stock.query_data(index='code')

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date

code

000001 stock_sz_000001 stock_sz_000001 1991-04-03 stock sz 000001 平安银行 1991-04-03 None

000002 stock_sz_000002 stock_sz_000002 1991-01-29 stock sz 000002 万 科A 1991-01-29 None

000004 stock_sz_000004 stock_sz_000004 1990-12-01 stock sz 000004 国华网安 1990-12-01 None

000005 stock_sz_000005 stock_sz_000005 1990-12-10 stock sz 000005 世纪星源 1990-12-10 None

000006 stock_sz_000006 stock_sz_000006 1992-04-27 stock sz 000006 深振业A 1992-04-27 None

... ... ... ... ... ... ... ... ... ...

605507 stock_sh_605507 stock_sh_605507 2021-08-02 stock sh 605507 国邦医药 2021-08-02 None

605577 stock_sh_605577 stock_sh_605577 2021-08-24 stock sh 605577 龙版传媒 2021-08-24 None

605580 stock_sh_605580 stock_sh_605580 2021-08-19 stock sh 605580 恒盛能源 2021-08-19 None

605588 stock_sh_605588 stock_sh_605588 2021-08-12 stock sh 605588 冠石科技 2021-08-12 None

605589 stock_sh_605589 stock_sh_605589 2021-08-10 stock sh 605589 圣泉集团 2021-08-10 None

[4136 rows x 9 columns]

>>> Stockus.record_data()

>>> df = Stockus.query_data(index='code')

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date

code

A stockus_nyse_A stockus_nyse_A NaT stockus nyse A 安捷伦 None None

AA stockus_nyse_AA stockus_nyse_AA NaT stockus nyse AA 美国铝业 None None

AAC stockus_nyse_AAC stockus_nyse_AAC NaT stockus nyse AAC Ares Acquisition Corp-A None None

AACG stockus_nasdaq_AACG stockus_nasdaq_AACG NaT stockus nasdaq AACG ATA Creativity Global ADR None None

AACG stockus_nyse_AACG stockus_nyse_AACG NaT stockus nyse AACG ATA Creativity Global ADR None None

... ... ... ... ... ... ... ... ... ...

ZWRK stockus_nasdaq_ZWRK stockus_nasdaq_ZWRK NaT stockus nasdaq ZWRK Z-Work Acquisition Corp-A None None

ZY stockus_nasdaq_ZY stockus_nasdaq_ZY NaT stockus nasdaq ZY Zymergen Inc None None

ZYME stockus_nyse_ZYME stockus_nyse_ZYME NaT stockus nyse ZYME Zymeworks Inc None None

ZYNE stockus_nasdaq_ZYNE stockus_nasdaq_ZYNE NaT stockus nasdaq ZYNE Zynerba Pharmaceuticals Inc None None

ZYXI stockus_nasdaq_ZYXI stockus_nasdaq_ZYXI NaT stockus nasdaq ZYXI Zynex Inc None None

[5826 rows x 9 columns]

>>> Stockus.query_data(code='AAPL')

id entity_id timestamp entity_type exchange code name list_date end_date

0 stockus_nasdaq_AAPL stockus_nasdaq_AAPL None stockus nasdaq AAPL 苹果 None None

>>> Stockhk.record_data()

>>> df = Stockhk.query_data(index='code')

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date

code

00001 stockhk_hk_00001 stockhk_hk_00001 NaT stockhk hk 00001 长和 None None

00002 stockhk_hk_00002 stockhk_hk_00002 NaT stockhk hk 00002 中电控股 None None

00003 stockhk_hk_00003 stockhk_hk_00003 NaT stockhk hk 00003 香港中华煤气 None None

00004 stockhk_hk_00004 stockhk_hk_00004 NaT stockhk hk 00004 九龙仓集团 None None

00005 stockhk_hk_00005 stockhk_hk_00005 NaT stockhk hk 00005 汇丰控股 None None

... ... ... ... ... ... ... ... ... ...

09996 stockhk_hk_09996 stockhk_hk_09996 NaT stockhk hk 09996 沛嘉医疗-B None None

09997 stockhk_hk_09997 stockhk_hk_09997 NaT stockhk hk 09997 康基医疗 None None

09998 stockhk_hk_09998 stockhk_hk_09998 NaT stockhk hk 09998 光荣控股 None None

09999 stockhk_hk_09999 stockhk_hk_09999 NaT stockhk hk 09999 网易-S None None

80737 stockhk_hk_80737 stockhk_hk_80737 NaT stockhk hk 80737 湾区发展-R None None

[2597 rows x 9 columns]

>>> df[df.code=='00700']

id entity_id timestamp entity_type exchange code name list_date end_date

2112 stockhk_hk_00700 stockhk_hk_00700 None stockhk hk 00700 腾讯控股 None None

>>> from zvt.contract import *

>>> zvt_context.tradable_schema_map

{'stockus': zvt.domain.meta.stockus_meta.Stockus,

'stockhk': zvt.domain.meta.stockhk_meta.Stockhk,

'index': zvt.domain.meta.index_meta.Index,

'etf': zvt.domain.meta.etf_meta.Etf,

'stock': zvt.domain.meta.stock_meta.Stock,

'block': zvt.domain.meta.block_meta.Block,

'fund': zvt.domain.meta.fund_meta.Fund}

其中key为交易标的的类型,value为其schema,系统为schema提供了统一的 记录(record_data) 和 查询(query_data) 方法。

>>> Index.record_data()

>>> df=Index.query_data(filters=[Index.category=='scope',Index.exchange='sh'])

>>> print(df)

id entity_id timestamp entity_type exchange code name list_date end_date publisher category base_point

0 index_sh_000001 index_sh_000001 1990-12-19 index sh 000001 上证指数 1991-07-15 None csindex scope 100.00

1 index_sh_000002 index_sh_000002 1990-12-19 index sh 000002 A股指数 1992-02-21 None csindex scope 100.00

2 index_sh_000003 index_sh_000003 1992-02-21 index sh 000003 B股指数 1992-08-17 None csindex scope 100.00

3 index_sh_000010 index_sh_000010 2002-06-28 index sh 000010 上证180 2002-07-01 None csindex scope 3299.06

4 index_sh_000016 index_sh_000016 2003-12-31 index sh 000016 上证50 2004-01-02 None csindex scope 1000.00

.. ... ... ... ... ... ... ... ... ... ... ... ...

25 index_sh_000020 index_sh_000020 2007-12-28 index sh 000020 中型综指 2008-05-12 None csindex scope 1000.00

26 index_sh_000090 index_sh_000090 2009-12-31 index sh 000090 上证流通 2010-12-02 None csindex scope 1000.00

27 index_sh_930903 index_sh_930903 2012-12-31 index sh 930903 中证A股 2016-10-18 None csindex scope 1000.00

28 index_sh_000688 index_sh_000688 2019-12-31 index sh 000688 科创50 2020-07-23 None csindex scope 1000.00

29 index_sh_931643 index_sh_931643 2019-12-31 index sh 931643 科创创业50 2021-06-01 None csindex scope 1000.00

[30 rows x 12 columns]

有了交易标的,才有交易标的 发生的事。

交易标的 行情schema 遵从如下的规则:

{entity_shema}{level}{adjust_type}Kdata

- entity_schema

就是前面说的TradableEntity,比如Stock,Stockus等。

- level

>>> for level in IntervalLevel:

print(level.value)

- adjust type

>>> for adjust_type in AdjustType:

print(adjust_type.value)

注意: 为了兼容历史数据,前复权是个例外,{adjust_type}不填

前复权

>>> Stock1dKdata.record_data(code='000338', provider='em')

>>> df = Stock1dKdata.query_data(code='000338', provider='em')

>>> print(df)

id entity_id timestamp provider code name level open close high low volume turnover change_pct turnover_rate

0 stock_sz_000338_2007-04-30 stock_sz_000338 2007-04-30 None 000338 潍柴动力 1d 2.33 2.00 2.40 1.87 207375.0 1.365189e+09 3.2472 0.1182

1 stock_sz_000338_2007-05-08 stock_sz_000338 2007-05-08 None 000338 潍柴动力 1d 2.11 1.94 2.20 1.87 86299.0 5.563198e+08 -0.0300 0.0492

2 stock_sz_000338_2007-05-09 stock_sz_000338 2007-05-09 None 000338 潍柴动力 1d 1.90 1.81 1.94 1.66 93823.0 5.782065e+08 -0.0670 0.0535

3 stock_sz_000338_2007-05-10 stock_sz_000338 2007-05-10 None 000338 潍柴动力 1d 1.78 1.85 1.98 1.75 47720.0 2.999226e+08 0.0221 0.0272

4 stock_sz_000338_2007-05-11 stock_sz_000338 2007-05-11 None 000338 潍柴动力 1d 1.81 1.73 1.81 1.66 39273.0 2.373126e+08 -0.0649 0.0224

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

3426 stock_sz_000338_2021-08-27 stock_sz_000338 2021-08-27 None 000338 潍柴动力 1d 19.39 20.30 20.30 19.25 1688497.0 3.370241e+09 0.0601 0.0398

3427 stock_sz_000338_2021-08-30 stock_sz_000338 2021-08-30 None 000338 潍柴动力 1d 20.30 20.09 20.31 19.78 1187601.0 2.377957e+09 -0.0103 0.0280

3428 stock_sz_000338_2021-08-31 stock_sz_000338 2021-08-31 None 000338 潍柴动力 1d 20.20 20.07 20.63 19.70 1143985.0 2.295195e+09 -0.0010 0.0270

3429 stock_sz_000338_2021-09-01 stock_sz_000338 2021-09-01 None 000338 潍柴动力 1d 19.98 19.68 19.98 19.15 1218697.0 2.383841e+09 -0.0194 0.0287

3430 stock_sz_000338_2021-09-02 stock_sz_000338 2021-09-02 None 000338 潍柴动力 1d 19.71 19.85 19.97 19.24 1023545.0 2.012006e+09 0.0086 0.0241

[3431 rows x 15 columns]

>>> Stockus1dKdata.record_data(code='AAPL', provider='em')

>>> df = Stockus1dKdata.query_data(code='AAPL', provider='em')

>>> print(df)

id entity_id timestamp provider code name level open close high low volume turnover change_pct turnover_rate

0 stockus_nasdaq_AAPL_1984-09-07 stockus_nasdaq_AAPL 1984-09-07 None AAPL 苹果 1d -5.59 -5.59 -5.58 -5.59 2981600.0 0.000000e+00 0.0000 0.0002

1 stockus_nasdaq_AAPL_1984-09-10 stockus_nasdaq_AAPL 1984-09-10 None AAPL 苹果 1d -5.59 -5.59 -5.58 -5.59 2346400.0 0.000000e+00 0.0000 0.0001

2 stockus_nasdaq_AAPL_1984-09-11 stockus_nasdaq_AAPL 1984-09-11 None AAPL 苹果 1d -5.58 -5.58 -5.58 -5.58 5444000.0 0.000000e+00 0.0018 0.0003

3 stockus_nasdaq_AAPL_1984-09-12 stockus_nasdaq_AAPL 1984-09-12 None AAPL 苹果 1d -5.58 -5.59 -5.58 -5.59 4773600.0 0.000000e+00 -0.0018 0.0003

4 stockus_nasdaq_AAPL_1984-09-13 stockus_nasdaq_AAPL 1984-09-13 None AAPL 苹果 1d -5.58 -5.58 -5.58 -5.58 7429600.0 0.000000e+00 0.0018 0.0004

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

8765 stockus_nasdaq_AAPL_2021-08-27 stockus_nasdaq_AAPL 2021-08-27 None AAPL 苹果 1d 147.48 148.60 148.75 146.83 55802388.0 8.265452e+09 0.0072 0.0034

8766 stockus_nasdaq_AAPL_2021-08-30 stockus_nasdaq_AAPL 2021-08-30 None AAPL 苹果 1d 149.00 153.12 153.49 148.61 90956723.0 1.383762e+10 0.0304 0.0055

8767 stockus_nasdaq_AAPL_2021-08-31 stockus_nasdaq_AAPL 2021-08-31 None AAPL 苹果 1d 152.66 151.83 152.80 151.29 86453117.0 1.314255e+10 -0.0084 0.0052

8768 stockus_nasdaq_AAPL_2021-09-01 stockus_nasdaq_AAPL 2021-09-01 None AAPL 苹果 1d 152.83 152.51 154.98 152.34 80313711.0 1.235321e+10 0.0045 0.0049

8769 stockus_nasdaq_AAPL_2021-09-02 stockus_nasdaq_AAPL 2021-09-02 None AAPL 苹果 1d 153.87 153.65 154.72 152.40 71171317.0 1.093251e+10 0.0075 0.0043

[8770 rows x 15 columns]

后复权

>>> Stock1dHfqKdata.record_data(code='000338', provider='em')

>>> df = Stock1dHfqKdata.query_data(code='000338', provider='em')

>>> print(df)

id entity_id timestamp provider code name level open close high low volume turnover change_pct turnover_rate

0 stock_sz_000338_2007-04-30 stock_sz_000338 2007-04-30 None 000338 潍柴动力 1d 70.00 64.93 71.00 62.88 207375.0 1.365189e+09 2.1720 0.1182

1 stock_sz_000338_2007-05-08 stock_sz_000338 2007-05-08 None 000338 潍柴动力 1d 66.60 64.00 68.00 62.88 86299.0 5.563198e+08 -0.0143 0.0492

2 stock_sz_000338_2007-05-09 stock_sz_000338 2007-05-09 None 000338 潍柴动力 1d 63.32 62.00 63.88 59.60 93823.0 5.782065e+08 -0.0313 0.0535

3 stock_sz_000338_2007-05-10 stock_sz_000338 2007-05-10 None 000338 潍柴动力 1d 61.50 62.49 64.48 61.01 47720.0 2.999226e+08 0.0079 0.0272

4 stock_sz_000338_2007-05-11 stock_sz_000338 2007-05-11 None 000338 潍柴动力 1d 61.90 60.65 61.90 59.70 39273.0 2.373126e+08 -0.0294 0.0224

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

3426 stock_sz_000338_2021-08-27 stock_sz_000338 2021-08-27 None 000338 潍柴动力 1d 331.97 345.95 345.95 329.82 1688497.0 3.370241e+09 0.0540 0.0398

3427 stock_sz_000338_2021-08-30 stock_sz_000338 2021-08-30 None 000338 潍柴动力 1d 345.95 342.72 346.10 337.96 1187601.0 2.377957e+09 -0.0093 0.0280

3428 stock_sz_000338_2021-08-31 stock_sz_000338 2021-08-31 None 000338 潍柴动力 1d 344.41 342.41 351.02 336.73 1143985.0 2.295195e+09 -0.0009 0.0270

3429 stock_sz_000338_2021-09-01 stock_sz_000338 2021-09-01 None 000338 潍柴动力 1d 341.03 336.42 341.03 328.28 1218697.0 2.383841e+09 -0.0175 0.0287

3430 stock_sz_000338_2021-09-02 stock_sz_000338 2021-09-02 None 000338 潍柴动力 1d 336.88 339.03 340.88 329.67 1023545.0 2.012006e+09 0.0078 0.0241

[3431 rows x 15 columns]

>>> FinanceFactor.record_data(code='000338')

>>> FinanceFactor.query_data(code='000338',columns=FinanceFactor.important_cols(),index='timestamp')

basic_eps total_op_income net_profit op_income_growth_yoy net_profit_growth_yoy roe rota gross_profit_margin net_margin timestamp

timestamp

2002-12-31 NaN 1.962000e+07 2.471000e+06 NaN NaN NaN NaN 0.2068 0.1259 2002-12-31

2003-12-31 1.27 3.574000e+09 2.739000e+08 181.2022 109.8778 0.7729 0.1783 0.2551 0.0766 2003-12-31

2004-12-31 1.75 6.188000e+09 5.369000e+08 0.7313 0.9598 0.3245 0.1474 0.2489 0.0868 2004-12-31

2005-12-31 0.93 5.283000e+09 3.065000e+08 -0.1463 -0.4291 0.1327 0.0603 0.2252 0.0583 2005-12-31

2006-03-31 0.33 1.859000e+09 1.079000e+08 NaN NaN NaN NaN NaN 0.0598 2006-03-31

... ... ... ... ... ... ... ... ... ... ...

2020-08-28 0.59 9.449000e+10 4.680000e+09 0.0400 -0.1148 0.0983 0.0229 0.1958 0.0603 2020-08-28

2020-10-31 0.90 1.474000e+11 7.106000e+09 0.1632 0.0067 0.1502 0.0347 0.1949 0.0590 2020-10-31

2021-03-31 1.16 1.975000e+11 9.207000e+09 0.1327 0.0112 0.1919 0.0444 0.1931 0.0571 2021-03-31

2021-04-30 0.42 6.547000e+10 3.344000e+09 0.6788 0.6197 0.0622 0.0158 0.1916 0.0667 2021-04-30

2021-08-31 0.80 1.264000e+11 6.432000e+09 0.3375 0.3742 0.1125 0.0287 0.1884 0.0653 2021-08-31

[66 rows x 10 columns]

#资产负债表

>>> BalanceSheet.record_data(code='000338')

#利润表

>>> IncomeStatement.record_data(code='000338')

#现金流量表

>>> CashFlowStatement.record_data(code='000338')

>>> zvt_context.schemas

[zvt.domain.dividend_financing.DividendFinancing,

zvt.domain.dividend_financing.DividendDetail,

zvt.domain.dividend_financing.SpoDetail...]

zvt_context.schemas为系统支持的schema,schema即表结构,即数据,其字段含义的查看方式如下:

- help

输入schema.按tab提示其包含的字段,或者.help()

>>> FinanceFactor.help()

- 源码

domain里的文件为schema的定义,查看相应字段的注释即可。

通过以上的例子,你应该掌握了统一的记录数据的方法:

Schema.record_data(provider='your provider',codes='the codes')

注意可选参数provider,其代表数据提供商,一个schema可以有多个provider,这是系统稳定的基石。

查看已实现的provider

>>> Stock.provider_map_recorder

{'joinquant': zvt.recorders.joinquant.meta.jq_stock_meta_recorder.JqChinaStockRecorder,

'exchange': zvt.recorders.exchange.exchange_stock_meta_recorder.ExchangeStockMetaRecorder,

'em': zvt.recorders.em.meta.em_stock_meta_recorder.EMStockRecorder,

'eastmoney': zvt.recorders.eastmoney.meta.eastmoney_stock_meta_recorder.EastmoneyChinaStockListRecorder}

你可以使用任意一个provider来获取数据,默认使用第一个。

再举个例子,股票板块数据获取:

>>> Block.provider_map_recorder

{'eastmoney': zvt.recorders.eastmoney.meta.eastmoney_block_meta_recorder.EastmoneyChinaBlockRecorder,

'sina': zvt.recorders.sina.meta.sina_block_recorder.SinaBlockRecorder}

>>> Block.record_data(provider='sina')

Block registered recorders:{'eastmoney': <class 'zvt.recorders.eastmoney.meta.china_stock_category_recorder.EastmoneyChinaBlockRecorder'>, 'sina': <class 'zvt.recorders.sina.meta.sina_china_stock_category_recorder.SinaChinaBlockRecorder'>}

2020-03-04 23:56:48,931 INFO MainThread finish record sina blocks:industry

2020-03-04 23:56:49,450 INFO MainThread finish record sina blocks:concept

再多了解一点record_data:

- 参数code[单个],codes[多个]代表需要抓取的股票代码

- 不传入code,codes则是全市场抓取

- 该方法会把数据存储到本地并只做增量更新

定时任务的方式更新可参考定时更新

查询数据使用的是query_data方法,把全市场的数据记录下来后,就可以在本地快速查询需要的数据了。

一个例子:2018年年报 roe>8% 营收增长>8% 的前20个股

>>> df=FinanceFactor.query_data(filters=[FinanceFactor.roe>0.08,FinanceFactor.report_period=='year',FinanceFactor.op_income_growth_yoy>0.08],start_timestamp='2019-01-01',order=FinanceFactor.roe.desc(),limit=20,columns=["code"]+FinanceFactor.important_cols(),index='code')

code basic_eps total_op_income net_profit op_income_growth_yoy net_profit_growth_yoy roe rota gross_profit_margin net_margin timestamp

code

000048 000048 2.7350 4.919000e+09 1.101000e+09 0.4311 1.5168 0.7035 0.1988 0.5243 0.2355 2020-04-30

000912 000912 0.3500 4.405000e+09 3.516000e+08 0.1796 1.2363 4.7847 0.0539 0.2175 0.0795 2019-03-20

002207 002207 0.2200 3.021000e+08 5.189000e+07 0.1600 1.1526 1.1175 0.1182 0.1565 0.1718 2020-04-27

002234 002234 5.3300 3.276000e+09 1.610000e+09 0.8023 3.2295 0.8361 0.5469 0.5968 0.4913 2020-04-21

002458 002458 3.7900 3.584000e+09 2.176000e+09 1.4326 4.9973 0.8318 0.6754 0.6537 0.6080 2020-02-20

... ... ... ... ... ... ... ... ... ... ... ...

600701 600701 -3.6858 7.830000e+08 -3.814000e+09 1.3579 -0.0325 1.9498 -0.7012 0.4173 -4.9293 2020-04-29

600747 600747 -1.5600 3.467000e+08 -2.290000e+09 2.1489 -0.4633 3.1922 -1.5886 0.0378 -6.6093 2020-06-30

600793 600793 1.6568 1.293000e+09 1.745000e+08 0.1164 0.8868 0.7490 0.0486 0.1622 0.1350 2019-04-30

600870 600870 0.0087 3.096000e+07 4.554000e+06 0.7773 1.3702 0.7458 0.0724 0.2688 0.1675 2019-03-30

688169 688169 15.6600 4.205000e+09 7.829000e+08 0.3781 1.5452 0.7172 0.4832 0.3612 0.1862 2020-04-28

[20 rows x 11 columns]

以上,你应该会回答如下的三个问题了:

- 有什么数据?

- 如何记录数据?

- 如何查询数据?

更高级的用法以及扩展数据,可以参考详细文档里的数据部分。

有了 交易标的 和 交易标的发生的事,就可以写策略了。

所谓策略回测,无非就是,重复以下过程:

系统支持两种模式:

- solo (随意的)

在 某个时间 根据发生的事件 计算条件 并买卖

- formal (正式的)

系统设计的二维索引多标的计算模型

嗯,这个策略真的很随便,就像我们大部分时间做的那样。

报表出来的时,我看一下报表,机构加仓超过5%我就买入,机构减仓超过50%我就卖出。

代码如下:

# -*- coding: utf-8 -*-

import pandas as pd

from zvt.api import get_recent_report_date

from zvt.contract import ActorType, AdjustType

from zvt.domain import StockActorSummary, Stock1dKdata

from zvt.trader import StockTrader

from zvt.utils import pd_is_not_null, is_same_date, to_pd_timestamp

class FollowIITrader(StockTrader):

finish_date = None

def on_time(self, timestamp: pd.Timestamp):

recent_report_date = to_pd_timestamp(get_recent_report_date(timestamp))

if self.finish_date and is_same_date(recent_report_date, self.finish_date):

return

filters = [StockActorSummary.actor_type == ActorType.raised_fund.value,

StockActorSummary.report_date == recent_report_date]

if self.entity_ids:

filters = filters + [StockActorSummary.entity_id.in_(self.entity_ids)]

df = StockActorSummary.query_data(filters=filters)

if pd_is_not_null(df):

self.logger.info(f'{df}')

self.finish_date = recent_report_date

long_df = df[df['change_ratio'] > 0.05]

short_df = df[df['change_ratio'] < -0.5]

try:

self.trade_the_targets(due_timestamp=timestamp, happen_timestamp=timestamp,

long_selected=set(long_df['entity_id'].to_list()),

short_selected=set(short_df['entity_id'].to_list()))

except Exception as e:

self.logger.error(e)

if __name__ == '__main__':

entity_id = 'stock_sh_600519'

Stock1dKdata.record_data(entity_id=entity_id, provider='em')

StockActorSummary.record_data(entity_id=entity_id, provider='em')

FollowIITrader(start_timestamp='2002-01-01', end_timestamp='2021-01-01', entity_ids=[entity_id],

provider='em', adjust_type=AdjustType.qfq, profit_threshold=None).run()

所以,写一个策略其实还是很简单的嘛。 你可以发挥想象力,社保重仓买买买,外资重仓买买买,董事长跟小姨子跑了卖卖卖......

然后,刷新一下http://127.0.0.1:8050/,看你运行策略的performance

更多可参考策略例子

简单的计算可以通过query_data来完成,这里说的是系统设计的二维索引多标的计算模型。

下面以技术因子为例对计算流程进行说明:

In [7]: from zvt.factors.technical_factor import *

In [8]: factor = BullFactor(codes=['000338','601318'],start_timestamp='2019-01-01',end_timestamp='2019-06-10', transformer=MacdTransformer())

data_df为factor的原始数据,即通过query_data从数据库读取到的数据,为一个二维索引DataFrame

In [11]: factor.data_df

Out[11]:

level high id entity_id open low timestamp close

entity_id timestamp

stock_sh_601318 2019-01-02 1d 54.91 stock_sh_601318_2019-01-02 stock_sh_601318 54.78 53.70 2019-01-02 53.94

2019-01-03 1d 55.06 stock_sh_601318_2019-01-03 stock_sh_601318 53.91 53.82 2019-01-03 54.42

2019-01-04 1d 55.71 stock_sh_601318_2019-01-04 stock_sh_601318 54.03 53.98 2019-01-04 55.31

2019-01-07 1d 55.88 stock_sh_601318_2019-01-07 stock_sh_601318 55.80 54.64 2019-01-07 55.03

2019-01-08 1d 54.83 stock_sh_601318_2019-01-08 stock_sh_601318 54.79 53.96 2019-01-08 54.54

... ... ... ... ... ... ... ... ...

stock_sz_000338 2019-06-03 1d 11.04 stock_sz_000338_2019-06-03 stock_sz_000338 10.93 10.74 2019-06-03 10.81

2019-06-04 1d 10.85 stock_sz_000338_2019-06-04 stock_sz_000338 10.84 10.57 2019-06-04 10.73

2019-06-05 1d 10.92 stock_sz_000338_2019-06-05 stock_sz_000338 10.87 10.59 2019-06-05 10.59

2019-06-06 1d 10.71 stock_sz_000338_2019-06-06 stock_sz_000338 10.59 10.49 2019-06-06 10.65

2019-06-10 1d 11.05 stock_sz_000338_2019-06-10 stock_sz_000338 10.73 10.71 2019-06-10 11.02

[208 rows x 8 columns]

factor_df为transformer对data_df进行计算后得到的数据,设计因子即对transformer进行扩展,例子中用的是MacdTransformer()。

In [12]: factor.factor_df

Out[12]:

level high id entity_id open low timestamp close diff dea macd

entity_id timestamp

stock_sh_601318 2019-01-02 1d 54.91 stock_sh_601318_2019-01-02 stock_sh_601318 54.78 53.70 2019-01-02 53.94 NaN NaN NaN

2019-01-03 1d 55.06 stock_sh_601318_2019-01-03 stock_sh_601318 53.91 53.82 2019-01-03 54.42 NaN NaN NaN

2019-01-04 1d 55.71 stock_sh_601318_2019-01-04 stock_sh_601318 54.03 53.98 2019-01-04 55.31 NaN NaN NaN

2019-01-07 1d 55.88 stock_sh_601318_2019-01-07 stock_sh_601318 55.80 54.64 2019-01-07 55.03 NaN NaN NaN

2019-01-08 1d 54.83 stock_sh_601318_2019-01-08 stock_sh_601318 54.79 53.96 2019-01-08 54.54 NaN NaN NaN

... ... ... ... ... ... ... ... ... ... ... ...

stock_sz_000338 2019-06-03 1d 11.04 stock_sz_000338_2019-06-03 stock_sz_000338 10.93 10.74 2019-06-03 10.81 -0.121336 -0.145444 0.048215

2019-06-04 1d 10.85 stock_sz_000338_2019-06-04 stock_sz_000338 10.84 10.57 2019-06-04 10.73 -0.133829 -0.143121 0.018583

2019-06-05 1d 10.92 stock_sz_000338_2019-06-05 stock_sz_000338 10.87 10.59 2019-06-05 10.59 -0.153260 -0.145149 -0.016223

2019-06-06 1d 10.71 stock_sz_000338_2019-06-06 stock_sz_000338 10.59 10.49 2019-06-06 10.65 -0.161951 -0.148509 -0.026884

2019-06-10 1d 11.05 stock_sz_000338_2019-06-10 stock_sz_000338 10.73 10.71 2019-06-10 11.02 -0.137399 -0.146287 0.017776

[208 rows x 11 columns]

result_df为可用于选股器的二维索引DataFrame,通过对data_df或factor_df计算来实现。 该例子在计算macd之后,利用factor_df,黄白线在0轴上为True,否则为False,具体代码

In [14]: factor.result_df

Out[14]:

score

entity_id timestamp

stock_sh_601318 2019-01-02 False

2019-01-03 False

2019-01-04 False

2019-01-07 False

2019-01-08 False

... ...

stock_sz_000338 2019-06-03 False

2019-06-04 False

2019-06-05 False

2019-06-06 False

2019-06-10 False

[208 rows x 1 columns]

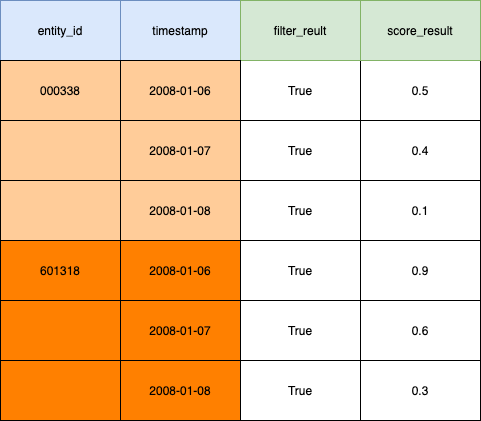

result_df的格式如下:

filter_result 为 True 或 False, score_result 取值为 0 到 1。

结合选股器和回测,整个流程如下:

>>> from zvt import *

>>> zvt_env

{'zvt_home': '/Users/foolcage/zvt-home',

'data_path': '/Users/foolcage/zvt-home/data',

'tmp_path': '/Users/foolcage/zvt-home/tmp',

'ui_path': '/Users/foolcage/zvt-home/ui',

'log_path': '/Users/foolcage/zvt-home/logs'}

>>> zvt_config

- jq_username 聚宽数据用户名

- jq_password 聚宽数据密码

- smtp_host 邮件服务器host

- smtp_port 邮件服务器端口

- email_username smtp邮箱账户

- email_password smtp邮箱密码

- wechat_app_id

- wechat_app_secrect

>>> init_config(current_config=zvt_config, jq_username='xxx', jq_password='yyy')

通用的配置方式为: init_config(current_config=zvt_config, **kv)

百度网盘: https://pan.baidu.com/s/1kHAxGSxx8r5IBHe5I7MAmQ 提取码: yb6c

google drive: https://drive.google.com/drive/folders/17Bxijq-PHJYrLDpyvFAm5P6QyhKL-ahn?usp=sharing

里面包含joinquant的日/周线后复权数据,个股估值,基金及其持仓数据,eastmoney的财务等数据。

把下载的数据解压到正式环境的data_path(所有db文件放到该目录下,没有层级结构)

数据的更新是增量的,下载历史数据只是为了节省时间,全部自己更新也是可以的。

项目数据支持多provider,在数据schema一致性的基础上,可根据需要进行选择和扩展,目前支持新浪,东财,交易所等免费数据。

但免费数据的缺点是显而易见的:不稳定,爬取清洗数据耗时耗力,维护代价巨大,且随时可能不可用。

个人建议:如果只是学习研究,可以使用免费数据;如果是真正有意投身量化,还是选一家可靠的数据提供商。

项目支持聚宽的数据,可戳以下链接申请使用(目前可免费使用一年)

https://www.joinquant.com/default/index/sdk?channelId=953cbf5d1b8683f81f0c40c9d4265c0d

项目中大部分的免费数据目前都是比较稳定的,且做过严格测试,特别是东财的数据,可放心使用

添加其他数据提供商, 请参考数据扩展教程

git clone https://github.com/zvtvz/zvt.git

设置项目的virtual env(python>=3.6),安装依赖

pip3 install -r requirements.txt

pip3 install pytest

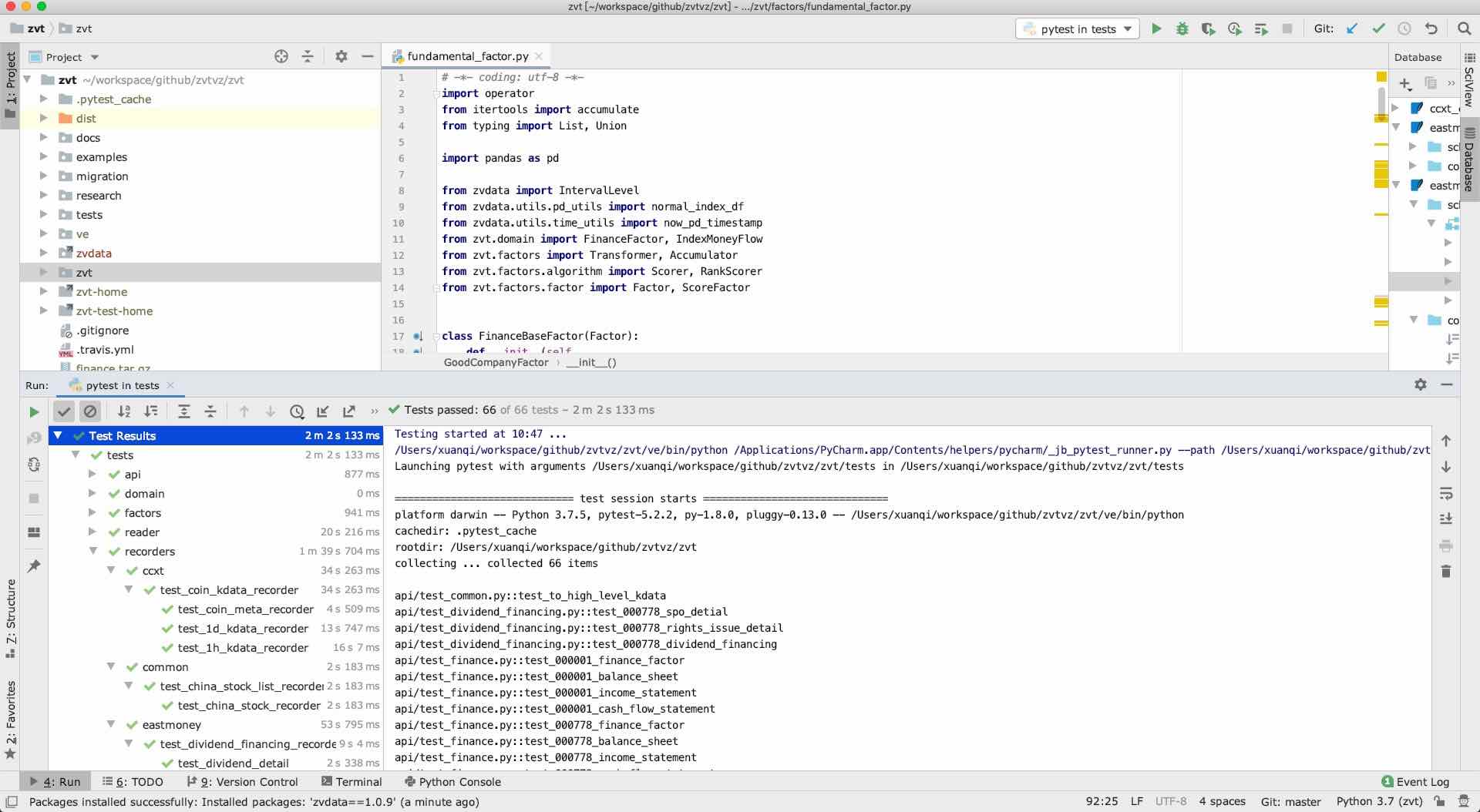

pycharm导入工程(推荐,你也可以使用其他ide),然后pytest跑测试案例

大部分功能使用都可以从tests里面参考

期待能有更多的开发者参与到 zvt 的开发中来,我会保证尽快 Reivew PR 并且及时回复。但提交 PR 请确保

先看一下1分钟代码规范

- 通过所有单元测试,如若是新功能,请为其新增单元测试

- 遵守开发规范

- 如若需要,请更新相对应的文档

也非常欢迎开发者能为 zvt 提供更多的示例,共同来完善文档。